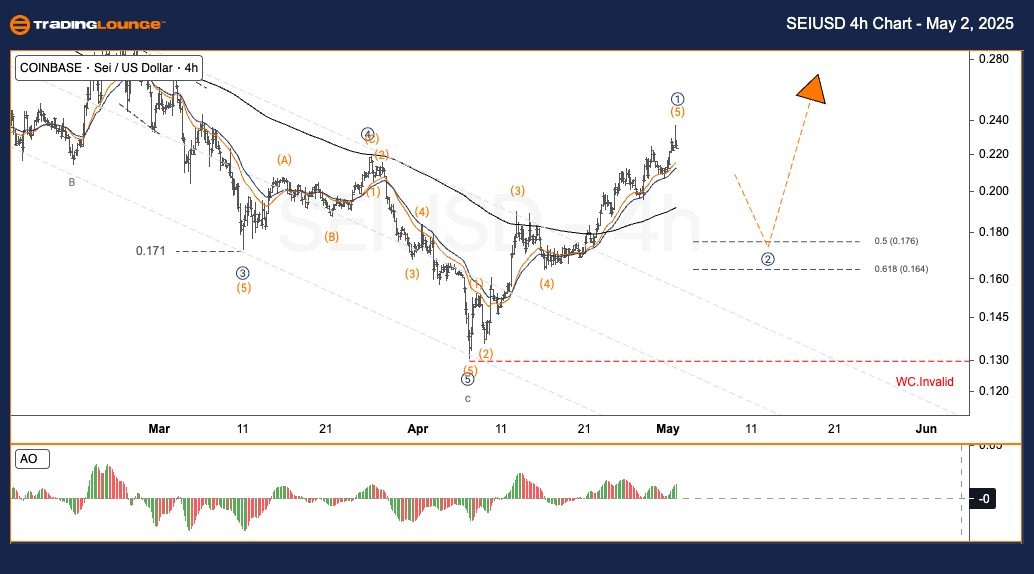

SEIUSD Elliott Wave Analysis TradingLounge Daily Chart

SEI/ U.S. Dollar (SEIUSD) Daily Chart Analysis

SEIUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

SEI/ U.S. Dollar (SEIUSD) Trading Strategy:

Following an extended corrective phase during early 2025, SEIUSD (Sei Cryptocurrency) appears to have completed its final downward leg around the $0.13–$0.14 support zone. SEIUSD has now initiated a strong bullish rally, marking the beginning of Elliott Wave ①. Presently, SEIUSD is entering Wave ②, expected to develop as a classic (A)-(B)-(C) corrective pattern.

Wave ② Support Targets:

50% Fibonacci Retracement: $0.1757

61.8% Fibonacci Retracement: $0.1637

Wave Cancel Invalid Level: A drop below $0.13 would invalidate the current Elliott Wave structure for SEIUSD and trigger a reassessment.

Trading Strategies

Strategy:

For Short-Term Traders (Swing Trading):

Monitor for a retracement into the key Fibonacci retracement zone and seek bullish reversal signals to enter long positions.

Risk Management:

Set stop-loss orders below the $0.16 support zone, or use $0.13 as the absolute invalidation level for SEIUSD trades.

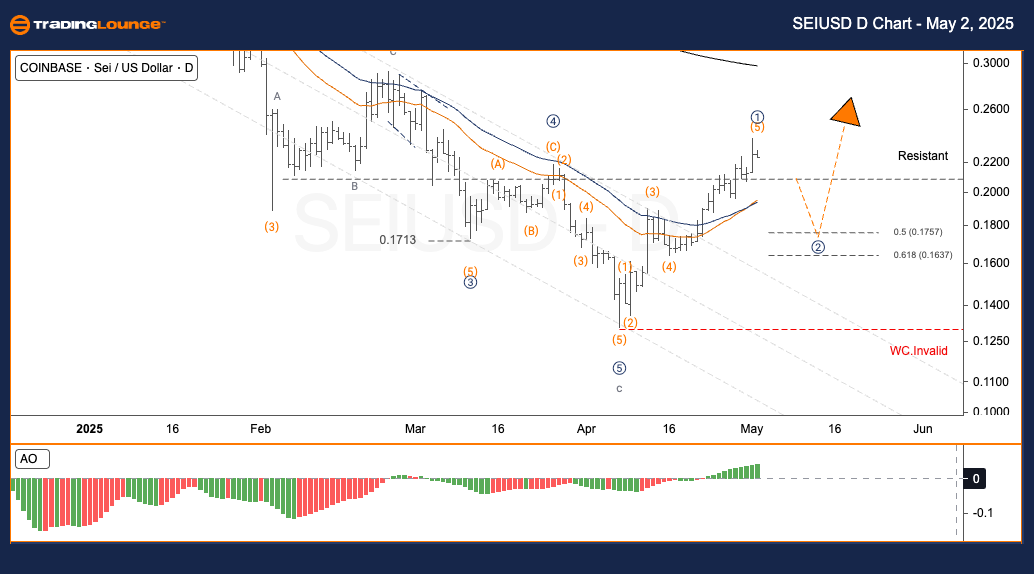

SEIUSD Elliott Wave Analysis TradingLounge H4 Chart

SEI/ U.S. Dollar (SEIUSD) 4-hour Chart Analysis

SEIUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Impulse

Position: Wave 2

Direction Next Higher Degrees:

Wave Cancel Invalid Level:

SEI/ U.S. Dollar (SEIUSD) Trading Strategy:

After a prolonged corrective phase during early 2025, SEIUSD has seemingly concluded its bearish cycle around the $0.13–$0.14 area and is now showing a sharp bullish movement that initiated Elliott Wave ①. Currently, SEIUSD is developing Wave ②, projected to unfold as an (A)-(B)-(C) corrective structure.

Wave ② Support Targets:

50% Fibonacci Retracement: $0.1757

61.8% Fibonacci Retracement: $0.1637

Wave Cancel Invalid Level: A decline below $0.13 would negate the current Elliott Wave count for SEIUSD, requiring a fresh technical reassessment.

Trading Strategies

Strategy:

For Short-Term Traders (Swing Trading):

Anticipate a retracement towards the Fibonacci retracement zone and watch for bullish reversal patterns to establish trading positions.

Risk Management:

Position stop-loss orders slightly under the $0.16 support zone or use $0.13 as the invalidation safeguard for SEIUSD swing trades.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: XRPUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support