Elliott Wave Analysis for NextEra Energy Inc. (NEE) - August 15, 2024

Welcome to our comprehensive Elliott Wave analysis of NextEra Energy Inc. (NEE) as of August 15, 2024. This report examines NEE's price action using Elliott Wave Theory to identify potential trading opportunities aligned with the current market trends. We provide insights by analyzing both the daily and 4-hour charts, offering a complete overview of NEE's market dynamics.

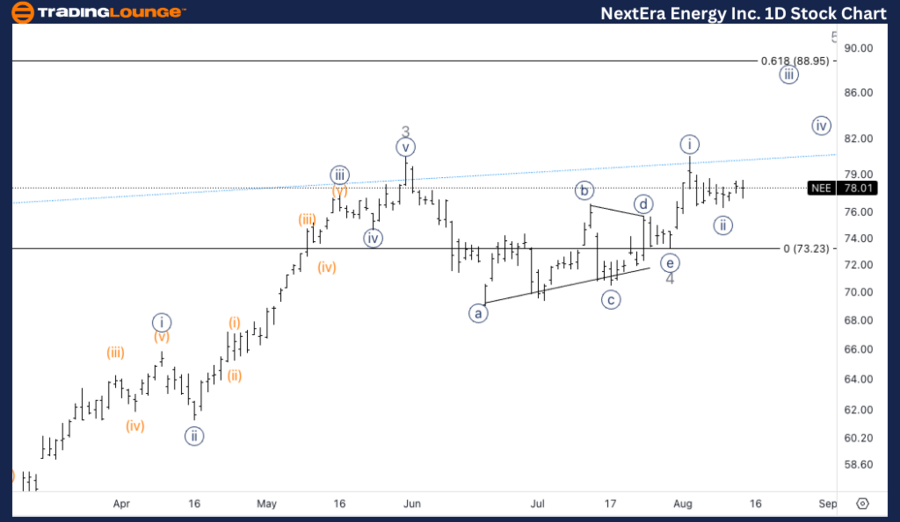

NEE Elliott Wave Analysis - Trading Lounge Daily Chart

NextEra Energy Inc. (NEE) Daily Chart Analysis

NEE Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {i} of 5

Direction: Upside in wave {iii}

Details:

The analysis indicates a possible bottoming in wave {ii}, projecting further upward movement as wave {iii} of 5 initiates. The key level to watch is the Trendline 8 (TL8) at $80. Breaking above this level would likely signal the start of wave {iii}, potentially leading to a strong rally as the wave advances.

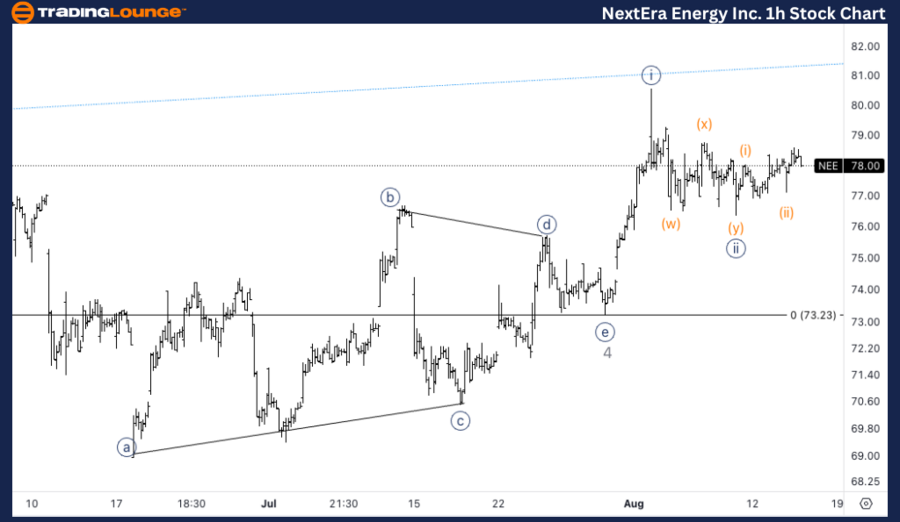

NEE Elliott Wave Analysis - Trading Lounge 4H Chart

NextEra Energy Inc. (NEE) 4H Chart Analysis

NEE Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iii) of {iii}

Direction: Upside in (iii)

Details:

The 4-hour chart suggests a potential acceleration in wave (iii) of {iii}. If this occurs, it would confirm the progression of wave {iii}. However, there is still a chance that the price is in a corrective phase within wave {ii}, which may lead to further consolidation before the next upward movement.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Caterpillar Inc. (CAT) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support