Welcome to our latest Elliott Wave analysis for NVIDIA Corp. (NVDA). This analysis offers a detailed examination of NVIDIA's price movements using the Elliott Wave Theory, assisting traders in identifying potential opportunities based on current trends and market structures. We will explore insights from both the daily and 4-hour charts to provide a thorough perspective on NVIDIA's market behavior.

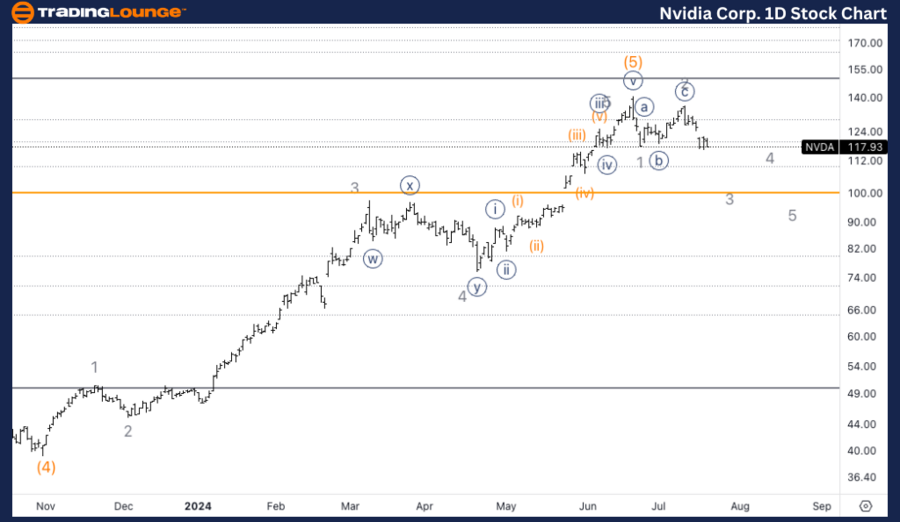

NVDA Elliott Wave Analysis Trading Lounge Daily Chart

NVIDIA Corp., (NVDA) Daily Chart Analysis

NVDA Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: ZigZag

POSITION: Intermediate wave (A)

DIRECTION: Downside in wave 3

DETAILS: The analysis suggests a significant top in wave (5) or the potential for continued upward movement after a clear three-wave move to the downside, indicating one more leg lower before resuming upward.

NVDA Stock Technical Analysis – Daily Chart

The daily chart analysis shows that NVDA may have reached a significant top in wave (5) or is set to continue higher after a corrective phase. Recent price movements reveal a clear three-wave pattern to the downside, suggesting one more leg lower before any potential upward resumption. Traders should watch for signs indicating the completion of wave 3 within this corrective phase.

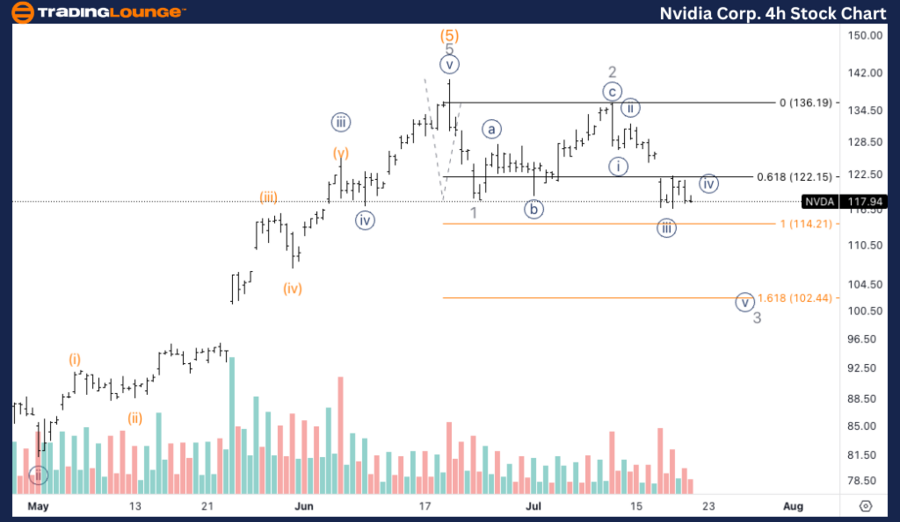

NVDA Elliott Wave Analysis Trading Lounge 4H Chart

NVIDIA Corp., (NVDA) 4H Chart Analysis

NVIDIA Corp Elliott Wave Technical Analysis

FUNCTION: Counter Trend

MODE: Corrective

STRUCTURE: ZigZag

POSITION: Wave 3 of (A)

DIRECTION: Downside in wave 3

DETAILS: The 4-hour chart reveals a five-wave move into wave 3, indicating a strong downward impulse. Common targets for wave 3 are around $102, supported by the 1.618 extension of wave 3 versus wave 1, which is confirmed by volume.

NVIDIA CorpTechnical Analysis – 4H Chart

The 4-hour chart highlights a five-wave move into wave 3, showing a strong downward impulse. Targets for wave 3 are commonly around $102, supported by the 1.618 extension of wave 3 versus wave 1. Volume analysis supports this target.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Visa Inc. (V) Ellott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support