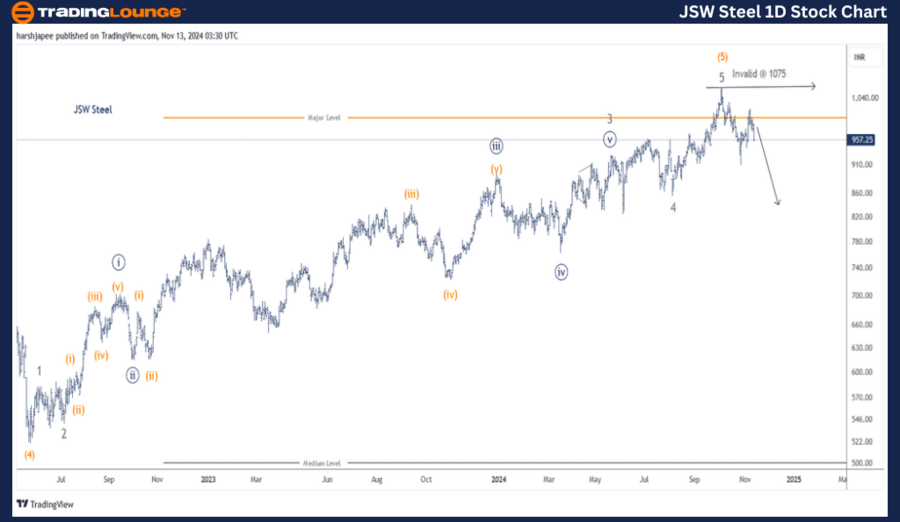

JSW STEEL Stock Analysis - TradingLounge (1D Chart)

JSW STEEL Stock 1D Chart Analysis

JSWSTEEL Elliott Wave Technical Analysis

Function: Counter Trend (Minor Degree Grey)

Mode: Corrective

Structure: Potential impulse within a larger degree correction

Position: Minute Degree is still unfolding

Details: The proposed wave structure has shifted as the stock moved below the 960 mark. Minor Wave 4 Grey has been adjusted, with Wave 5 potentially completing near 1075. A push beyond 1075 will likely reestablish bullish momentum.

Invalidation Point: 1075

JSW STEEL Daily Chart Analysis and Elliott Wave Counts

The JSW STEEL daily chart signals a larger degree trend, terminating at the 1075 high. Intermediate Wave (5) Orange is complete, with prices declining toward the 850 mark at a Minor Degree. At the time of writing, the stock trades around 932.

Key observations:

- Intermediate Wave (4) Orange concluded around 520 in May 2022.

- The subsequent rally subdivides into five waves, labeled Minor Wave 1 through 5, visible on the daily chart.

- Although not explicitly labeled yet, a larger degree correction against the 1075 high is underway.

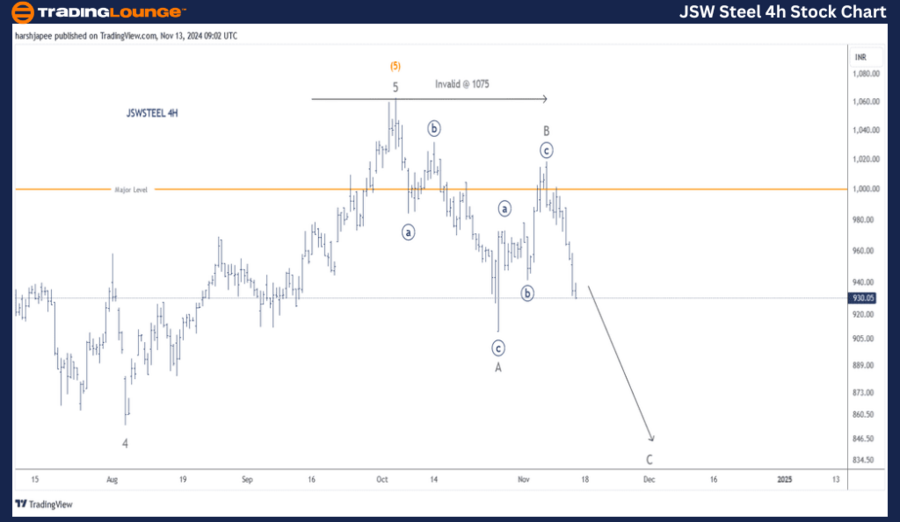

JSW STEEL Stock Analysis - TradingLounge (4H Chart)

JSW STEEL Stock 4-hour Chart Analysis

JSW STEEL – JSWSTEEL Technical Analysis

Function: Counter Trend (Minor Degree Grey)

Mode: Corrective

Structure: Potential impulse within a larger degree correction

Position: Minute Degree is still unfolding

Details:

The wave structure has shifted following a drop below 960. Minor Wave 4 Grey was adjusted, with Wave 5 likely completing near 1075. Bulls could regain control with a breakout above 1075. A potential corrective A-B-C pattern is visible, with Wave C seemingly progressing downward.

Invalidation Point: 1075

JSW STEEL 4H Chart Analysis and Elliott Wave Counts

The JSW STEEL 4H chart reflects adjusted wave counts after Minor Wave 4 concluded near 855 in August 2024. The decline from the 1075 high may represent a Minor Degree A-B-C correction or a more complex pattern. Bears currently dominate, targeting the 850 mark. Any changes to this count will be addressed in the next update.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: EICHER MOTORS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

JSW STEEL is undergoing a corrective decline at a Minor Degree, retracing from the 1075 high.