LINKUSD Elliott Wave Technical Analysis (Daily Chart)

LINKUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Double Corrective

Position: Wave 2

Invalidation Level: Not defined

Chainlink (LINKUSD) Trading Strategy:

In the prior upward wave (Wave I), LINKUSD completed an Expanded Diagonal structure, topping out at $17.97. The subsequent pullback, classified as Wave II, followed a Double Zigzag pattern, reaching the 0.786 Fibonacci retracement level at $11.43.

Currently, prices are climbing in wave (1) and may be entering a corrective wave (2) before initiating wave (3), which could indicate a renewed bullish impulse.

A significant resistance level is located at $16.00, acting as a bullish confirmation point. If price action breaks above this zone, it could affirm a mid-term bullish trend for Chainlink.

Trading Strategy Highlights:

✅ Swing Trading (Short-term):

- Wait until the current wave (2) consolidation concludes.

- Position during wave (3) to capitalize on potential momentum.

🟥 Risk Management:

Monitor the $10.80 level as a potential invalidity zone to manage downside exposure.

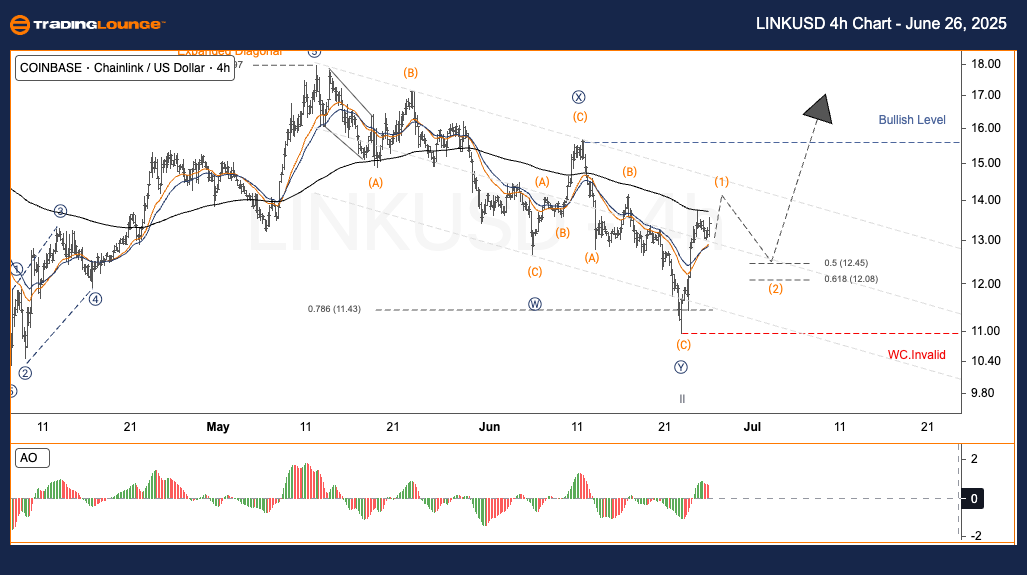

LINKUSD Elliott Wave Technical Analysis (4-Hour Chart)

Function: Counter Trend

Mode: Corrective

Structure: Double Corrective

Position: Wave 2

Invalidation Level: Not defined

Overview:

Mirroring the Daily Chart, Wave I peaked at $17.97, and the retracement in Wave II bottomed at $11.43, completing a Double Zigzag correction.

The current price activity suggests upward momentum in wave (1), with a likely minor pullback in wave (2) forming short-term.

The $16.00 resistance remains a crucial breakout level, which, if breached, supports the bullish case for wave (3) continuation.

✅ Swing Trade Strategy:

Stay patient until wave (2) ends to initiate new positions into wave (3).

🟥 Invalidation Zone: Near $10.80

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: ETHUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support