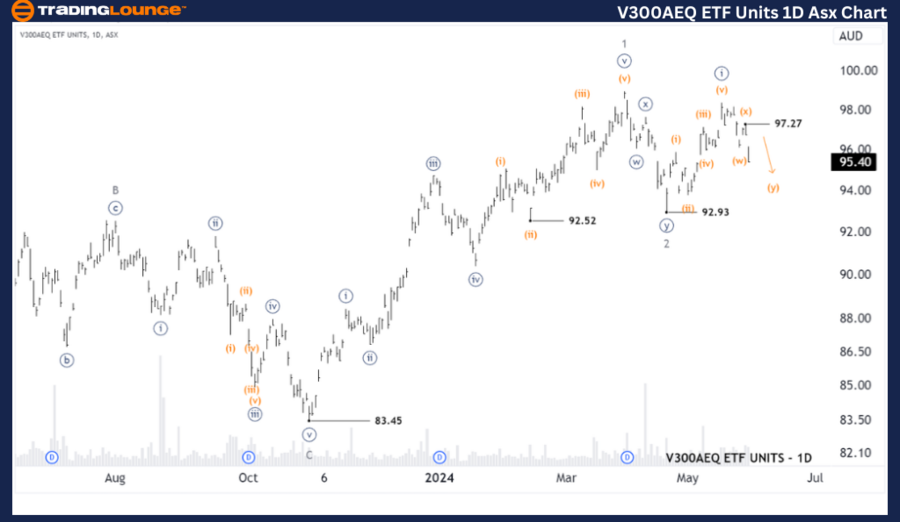

ASX: V300AEQ ETF UNITS – VAS Elliott Elliott Wave Technical Analysis TradingLounge (1D Chart)

Greetings, Our latest Elliott Wave analysis updates the Australian Stock Exchange (ASX) regarding V300AEQ ETF Units – VAS. We have confirmed the completion of wave 2-red and observed that wave 3-red is beginning its ascent.

ASX: V300AEQ ETF Units – VAS Elliott Wave Technical Analysis

1D Chart Analysis (Semilog Scale)

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave (y)-orange of Wave ((ii))-navy of Wave 3-grey

Details: The short-term outlook indicates that wave 2-grey has completed, and wave 3-grey is currently unfolding. This wave is subdividing into wave ((i))-navy, which has completed a five-wave pattern and reached its peak. Now, wave ((ii))-navy is unfolding as a Double Zigzag. Once wave ((ii))-navy completes, a long trade setup will be in place to buy into wave ((iii))-navy of wave 3-grey.

Invalidation Point: 92.93

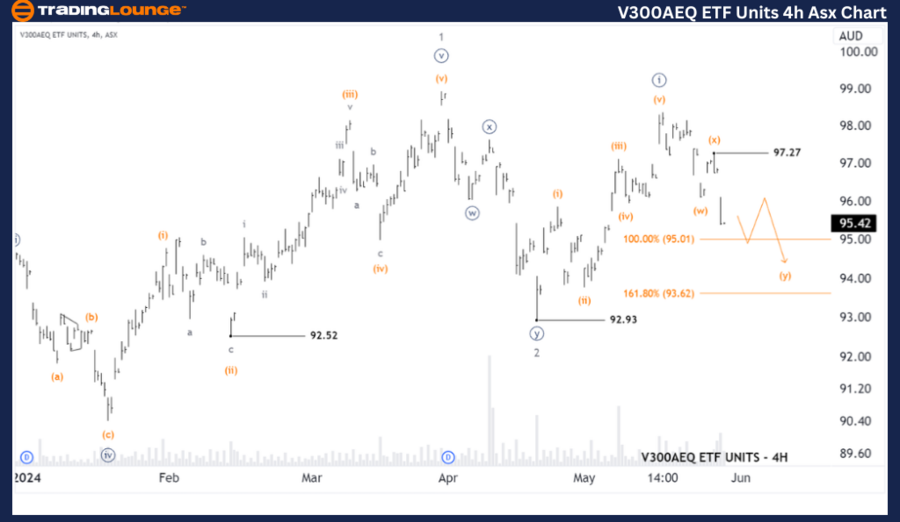

ASX: V300AEQ ETF Units – VAS Elliott Wave Technical Analysis (4-Hour Chart)

4-Hour Chart Analysis

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave (y)-orange of Wave ((ii))-green

Details: The shorter-term outlook shows that wave ((i))-navy has ended after a five-wave subdivision. Wave ((ii))-navy is currently unfolding and pushing lower, developing as a Double Zigzag labeled (w), (x), (y)-orange. This movement is expected to find support in the 95.01 - 93.62 range. Once wave ((ii))-navy completes, a strong long trade setup targeting wave ((iii))-navy will emerge.

Invalidation Point: 92.93

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: ASX: NEWS CORPORATION. – NWS Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion

Our analysis provides a detailed forecast of contextual trends and a short-term outlook for ASX: V300AEQ ETF Units – VAS. These insights help investors understand the current market trends and capitalize on them effectively. We offer specific price points that act as validation or invalidation signals for our wave count, enhancing confidence in our perspective. By combining these factors, we aim to provide the most objective and professional market trend analysis.