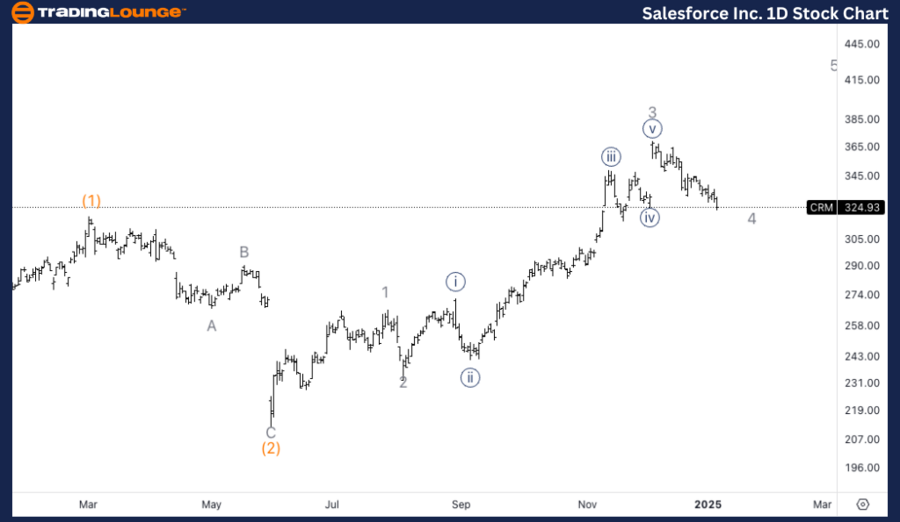

Salesforce Inc. (CRM) Elliott Wave Analysis - Trading Lounge Daily Chart

CRM Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Complex

Position: Wave 4 of (3)

Direction: Pullback in Wave 4

Details:

Salesforce Inc. is currently experiencing a potential Wave 4 correction, which seems to be nearing completion. However, it remains uncertain whether this is Wave 4 of (3) or if the stock has transitioned into Wave 1 of (3), indicating greater upside potential. Confirmation of the wave structure will be crucial to determine the next directional move. For now, traders should monitor the completion of the Wave 4 pullback to assess whether it will lead to a continuation in the uptrend (Wave (3)) or lay the foundation for a broader bullish breakout.

CRM Elliott Wave Technical Analysis – Daily Chart

Salesforce's Wave 4 corrective pullback appears close to completion on the daily chart. The current wave structure presents two possibilities: either the correction concludes Wave 4 of (3), continuing the uptrend, or it represents the early stages of Wave 1 of (3), signaling substantial bullish potential ahead. Until wave confirmation is observed, traders should prepare for an imminent resolution of the correction.

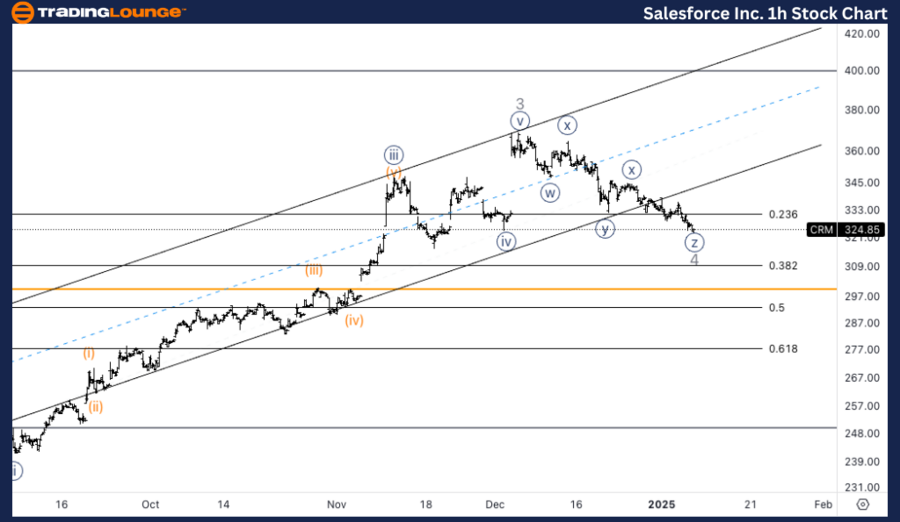

Salesforce Inc. (CRM) Elliott Wave Analysis - Trading Lounge 1-Hour Chart

CRM Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Complex

Position: Wave {z} of 4

Direction: Approaching Bottom in Wave 4

Details:

The 1-hour chart analysis indicates a Wave {z} of 4 correction, which is nearing its final stages. The price is approaching the typical correction zone near the previous Wave {iv}, where a bottom could form. A reversal or a pullback higher is expected in the short term, signaling the end of Wave 4 and the potential start of an upward trend.

CRM Elliott Wave Technical Analysis – 1-Hour Chart

The 1-hour timeframe suggests that Salesforce is in the last phase of its Wave {z} of 4 correction. As the price nears the region of the prior Wave {iv}, a bottom is anticipated soon. This corrective phase is likely to conclude with either a reversal or at least a higher pullback, marking the transition to a bullish movement. Traders should closely watch for confirmations signaling the completion of Wave 4 and the onset of an upward trend.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Netflix Inc. (NFLX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support