TradingLounge Commodity: Cocoa Elliott Wave Analysis

Cocoa Elliott Wave Technical Analysis

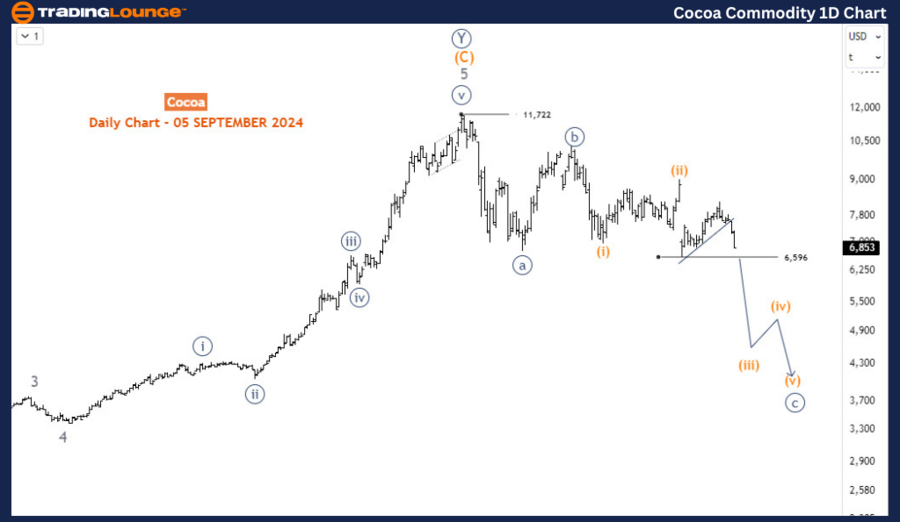

Cocoa prices have been consolidating within a range since mid-May 2024, fluctuating between $10,000 and $6,770. Despite minor rebounds, the likelihood of cocoa breaking the $6,770 support level remains high. The commodity touched this low on August 7, followed by a small bounce. However, the broader correction that began in April 2024, when cocoa peaked at an all-time high of $11,722, is expected to continue, potentially driving prices down to $6,000 or even below $5,000 in the coming weeks.

Cocoa Daily Chart Analysis

From a long-term perspective, cocoa completed a significant bullish impulse wave cycle that began in September 2022 when prices were around $2,000. This powerful impulse wave, consistent with Elliott Wave theory, propelled prices upward by over 430%, reaching a peak of $11,722 in April 2024. According to Elliott Wave principles, after such a substantial impulsive move, markets typically enter a three-wave corrective phase. Currently, cocoa is in this corrective phase, forming an a-b-c wave pattern.

In this structure, waves a and b (circled) have already completed. Wave a marked the initial decline from the all-time high, and wave b represented a brief rebound. The market is now in wave c, the final and most aggressive leg of this corrective phase. Wave c is expected to extend lower, potentially reaching $5,000 or below before the correction concludes. This decline is a natural progression following the massive bullish impulse, and upon completion, cocoa may either resume its upward trend or experience a corrective bounce.

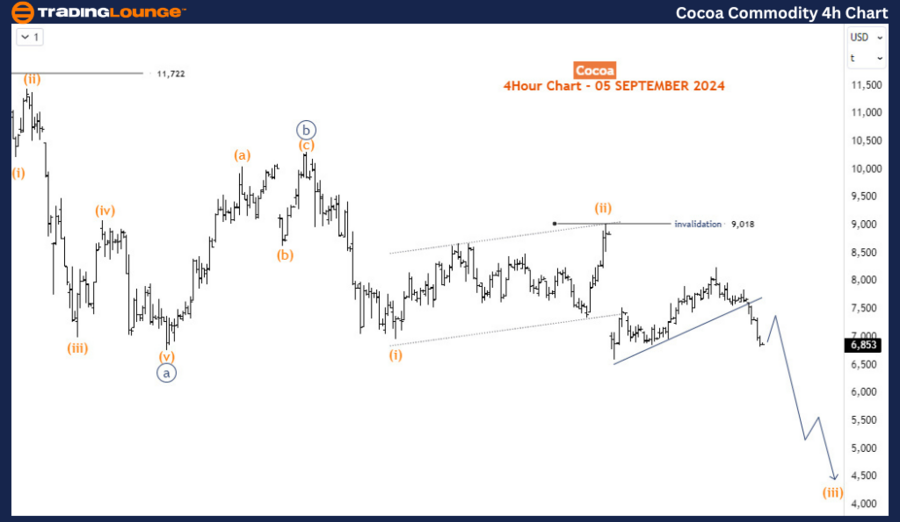

Cocoa H4 Chart Analysis

On the H4 chart, the ongoing corrective decline is unfolding in a 5-3-5 corrective pattern, typical of wave c movements. Wave c is currently in the third sub-wave, labeled wave (iii), which is typically the strongest part of the decline. Given the current momentum, it is likely that the $6,596 support level will be breached, extending the selloff that started at the $11,722 peak. The overall target for this wave is near $5,000, where support may emerge, leading to either a continuation of the long-term bullish trend or another corrective bounce.

This analysis underscores the ongoing bearish momentum in cocoa prices, with key levels indicating further downside before any significant recovery.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Cron Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support