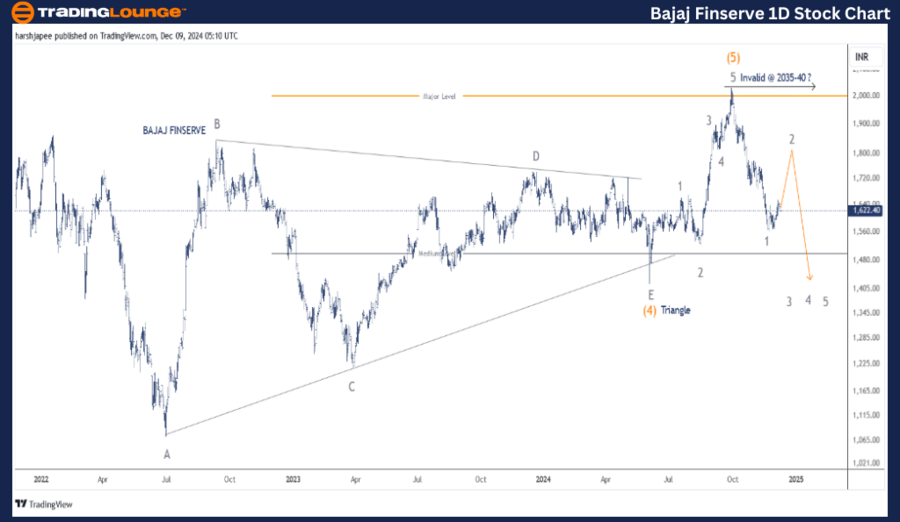

BAJAJ FINSERVE – BAJAJFINSV (1D Chart) Elliott Wave Technical Analysis

BAJAJFINSV Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree Grey)

Mode: Corrective

Structure: Impulse within larger degree correction.

Position: Minor Wave 1 Grey

Details: Minor Wave 1 appears to have completed below 1600. If correct, Minor Wave 2 rally may target the 1800 level before bearish momentum resumes.

Invalidation point: 2040

BAJAJ FINSERVE Daily Chart Technical Analysis and Potential Elliott Wave Counts

The daily chart of BAJAJ FINSERVE suggests a likely trend reversal below the 2040 high recorded in September 2024. The larger degree uptrend seems to have concluded, with bearish forces working towards completing the first impulse wave lower, potentially in the 1400-1550 range.

Previously, the stock exhibited a larger triangle consolidation phase from July 2022 to June 2024, with Intermediate Wave (4) Orange terminating near 1420. Bulls concluded Intermediate Wave (5) as a thrust impulse wave, followed by a sharp price reversal.

Assuming this analysis holds, the price action might breach the 1400 mark in the short term before a counter-trend rally emerges.

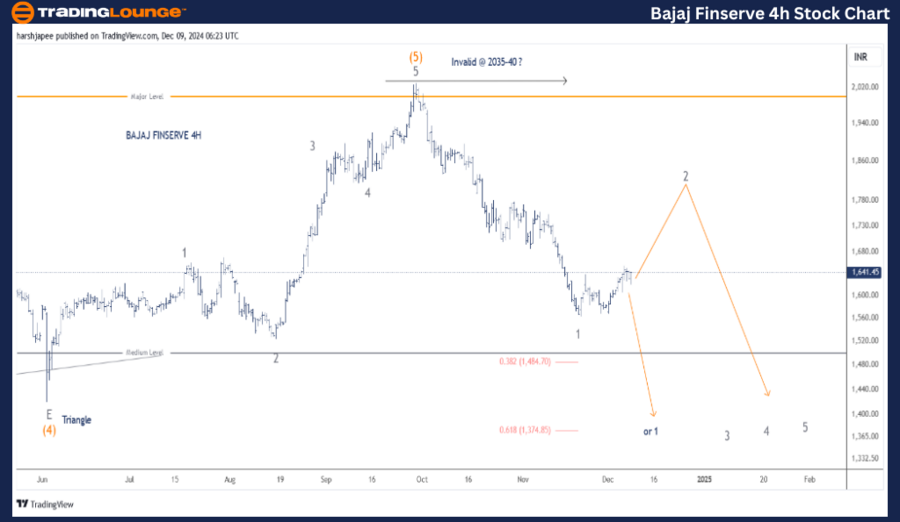

BAJAJ FINSERVE – BAJAJFINSV (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree Grey)

Mode: Corrective

Structure: Impulse within larger degree correction.

Position: Minor Wave 1 Grey

Details: Minor Wave 1 seems to have completed below 1600. If this is accurate, a Minor Wave 2 rally could aim for the 1800 level before bearish control resumes. Alternatively, Minor Wave 1 may complete near the 1400 level, after which the corrective rally would likely commence.

Invalidation point: 2040

BAJAJ FINSERVE 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4-hour chart of BAJAJ FINSERVE outlines sub-waves following the termination of Intermediate Wave (4) Orange, which concluded as a triangle near the 1420 level in June 2024. Intermediate Wave (5) unfolded as an impulse, peaking around the 2035-2040 range.

Since then, the stock has turned bearish, potentially forming an impulse lower. This impulse may have already completed near 1565 or could extend further to the 1400 zone. Note that the 1400 level aligns closely with the prior triangle termination of Wave (4). Once Minor Wave 1 completes its downward movement, a counter-trend rally is anticipated.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: TATAMOTORS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

BAJAJ FINSERVE appears to have reversed below the 2040 high, potentially completing its initial impulse wave drop near 1550. If this analysis holds, a counter-trend rally for Minor Wave 2 Grey is likely to unfold shortly.