Gold (XAUUSD) Commodity Elliott Wave Technical Analysis

Gold Elliott Wave Technical Analysis

Gold continues to maintain its strong upward momentum in 2024, nearing another high in just over three weeks. The precious metal has gained over 23% year-to-date, now testing levels close to a new all-time high. Despite this bullish trend, a minor pullback is expected in the near term.

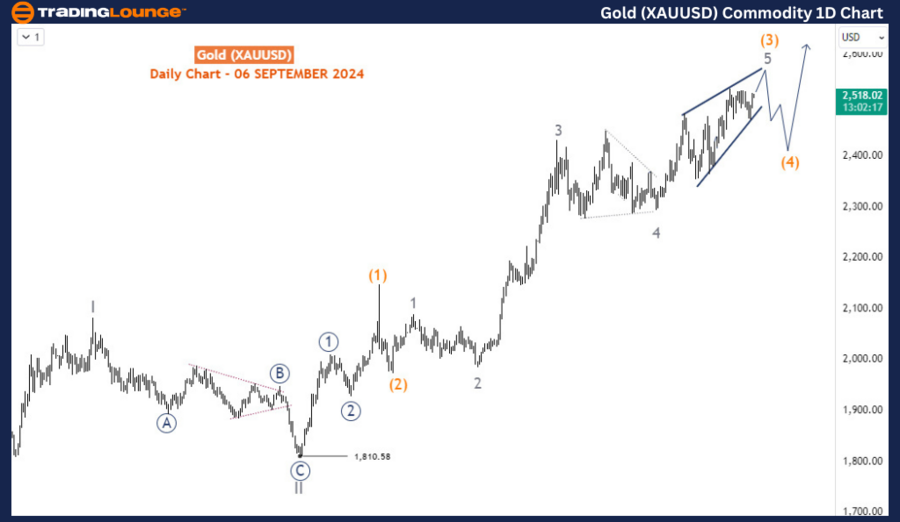

Gold (XAUUSD) Daily Chart Analysis

On the daily chart, Gold has followed a long-term bullish trend since December 2015. Based on Elliott Wave analysis, the supercycle wave (IV) of this larger uptrend was recently completed, setting the stage for a new impulsive move in wave (V). Within wave (V), waves I and II completed in May and October 2023, respectively. Currently, Gold is advancing within wave (3) of 3 (circled) of wave III, which may extend beyond the 2550 level before reaching its peak.

The consolidation phase seen between April 12 and June 26 aligns with wave 4 of (3), acting as a corrective structure in the broader trend. The ongoing upward movement appears to form an ending diagonal structure for wave 5 of (3). If this diagonal holds, Gold is poised to break previous highs and reach a new peak. However, if the structure fails, a correction in wave (4) may follow. This wave (4) correction would offer the market a chance to absorb recent gains before potentially resuming the uptrend.

Gold (XAUUSD) H4 Chart Analysis

On the H4 chart, price action is progressing within wave v (circled) of 5 of (3), following the completion of a flat structure for wave iv (circled). While minor pullbacks have occurred, as long as the price stays above 2472, further rallies are anticipated. For short-term traders, these small dips could serve as entry opportunities as Gold targets new highs.

In the medium term, the completion of wave (3) is approaching, with an expected pullback for wave (4). This pullback could act as a healthy correction, giving the market time to regroup before wave (V) resumes. Traders should prepare for potential reversals as wave (3) concludes and wave (4) begins, marking a crucial point in Gold's multi-year bullish cycle.

This analysis indicates that although Gold shows continued strength, the Elliott Wave structure points to an imminent correction before the broader uptrend resumes.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cocoa Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support