Welcome to our latest Elliott Wave analysis for The Coca-Cola Company (KO) as of July 23, 2024. This analysis provides an in-depth look at KO's price movements using the Elliott Wave Theory, helping traders identify potential opportunities based on current trends and market structure. We will cover insights from both the daily and 4-hour charts to offer a comprehensive perspective on KO's market behavior.

The Coca-Cola Company (KO) Elliott Wave Analysis Trading Lounge Daily Chart

KO Elliott Wave Analysis

The Coca-Cola Company (KO): Daily Chart

Mode: Impulsive

Structure: Motive

Position: Wave 5

Direction: Top in wave 5

Details: A clear five-wave move into Intermediate wave (1) is either completed or near completion, as the price has reached the medium level of $65.

KO Elliott Wave Technical Analysis – Daily Chart

The daily chart indicates a clear five-wave move into Intermediate wave (1), which is either completed or near completion as the price has reached the medium level around $65. Traders should watch for signs of a potential top in wave 5, as this could indicate the end of the current bullish phase and the beginning of a corrective phase.

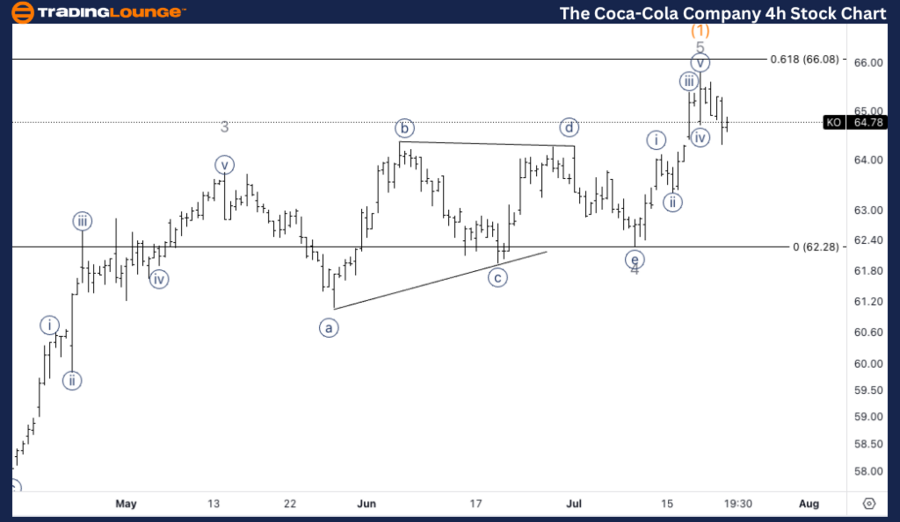

The Coca-Cola Company (KO) Elliott Wave Analysis Trading Lounge 4H Chart

The Coca-Cola Company (KO): 4H Chart

Mode: Impulsive

Structure: Motive

Position: Wave 5

Direction: Top in wave 5

Details: A five-wave move from the bottom in the triangle in wave 4 suggests that wave 5 might be completed, or wave {i} of 5 has just been completed.

KO Elliott Wave Technical Analysis – 4H Chart

The 4-hour chart shows that a five-wave move can be counted from the bottom of the triangle in wave 4, suggesting that wave 5 might be completed or wave {i} of 5 is completed. This indicates that traders should be cautious of a potential top formation and be prepared for a possible corrective move.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NVDA Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support