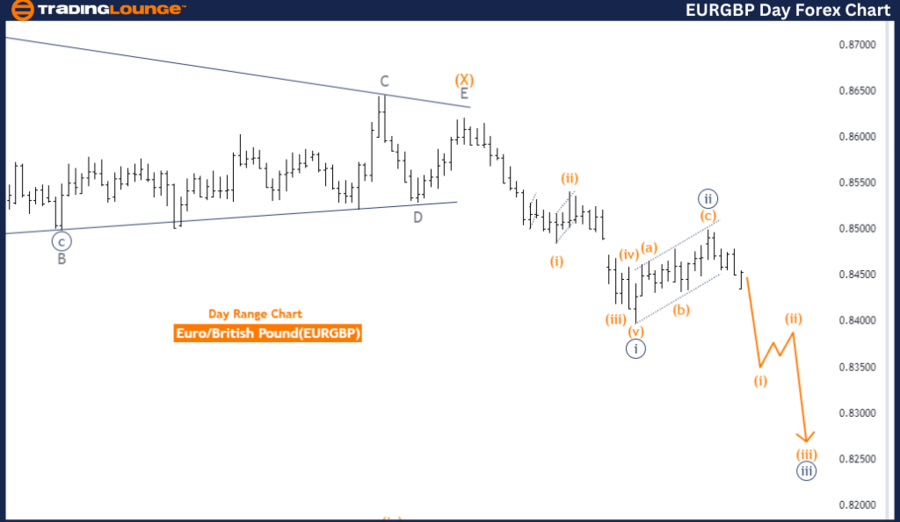

EURGBP Elliott Wave Analysis Trading Lounge Day Chart

EURGBP Elliott Wave Technical Analysis Day Chart

The EURGBP Elliott Wave Analysis on the daily chart focuses on identifying the trend and wave structure of the Euro against the British Pound. This analysis captures the ongoing trend, classified as impulsive, indicating strong directional movement and suggesting the trend's continuation.

Function: Trend

Mode: Impulsive

Structure: Orange wave 1

Position: Navy blue wave 3

Direction Next Higher Degrees: Orange wave 2

Details: Navy blue wave 2 completed at 0.84994, now orange wave 1 of 3 is in play. Wave cancel invalid level: 0.84994

Key Points:

- The specific wave structure under scrutiny is orange wave 1.

- The current position within this structure is navy blue wave 3, signifying an advanced stage of a larger impulsive wave sequence.

- This stage is crucial as it typically denotes significant and powerful market movement.

- The analysis points out that navy blue wave 2 appears completed at 0.84994. This completion follows a corrective move and precedes a substantial impulsive move. With navy blue wave 2 concluded, the market is now in orange wave 1 of 3. This phase generally involves a strong and extended movement in the direction of the overall trend.

Next Steps:

- The direction in the next higher degrees indicates the formation of orange wave 2.

- After the completion of the current impulsive wave (orange wave 1), the market will enter a corrective phase (orange wave 2).

- The immediate focus remains on the development and progression of orange wave 1.

- The wave cancel invalid level is set at 0.84994. This level is essential for maintaining the validity of the current wave structure. If the market surpasses this threshold, the existing wave count would be invalidated, necessitating a re-evaluation and potential re-labeling of the wave counts.

Summary:

- The EURGBP daily chart analysis indicates that the market is in an impulsive trend with orange wave 1 currently unfolding within navy blue wave 3.

- The analysis suggests that navy blue wave 2 has been completed at 0.84994, and orange wave 1 of 3 is now in play.

- The focus is on the continuation of this impulsive movement, with the wave cancel invalid level set at 0.84994.

- This analysis underscores the potential for further upward movement in the EURGBP currency pair.

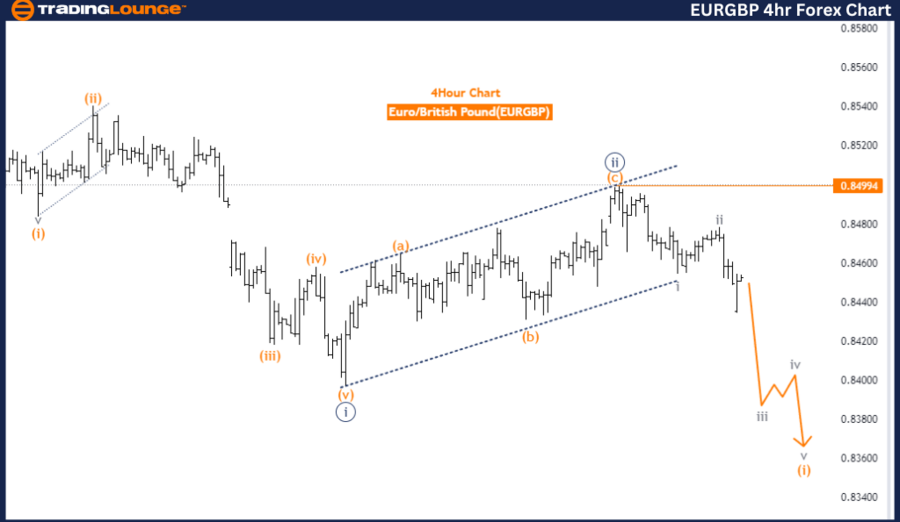

EURGBP Elliott Wave Analysis Trading Lounge 4 Hour Chart

EURGBP Elliott Wave Technical Analysis 4 Hour Chart

The EURGBP Elliott Wave Analysis on the four-hour chart aims to identify the current trend and wave structure of the Euro against the British Pound. This analysis focuses on capturing the trend, classified as impulsive, indicating strong directional movement and suggesting the trend's continuation.

Function: Trend

Mode: Impulsive

Structure: Gray wave 3

Position: Orange wave 1

Direction Next Higher Degrees: Gray wave 4

Details: Gray wave 2 completed, now gray wave 3 of 1 is in play. Wave cancel invalid level: 0.84994

Key Points:

- The specific wave structure under analysis is gray wave 3.

- The position within this structure is orange wave 1, indicating the market is in the early stages of a larger impulsive wave sequence.

- This stage is significant as it typically marks the beginning of a powerful and sustained market movement.

- The analysis points out that gray wave 2 appears completed. This completion follows a corrective move and precedes a significant impulsive move. With gray wave 2 concluded, the market is now in gray wave 3 of 1. This phase typically involves a strong and extended movement in the direction of the overall trend.

Next Steps:

- The direction in the next higher degrees points towards gray wave 4.

- After the completion of the current impulsive wave (gray wave 3), the market will enter a corrective phase (gray wave 4).

- The immediate focus remains on the progression of gray wave 3.

- The wave cancel invalid level is set at 0.84994. This level is essential for maintaining the validity of the current wave structure. If the market surpasses this threshold, the existing wave count would be invalidated, requiring a re-evaluation and potential re-labeling of the wave counts.

Summary:

- The EURGBP four-hour chart analysis indicates that the market is in an impulsive trend with gray wave 3 currently unfolding within orange wave 1.

- The analysis suggests that gray wave 2 has been completed, and gray wave 3 of 1 is now in play.

- The focus is on the continuation of this impulsive movement, with the wave cancel invalid level set at 0.84994.

- This analysis highlights the potential for further upward movement in the EURGBP currency pair.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support