Welcome to our latest Elliott Wave analysis for Eaton Corp PLC (ETN). This analysis delves into ETN's price movements utilizing Elliott Wave Theory, offering traders insights into potential trading opportunities based on current trends and market structure. We explore both the daily and 4-hour charts for a thorough understanding of ETN's market trajectory.

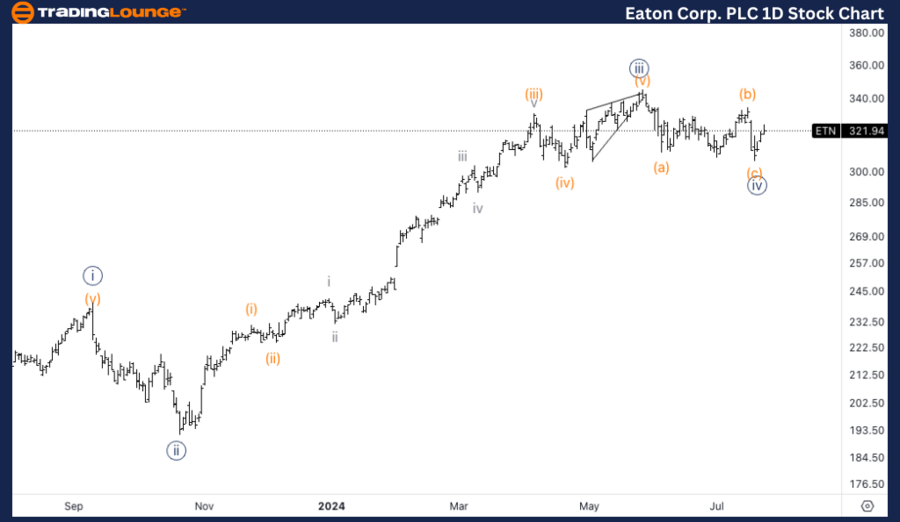

ETN Elliott Wave Analysis Trading Lounge Daily Chart

Eaton Corp PLC (ETN) Daily Chart Analysis

ETN Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minute {v}

Direction: Upside in wave {v}

Details: A clear three-wave movement into wave {iv} occurred just below the 0.618 retracement level of wave {ii}. The support at MG1 indicates potential for further upward movement in wave {v}.

ETN Elliott Wave Technical Analysis – Daily Chart

The daily chart exhibits a distinct three-wave progression into wave {iv}, which terminated just short of the 0.618 retracement level of wave {ii}. The presence of support at MG1 suggests a likelihood of further gains in wave {v}. Traders should watch the support level for signals of sustained upward momentum.

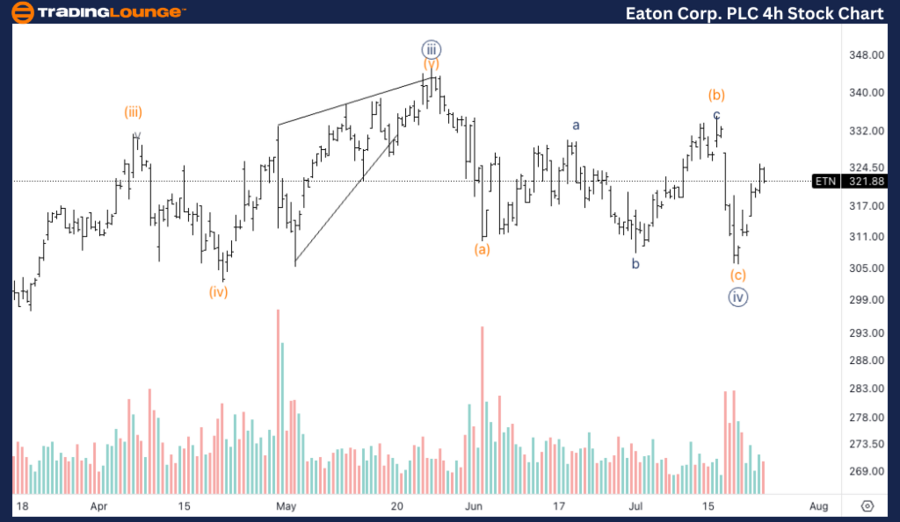

ETN Elliott Wave Analysis Trading Lounge 4H Chart

Eaton Corp PLC (ETN) 4H Chart Analysis

ETN Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (i) of {v}

Direction: Upside in wave {v}

Details: The 4-hour chart suggests a potential top in wave (i) of {v}, with volume spikes indicating that a low might be established. A breakout and sustained support above $320 would confirm the upward trend, indicating a continuation in wave {v}.

ETN Elliott Wave Technical Analysis – 4H Chart

The 4-hour chart points to a potential top in wave (i) of {v}, with increased volume indicating a possible bottom. A decisive break above $320, followed by support, would affirm the bullish trend, paving the way for a further rise in wave {v}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: The Coca-Cola Company (KO) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support