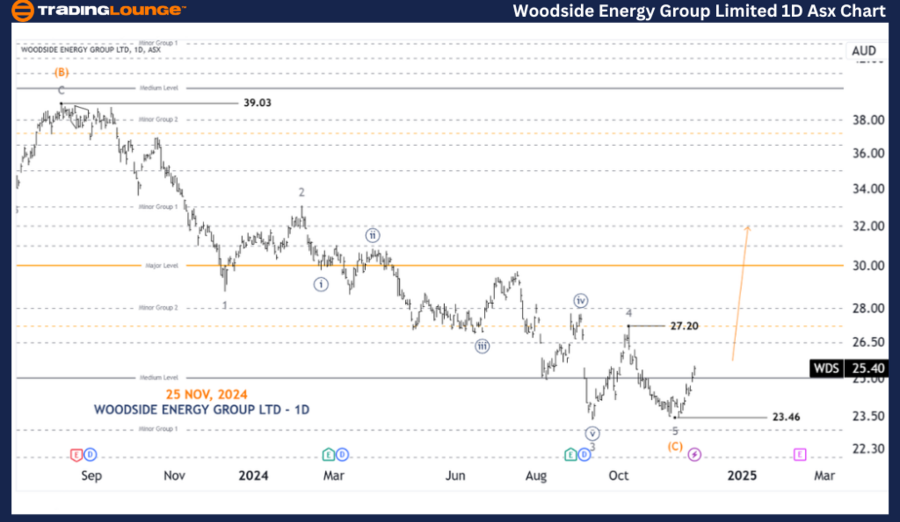

ASX: WOODSIDE ENERGY GROUP LTD - WDS Elliott Wave Analysis 1D Chart

Greetings! In this Elliott Wave analysis update, we delve into the Australian Stock Exchange (ASX) with a focus on WOODSIDE ENERGY GROUP LTD (ASX: WDS). Our observations suggest that ASX: WDS may be in the process of unfolding a wave ((iii))-navy, indicating the potential for upward movement. A break above the 27.20 level would further validate this analysis.

ASX: WOODSIDE ENERGY GROUP LTD - WDS 1D Chart (Semilog Scale) Analysis

WDS Elliott Wave Technical Analysis

Function: Major Trend (Primary Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((3))-navy

Details:

Our analysis shows signs that wave ((2))-navy may have completed, and wave ((3))-navy is likely in progress. A confirmed push above the 27.20 level would reinforce this outlook.

Invalidation Point: 23.46

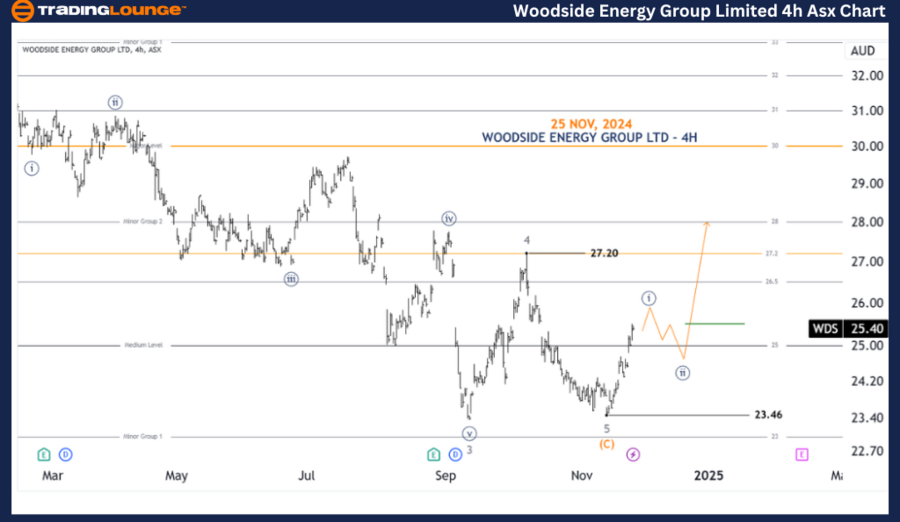

ASX: WOODSIDE ENERGY GROUP LTD - WDS 4-Hour Chart Analysis

Function: Major Trend (Minuette Degree, Navy)

Mode: Motive

Structure: Impulse

Position: Wave ((i))-navy

Details:

From the recent low at 23.46, the chart displays a probable five-wave structure that can be identified as wave ((i))-navy. This suggests the potential for further upward movement before a pullback in wave ((ii))-navy. Upon completion of this pullback, a renewed upward push is expected.

To capitalize on this setup, traders could look to Go Long after the price pulls back and then moves above the wave B level of wave ((ii))-navy. The 25.00 level would then act as a medium-term support level, strengthening the potential for a quality long position.

Invalidation Point: 23.46

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WESFARMERS LIMITED – WES Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

Our analysis of ASX: WOODSIDE ENERGY GROUP LTD - WDS offers insights into both contextual market trends and short-term trading opportunities. By highlighting specific price levels such as 27.20 (validation) and 23.46 (invalidation), we aim to provide a structured and objective perspective on the current wave count. These levels allow traders to better assess the reliability of the forecast and act accordingly. Combining technical insights with actionable strategies, we aim to empower readers to navigate market movements effectively.