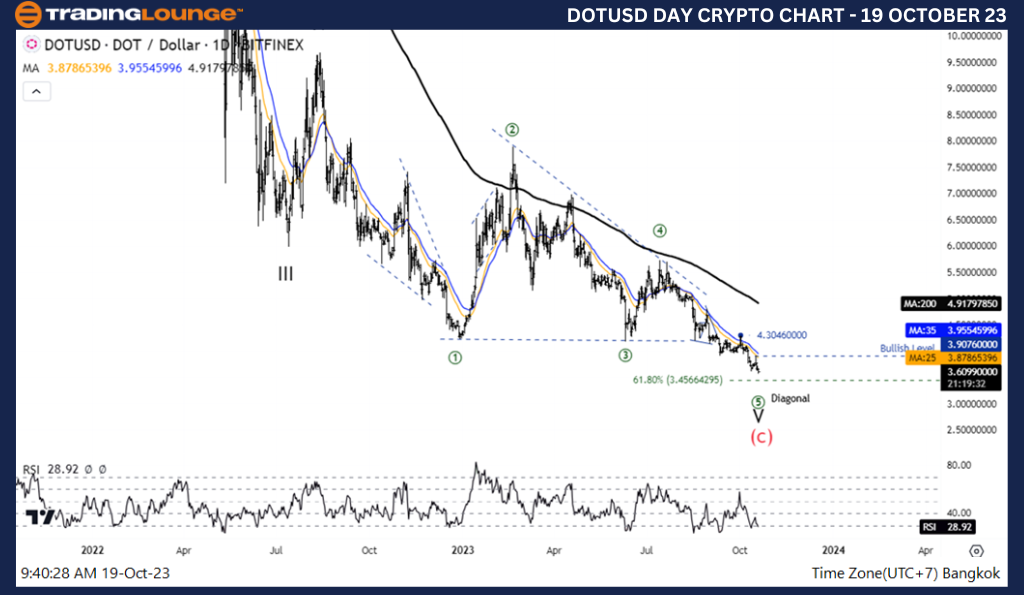

Elliott Wave Analysis TradingLounge Daily Chart, 19 October 23,

Polkadot/U.S. dollar(DOTUSD)

DOTUSD Elliott Wave Technical Analysis

Function: counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave B

Direction Next higher Degrees: wave ((5)) of Diagonal

Wave Cancel invalid level: 4.20

Details: the fall not complete, decline .in wave ((5))

Polkadot/U.S. dollar(DOTUSD)Trading Strategy: Wave 5's decline appears to be nearing its end, with Wave 5 providing early warning of a correction or trend change. And we are waiting for a five-wave rally above 3.9076 to support this idea.

Polkadot/U.S. dollar(DOTUSD)Technical Indicators: The price is below the MA200 indicating a Downtrend, RSI is a Bearish Momentum.

TradingLounge Analyst: Kittiampon Somboonsod, CEWA

Source: Tradinglounge.com get trial here!

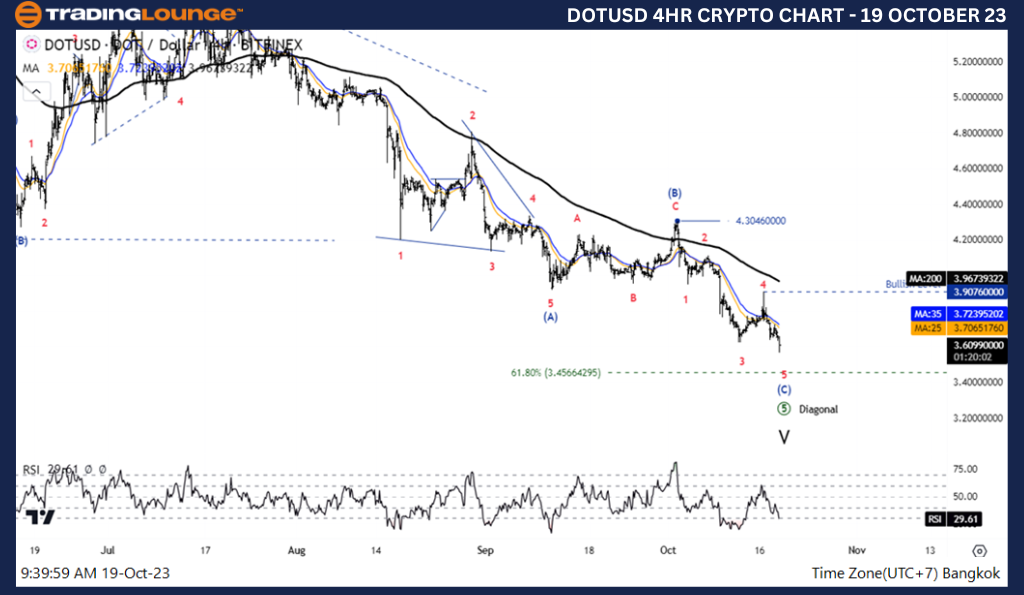

Elliott Wave Analysis TradingLounge 4H Chart, 19 October 23,

Polkadot/U.S. dollar(DOTUSD)

DOTUSD Elliott Wave Technical Analysis

Function: Follow Trend

Mode: Motive

Structure: Diagonal

Position: Wave ((5))

Direction Next higher Degrees: wave V of Impulse

Wave Cancel invalid level:

Details: the fall not complete, decline .in wave ((5))

Polkadot/U.S. dollar(DOTUSD)Trading Strategy: Wave 5's decline appears to be nearing its end, with Wave 5 providing early warning of a correction or trend change. And we are waiting for a five-wave rally above 3.9076 to support this idea.

Polkadot/U.S. dollar(DOTUSD)Technical Indicators: The price is below the MA200 indicating a Downtrend, RSI is a Bearish Momentum.