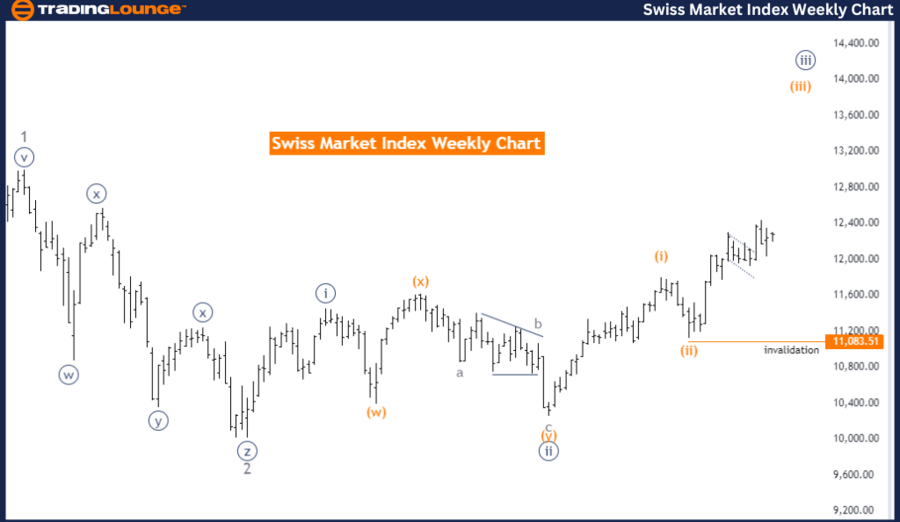

Swiss Market Index Elliott Wave Analysis - Daily Chart

Swiss Market Index Daily Chart Analysis

Function: Trend

Mode: Impulsive

Structure: Gray wave 3

Position: Orange wave 3

Direction Next Lower Degrees: Gray wave 4

Details: The completion of gray wave 2 within orange wave 3 suggests that gray wave 3 is now in progress.

Wave Cancel Invalid Level: 11913.57

Swiss Market Index Elliott Wave Technical Analysis

The Elliott Wave Analysis of the Swiss Market Index on the daily chart shows that the index is currently in an impulsive trend mode. The structure being analyzed is gray wave 3, situated within the larger orange wave 3. This setup indicates strong upward momentum, driven by impulsive price movements.

The analysis identifies that gray wave 2 of orange wave 3 has likely completed. This completion marks the end of the corrective phase, represented by gray wave 2, and indicates the beginning of gray wave 3, which continues within the broader orange wave 3. This transition suggests the continuation of the upward trend, with expectations of increased market momentum.

The next lower degree direction is identified as gray wave 4. Following the completion of the ongoing gray wave 3, a corrective phase marked as gray wave 4 is anticipated. This phase may involve a short-term retracement or consolidation before the market resumes its primary upward trend. The presence of gray wave 4 indicates potential short-term fluctuations before the index continues its overall upward movement.

The wave cancel invalid level is established at 11913.57. This level is critical for validating the current wave analysis. If the Swiss Market Index drops below this threshold, the existing wave count would be invalidated, necessitating a reassessment of the wave count and overall market outlook.

In summary, the Swiss Market Index Elliott Wave Analysis on the daily chart suggests that the index is in an impulsive upward trend within gray wave 3, which is part of orange wave 3. The analysis indicates that gray wave 2 has been completed, and gray wave 3 is currently underway, with gray wave 4 expected to follow. The critical wave cancel invalid level of 11913.57 must be monitored closely, as a breach would invalidate the current wave structure, prompting a reassessment.

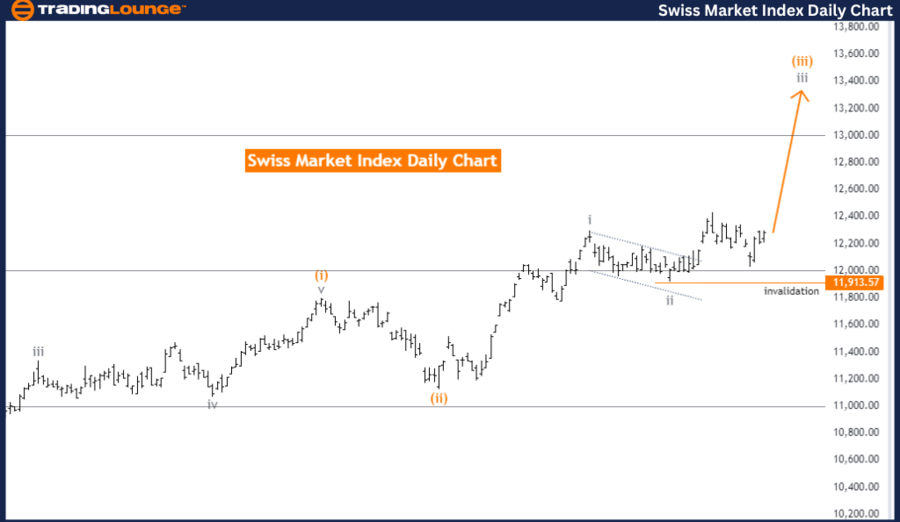

Swiss Market Index Elliott Wave Analysis - Weekly Chart

Swiss Market Index Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Orange wave 3

Position: Navy Blue Wave 3

Direction Next Lower Degrees: Orange wave 4

Details: The completion of orange wave 2 within orange wave 3 suggests that orange wave 3 is currently active.

Wave Cancel Invalid Level: 11083.51

The Elliott Wave Analysis of the Swiss Market Index on the weekly chart indicates a trending function in an impulsive mode. The current structure is identified as orange wave 3, located within the larger navy blue wave 3. This analysis highlights strong upward momentum in the market, characterized by significant price movements.

The technical analysis suggests that orange wave 2 of orange wave 3 has been completed. This completion marks the end of the corrective phase, indicated by orange wave 2, and signifies the beginning of the more dynamic orange wave 3, still within the broader navy blue wave 3. This transition signals a continuation of the upward trend, with expectations of increased market activity and potential price gains.

The direction for the next lower degrees is identified as orange wave 4. After the completion of the ongoing orange wave 3, a corrective phase marked by orange wave 4 is anticipated. This phase may involve a temporary pullback or consolidation before the market resumes its primary upward movement. The presence of orange wave 4 suggests that the market may experience short-term fluctuations before continuing its overall upward trend.

The wave cancel invalid level is established at 11083.51. This level serves as a critical point for the current wave analysis. If the Swiss Market Index falls below this level, the current wave count would be invalidated. Such a scenario would imply that the expected wave pattern is no longer applicable, necessitating a reevaluation of the wave count and market outlook.

In summary, the Swiss Market Index Elliott Wave Analysis on the weekly chart shows that the index is in an impulsive upward trend within orange wave 3, positioned in navy blue wave 3. The analysis suggests that orange wave 2 has been completed, and orange wave 3 is now active, with orange wave 4 expected to follow. The critical wave cancel invalid level of 11083.51 must be monitored closely, as a breach would invalidate the current wave structure, prompting a reassessment.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: Hang Seng Index Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support