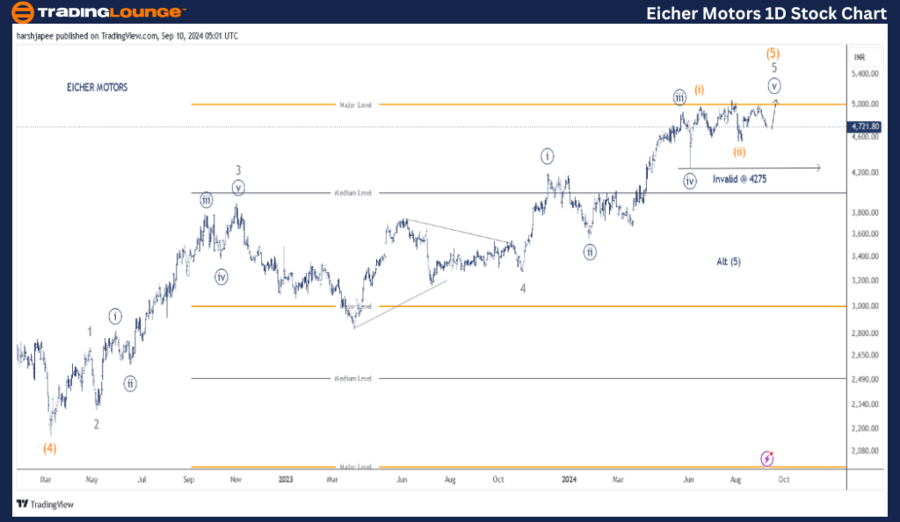

EICHER MOTORS – EICHERMOT Elliott Wave Analysis (1D Chart)

Eicher Motors Day Chart Analysis

Eicher Motors Elliott Wave Technical Analysis

Function: Larger Degree Trend Higher (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Minuette Wave (iii) Orange

Details: Minuette Wave (iii) Orange of Minute Wave ((v)) Navy within Minor Wave 5 is advancing against 4275. Alternatively, Intermediate Wave (5) Orange may have terminated near the 5075 level.

Invalidation Point: 4275

Eicher Motors Daily Chart Technical Analysis and Potential Elliott Wave Counts:

The daily chart for Eicher Motors shows that Minor Wave 5 of Intermediate Wave (5) Orange is progressing, targeting levels above the 5075 mark. Alternatively, if Intermediate Wave (5) Orange is complete around 5075, a bearish trend may resume.

Previously, Intermediate Wave (4) Orange concluded near 2170 in March 2022. Since then, Minor degree Waves 1, 2, 3, and 4 have likely completed, with Minor Wave 4 forming a contracting triangle around the 3285 level.

Assuming the analysis holds, Minor Wave 5 Grey is advancing and can be subdivided into Minute Waves ((i)), ((ii)), ((iii)), and ((iv)). At the time of writing, Minute Wave ((v)) Navy is unfolding higher, with prices expected to remain above 4275.

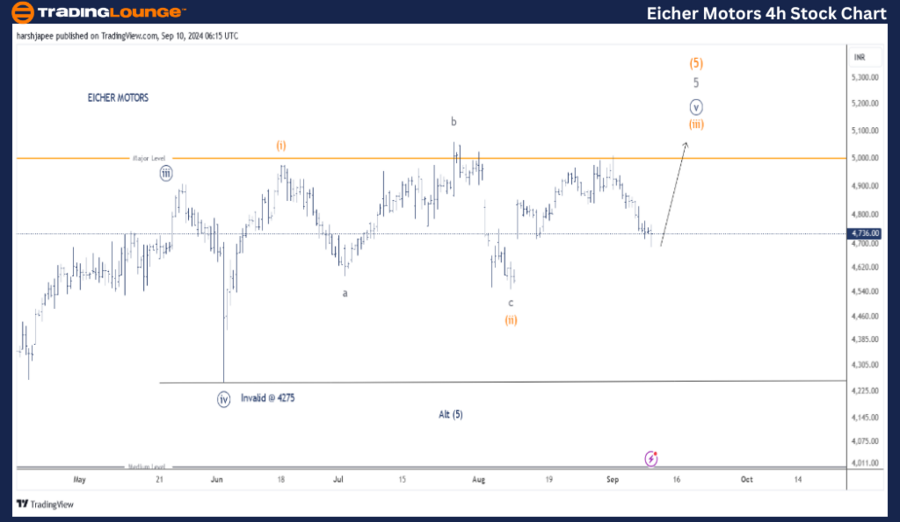

EICHER MOTORS – EICHERMOT Elliott Wave Analysis (4H Chart)

Eicher Motors 4-Hour Chart Analysis

Function: Larger Degree Trend Higher (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Minuette Wave (iii) Orange

Details: Minuette Wave (iii) Orange of Minute Wave ((v)) Navy within Minor Wave 5 is advancing against 4275. Alternatively, Intermediate Wave (5) Orange may have completed around 5075. A decline below 4545 would further support a bearish outlook.

Invalidation Point: 4275

Eicher Motors 4H Chart Technical Analysis and Potential Elliott Wave Counts:

The 4-hour chart of Eicher Motors highlights the sub-waves within Minute Wave ((v)) Navy since the 4275 low. Minuette Waves (i) and (ii) Orange seem to have completed around the 4975 and 4545-50 levels. If this is accurate, Minuette Wave (iii) Orange is now advancing above the 4545-50 range.

Alternatively, Minute Wave ((v)) Navy may have already ended near the 5075 high, recorded on July 26, 2024. The stock has moved lower since, and a break below 4545-50 would confirm that the bears are back in control.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: Bajaj Auto Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Eicher Motors appears to be progressing in Minute Wave ((v)) Navy within Minor Wave 5 Grey of Intermediate Wave (5) Orange, moving above the 4275 support level.