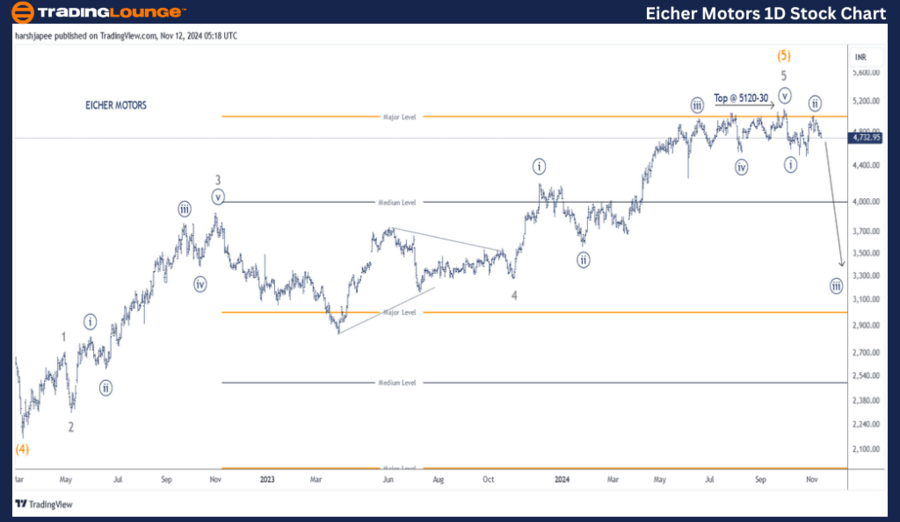

EICHER MOTORS – EICHERMOT Elliott Wave Technical Analysis (1D Chart)

EICHERMOT Elliott Wave Technical Analysis

Function: Counter Trend (Minute Degree, Orange)

Mode: Corrective

Structure: Impulse with Larger Degree Correction

Position: Minute Wave ((ii)) Navy

Details:

- The structure appears to have turned lower against the 5120-30 high, signaling potential Intermediate Wave (5) termination.

- Minute Wave ((i)) has completed its first impulse drop, and Minute Wave ((ii)) looks to be finished as prices turn lower from the 5010 level.

- Minute Wave ((iii)) is likely in progress.

Invalidation Point: 5120

EICHER MOTORS Daily Chart Technical Analysis and Elliott Wave Counts

- The daily chart indicates a larger degree uptrend that likely terminated in the 5120-30 range, marking Intermediate Wave (5) Orange as complete.

- The stock has turned lower, carving out Minute Waves ((i)) and ((ii)) around 4536 and 5010 levels, respectively.

- Earlier, in March 2022, the stock dropped to 2175 lows, completing Intermediate Wave (4) Orange. The subsequent rally subdivided into five Minor Waves (1 to 5) clearly visible on the chart.

If this wave structure holds true, EICHER MOTORS has concluded its larger degree uptrend around the 5120-30 range and entered a bearish phase, with bears maintaining control over the current price action.

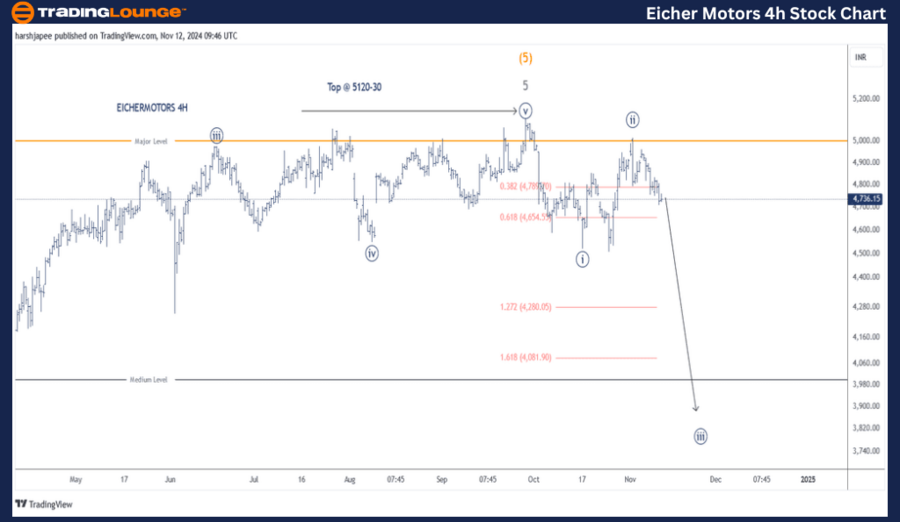

EICHER MOTORS – EICHERMOT Elliott Wave Technical Analysis (4H Chart)

Function: Counter Trend (Minute Degree, Orange)

Mode: Corrective

Structure: Impulse with Larger Degree Correction

Position: Minute Wave ((ii)) Navy

Details:

- The structure likely turned lower after hitting the 5120-30 high, which aligns with the potential termination of Intermediate Wave (5) Orange.

- Minute Wave ((i)) is completed around the 4536 level, followed by an expanded flat Minute Wave ((ii)) near 5010.

- Minute Wave ((iii)) appears to be underway and pulling prices lower.

Invalidation Point: 5120

EICHER MOTORS 4H Chart Technical Analysis and Elliott Wave Counts

- The 4H chart reveals lower-degree wave counts following highs around the 5120 level, marking a likely Intermediate Wave (5) Orange termination.

- Minute Wave ((i)) carved out at 4536, followed by an expanded flat correction to Minute Wave ((ii)) at 5010.

- If accurate, Minute Wave ((iii)) is actively dragging prices downward, signaling further bearish momentum.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANIPORTS Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

EICHER MOTORS is likely declining within Minute Wave ((iii)), maintaining a bearish stance as long as prices stay below the 5120-30 range.