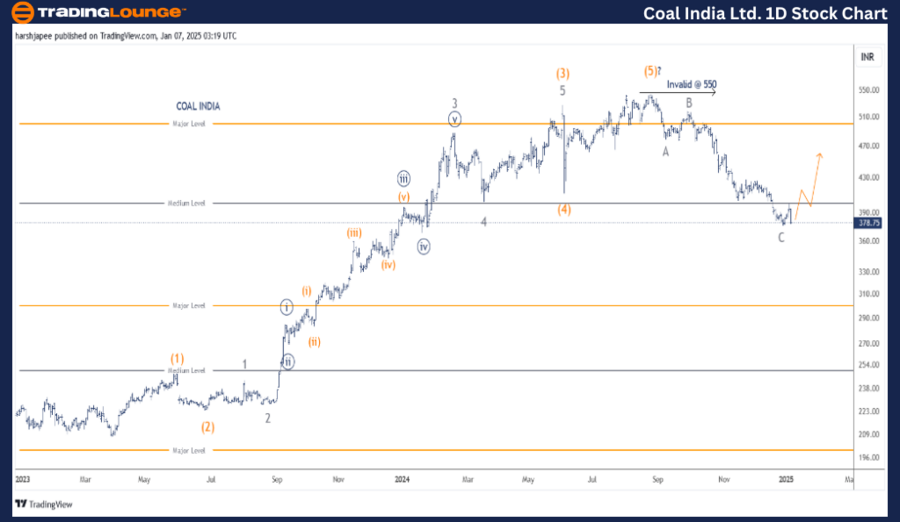

COAL INDIA LTD – COALINDIA (1D Chart) Elliott Wave Technical Analysis

COALINDIA Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree, Grey)

Mode: Corrective

Structure: Potential Flat

Position: A-B-C Flat Might Be Complete

Details:

A potential top has formed around the 550 level, marking the termination of Intermediate Wave (5) in Orange. The stock has declined to approximately 375 in three waves (A-B-C). A short-term rally is anticipated from current levels before the next leg of the downward trend resumes.

Invalidation Point: 550

COAL INDIA Daily Chart Technical Analysis and Potential Elliott Wave Counts

The COAL INDIA daily chart signals a major top at the 550 mark. The stock surged from 208 in March 2023 to 550 in August 2024 as an impulse wave, marking the completion of Intermediate Wave (5) in Orange.

Since reaching 550, the price has reversed sharply, dropping to 375 in an A-B-C flat corrective structure. Based on this analysis, a corrective rally towards at least 430 levels is likely before the next leg of the downtrend continues.

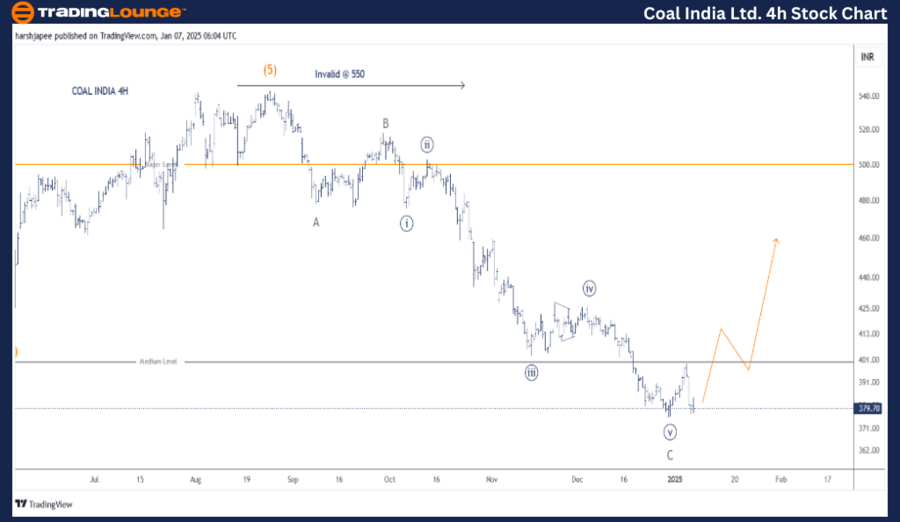

COAL INDIA LTD – COALINDIA (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend Lower (Minor Degree, Grey)

Mode: Corrective

Structure: Potential Flat

Position: A-B-C Flat Might Be Complete

Details:

A potential top is visible at the 550 level, marking the end of Intermediate Wave (5) in Orange. From this level, the stock has dropped to the 375 mark, forming an A-B-C corrective flat. Minor Wave C subdivides into five smaller waves, suggesting the possibility of a short-term rally before the downward movement resumes.

Invalidation Point: 550

COAL INDIA 4H Chart Technical Analysis and Potential Elliott Wave Counts

The COAL INDIA 4H chart illustrates a wave structure since the 550 high. The pattern resembles an A-B-C (3-3-5) flat correction, complete at the 375 level. If correct, buyers might re-enter soon, driving a short-term rally.

Alternatively, if the decline continues, the current structure could extend or evolve into an impulse wave from the 550 high. Nevertheless, a pullback rally is anticipated before further downside moves materialize.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ADANI ENTERPRISES LTD. Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

COAL INDIA appears set for a corrective pullback from the 375 low, having completed a Minor Degree A-B-C flat correction from the 550 high. Traders should monitor for a potential rally before the next downward leg resumes.