AXIS BANK Elliott Wave Analysis – Trading Lounge Day Chart

AXIS BANK Indian Stock Day Chart Analysis

AXIS BANK Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 5

Next Higher Degree Direction: Navy Blue Wave 3

Details: Navy blue wave 1 completed; wave 2 of 5 currently developing

Invalidation Level: 932

Market Overview and Structural Breakdown

The daily Elliott Wave chart for AXIS BANK outlines a corrective phase within a broader bullish cycle. The stock is presently navigating navy blue wave 2, which is embedded in the longer-term gray wave 5 sequence. This current phase signals a short-term pullback within a generally upward trend.

Navy blue wave 1 has concluded, giving way to wave 2's development. As a counter-trend move, this suggests a temporary slowdown in upward momentum. The next anticipated shift is toward navy blue wave 3, aligning with a return to the primary bullish trajectory.

Key Technical Levels and Market Dynamics

The critical invalidation point is 932. A drop below this level would invalidate the present wave count, requiring structural reassessment.

Since wave 2 is corrective by nature, traders can expect low momentum, which may translate to sideways or mildly bearish price action. It's prudent to wait for the completion of wave 2 before projecting the start of navy blue wave 3, which is expected to carry more decisive market direction.

Trading Strategy and Market Implications

This analysis serves as a framework for interpreting market cycles via the Elliott Wave method. The current corrective structure in wave 2 emphasizes caution. Traders should use the 932 level as a reference point for managing downside risk.

Monitoring this setup allows for strategic positioning, ensuring alignment with broader wave patterns and disciplined risk control.

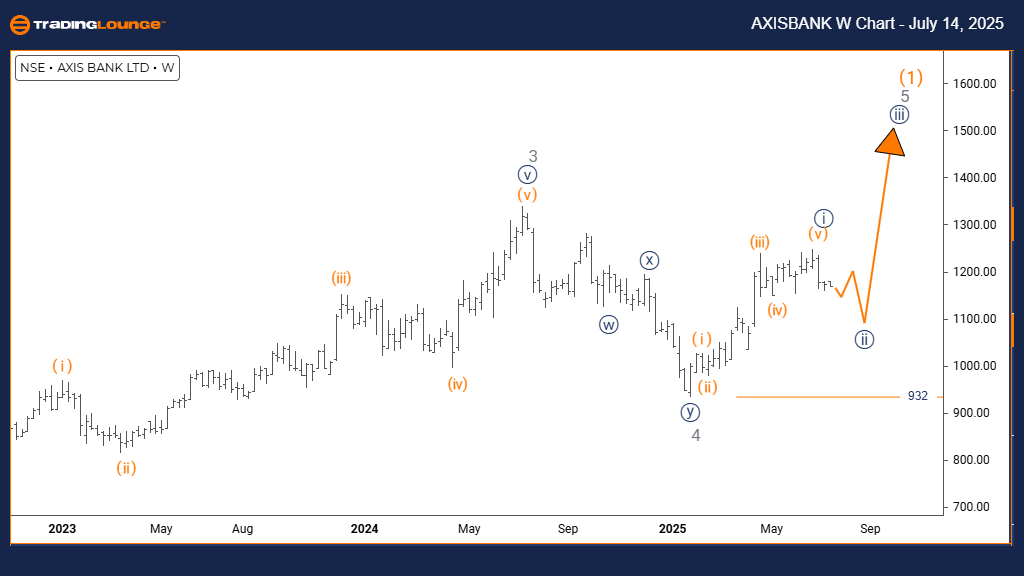

AXIS BANK Elliott Wave Analysis – Trading Lounge Weekly Chart

AXIS BANK Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Navy Blue Wave 2

Position: Gray Wave 5

Next Higher Degree Direction: Navy Blue Wave 3

Details: Wave 1 has likely concluded; wave 2 of 5 is currently forming

Invalidation Level: 932

Weekly Outlook and Structural Synopsis

The weekly Elliott Wave analysis of AXIS BANK suggests a counter-trend corrective phase, currently progressing within navy blue wave 2, part of the broader gray wave 5 structure. This development hints at a medium-term retracement within a sustained uptrend.

With navy blue wave 1 appearing complete, the market now unfolds into wave 2 of 5. This segment typically reflects a temporary pullback before a potential bullish continuation through navy blue wave 3.

Key Price Levels and Technical Focus

Wave 2's corrective identity implies a slowdown, often reflected in sideways or declining price action. This contrasts with the momentum-driven nature of impulse waves. The invalidation point remains firmly at 932—if breached, the entire wave structure would be invalidated.

This level becomes a vital reference for risk management and trading confidence, helping traders discern between wave continuation and potential structural shifts.

Strategic Considerations for Market Participants

This wave-based reading provides long-term market clarity, especially for those integrating multi-timeframe analysis. Understanding wave progression helps recognize potential trend reversal points and structure-aligned entry opportunities.

As wave 2 nears completion, traders should prepare for a possible transition to the more impulsive wave 3. Respect for the invalidation threshold at 932 remains crucial for safeguarding trading capital and maintaining tactical flexibility.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: INFOSYS LABORATORIES Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support