ASX: QBE INSURANCE GROUP LIMITED – QBE Elliott Wave Technical Analysis TradingLounge

Introduction:

Welcome to our Elliott Wave analysis for the Australian Stock Exchange (ASX), featuring QBE INSURANCE GROUP LIMITED (ASX: QBE). Our forecast indicates continued growth in QBE, with the progression of wave (iii)-orange, followed by wave (v)-orange in the broader trend structure.

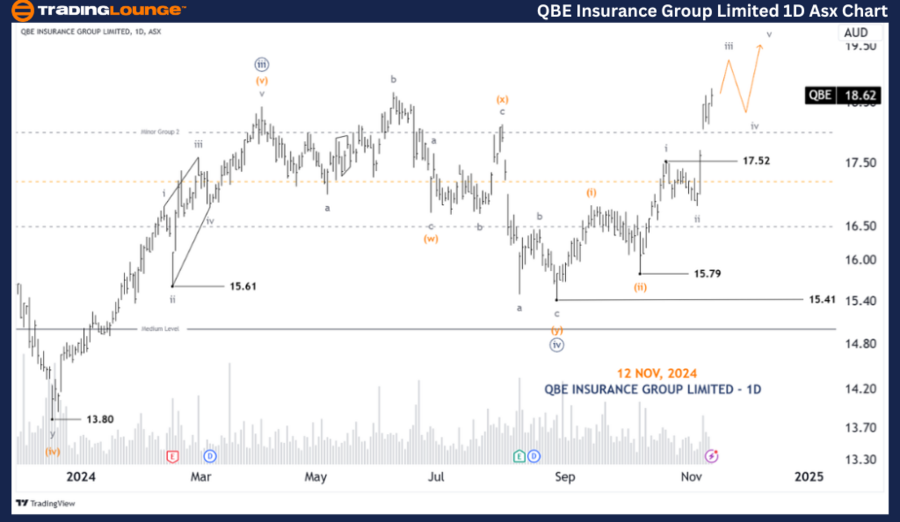

ASX: QBE INSURANCE GROUP LIMITED – QBE 1-Day Chart Analysis (Semilog Scale)

QBE Elliott Wave Technical Analysis

Function: Major trend (Subminuette degree, gray)

Mode: Motive

Structure: Impulse

Position: Wave iii-gray of Wave (iii)-orange of Wave ((v))-navy

Details:

Wave iii-gray of wave (iii)-orange of wave ((v))-navy is advancing higher. For this bullish outlook to remain intact, the price must stay above 17.52, as wave 4 cannot overlap wave 1.

Invalidation Point: 17.52

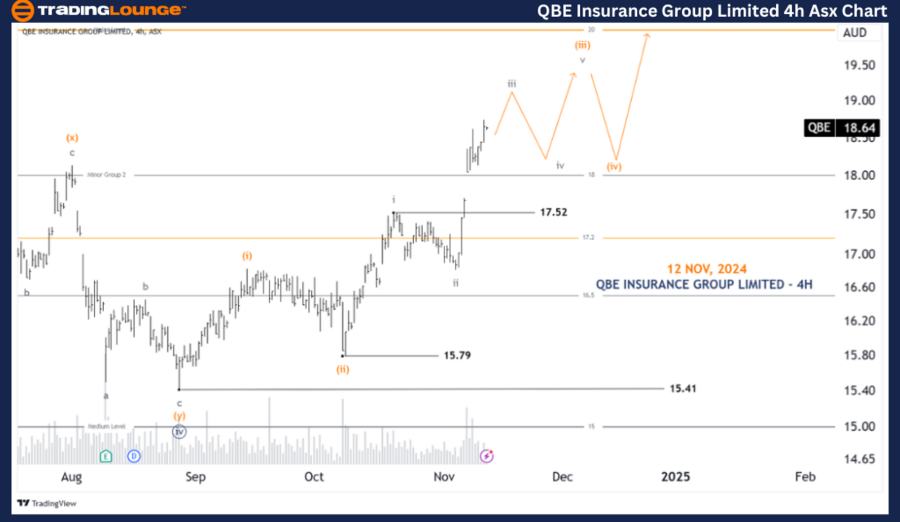

ASX: QBE INSURANCE GROUP LIMITED – QBE 4-Hour Chart Analysis

Function: Major trend (Minuette degree, orange)

Mode: Motive

Structure: Impulse

Position: Wave iii-gray of Wave (iii)-orange

Details:

From the low at 15.79, wave (iii)-orange is extending, with wave iii-gray currently unfolding. A higher push is expected in wave iii-gray, although a temporary pullback into wave iv-gray could occur before the final upward movement in wave v-gray completes the impulse. Importantly, wave iv-gray must not drop below 17.52 to maintain this wave count.

Invalidation Point: 17.52

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: TCL Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

This Elliott Wave analysis for ASX: QBE INSURANCE GROUP LIMITED highlights both the broader and short-term trends, offering actionable insights for traders and investors. Critical price levels, such as 17.52, serve as key validation and invalidation points for our wave structure, ensuring a robust analytical framework. By leveraging these insights, market participants can navigate QBE's price movements with greater precision and confidence.