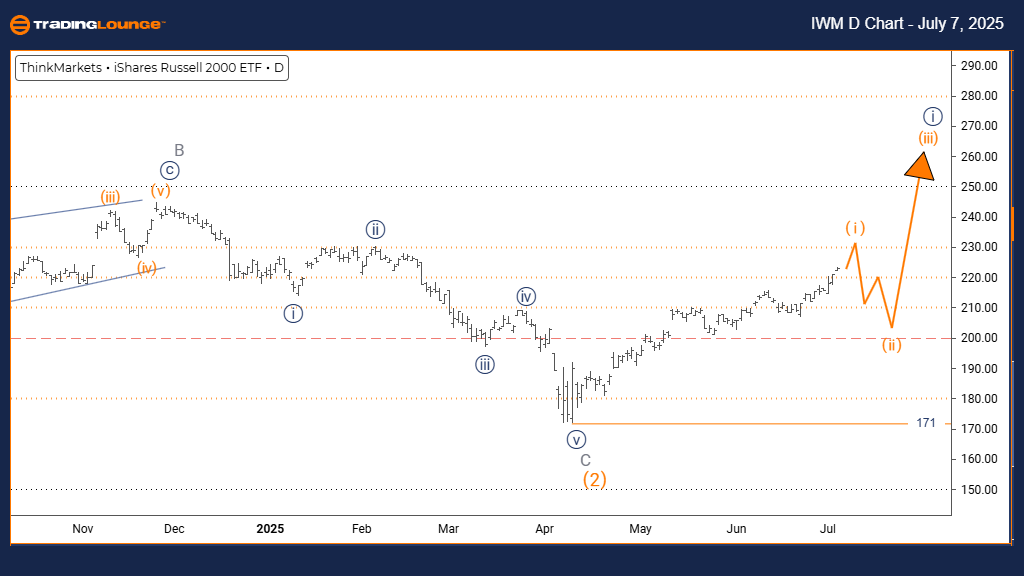

RUSSELL 2000 Elliott Wave Analysis | Trading Lounge Day Chart

RUSSELL 2000 Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Orange Wave 1

Position: Navy Blue Wave 1

Direction Next Lower Degrees: Orange Wave 2

Details: Orange Wave 1 of Navy Blue Wave 1 is currently forming within a developing uptrend.

Wave Cancel Invalidation Level: 171

The Russell 2000 index daily chart reflects a bullish Elliott Wave structure, confirming a strong impulsive rally. The current formation—Orange Wave 1 within Navy Blue Wave 1—suggests the start of a broader upward cycle, indicating early momentum in a new bullish trend.

As Orange Wave 1 unfolds, it supports a foundation for continued price appreciation. The upcoming wave—Orange Wave 2—is expected to be a corrective phase, which often presents strategic buying opportunities before the rally resumes.

A key technical reference is the wave invalidation level at 171. If prices retreat to this level, it would invalidate the current wave count, necessitating a revised Elliott Wave analysis. Traders should monitor this support closely to align risk and entry strategies.

With current wave dynamics pointing upward, the technical landscape favors bullish trading setups. Identifying confirmation signals and managing trades relative to the invalidation level enhances trading precision as the trend matures.

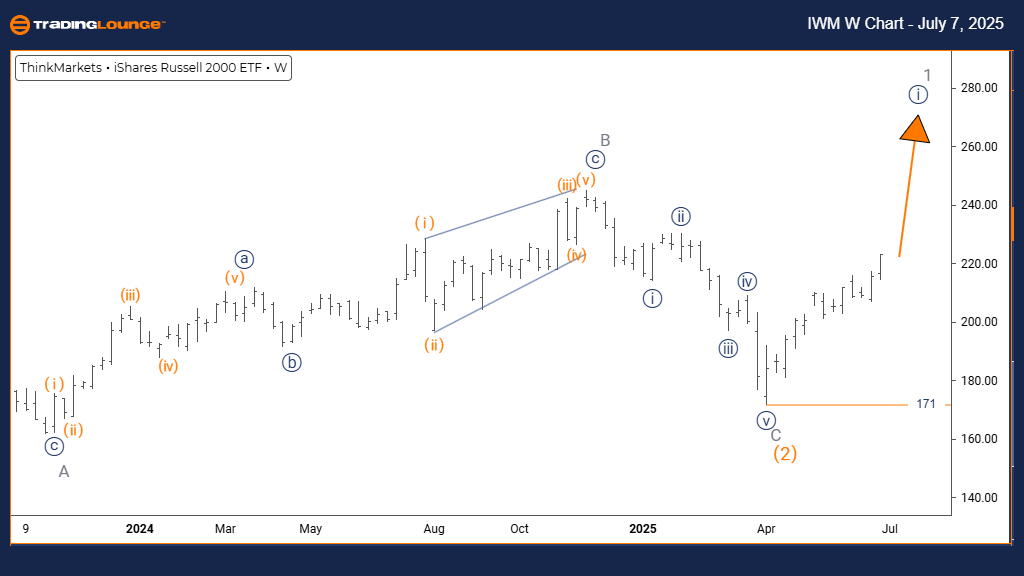

RUSSELL 2000 Elliott Wave Analysis | Trading Lounge Weekly Chart

RUSSELL 2000 Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Direction Next Lower Degrees: Navy Blue Wave 2

Details: Orange Wave 2 appears completed; Navy Blue Wave 1 of 1 is currently forming.

Wave Cancel Invalidation Level: 171

On the Russell 2000 weekly chart, Elliott Wave analysis confirms a strong bullish market structure in impulsive mode. The current movement—Navy Blue Wave 1 inside Gray Wave 1—marks the onset of a potentially sustained upward trend.

With Orange Wave 2 likely completed, the market is progressing through Navy Blue Wave 1, suggesting the first phase of a long-term bullish cycle. This phase is expected to continue until the next correction, identified as Navy Blue Wave 2, emerges.

The wave invalidation threshold at 171 remains pivotal. A move to this level would signal a break in the current bullish count and prompt a reevaluation of the trend. This level is essential for managing trade risk and directional bias.

Overall, the structure indicates favorable conditions for long-term bullish positions. Investors and traders should monitor price action for confirmation of trend continuation and leverage strategic entries while respecting the invalidation level for sound risk management.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Bovespa Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support