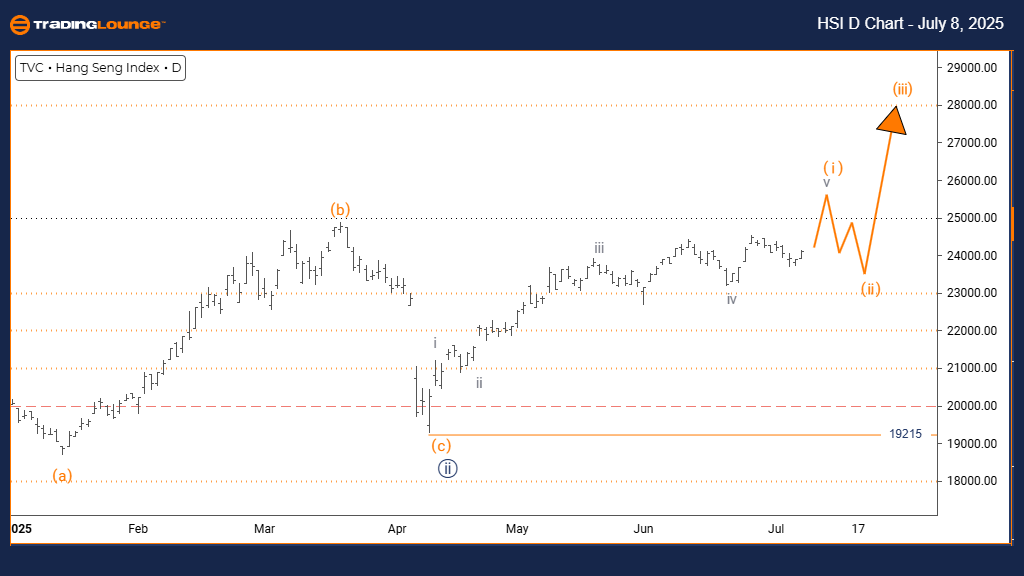

Hang Seng Index Elliott Wave Analysis | Trading Lounge Day Chart

Hang Seng Index Day Chart Analysis

FUNCTION: Bullish Market Trend

MODE: Impulsive Wave Formation

STRUCTURE: Orange Wave 1 Initiated

POSITION: Navy Blue Wave 3 Development

DIRECTION (Next Lower Degree): Orange Wave 2 Projection

DETAILS:

The Hang Seng Index daily chart reveals that navy blue wave 2 has likely concluded, and orange wave 1 within navy blue wave 3 is currently progressing.

Key Invalidation Level: 19215

According to Elliott Wave analysis, the Hang Seng Index is exhibiting bullish momentum. The chart structure suggests an impulsive move, where orange wave 1 unfolds as the initial part of navy blue wave 3 — a scenario that often signals a fresh bullish leg.

The end of navy blue wave 2 indicates that buying strength is building. The emergence of orange wave 1 points to early-stage upward pressure, supporting a continuation of the current bullish bias. As long as prices remain above the 19215 invalidation level, this setup holds potential for further gains.

This segment is crucial for swing traders and short-term investors, as the upcoming orange wave 2 correction could provide another buying opportunity. Being positioned within navy blue wave 3 suggests the market might experience a sustained upward breakout in the near term.

Hang Seng Index Elliott Wave Analysis | Trading Lounge Weekly Chart

Hang Seng Index Elliott Wave Technical Forecast

FUNCTION: Long-Term Bullish Trend

MODE: Impulsive Structure Forming

STRUCTURE: Navy Blue Wave 3 In Progress

POSITION: Gray Wave 1 Cycle

DIRECTION (Next Lower Degree): Navy Blue Wave 4 Anticipation

DETAILS:

The weekly chart of the Hang Seng Index indicates that navy blue wave 2 has ended, and navy blue wave 3 is actively developing.

Key Invalidation Level: 19215

The long-term Elliott Wave view of the Hang Seng Index confirms a strong bullish outlook. The impulsive phase within navy blue wave 3 signals the start of a robust upward cycle under gray wave 1. This aligns with expectations of a multi-week rally.

Since completing navy blue wave 2, price momentum has shifted into navy blue wave 3 — typically the most forceful in the Elliott Wave count. With continued higher highs and higher lows, the index signals investor confidence and potential price acceleration. A move below 19215 would challenge this wave scenario.

As long as the Hang Seng Index trades above the invalidation point, bullish positions remain supported. The wave 4 correction is expected later in the sequence, offering intermediate pullbacks within the broader uptrend.

The weekly timeframe adds strategic weight to the analysis, highlighting a larger bullish cycle supported by solid technical patterns. This stage presents favorable conditions for medium- to long-term positioning.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: RUSSELL 2000 Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support