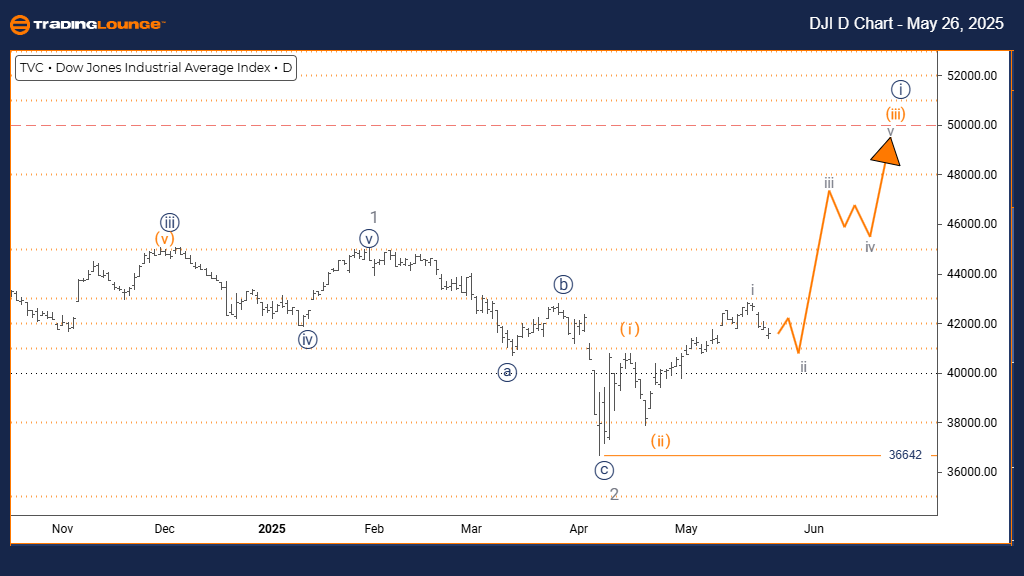

DOW JONES – DJI Elliott Wave Analysis | Trading Lounge Day Chart

DOW JONES – DJI Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Orange Wave 3

POSITION: Navy Blue Wave 1

DIRECTION NEXT LOWER DEGREES: Orange Wave 4

DETAILS: Orange Wave 2 has likely completed. Orange Wave 3 is currently in progress.

Invalidation Level: 36642

The daily Elliott Wave chart of the Dow Jones Industrial Average (DJI) displays robust bullish momentum, supporting an ongoing upward trend. The current pattern indicates the development of orange wave 3, part of a larger navy blue wave 1. The market has transitioned out of orange wave 2, typically marking the beginning of the most dynamic and impulsive segment.

With orange wave 2 concluded, the rally now enters the third wave, historically known for strong price acceleration. This suggests consistent institutional buying strength, reinforcing the possibility of continued upward movement. A daily close beneath 36642 would invalidate the existing count and prompt a reassessment of the wave structure.

This bullish wave count positions the DJI favorably for trend-following strategies. The anticipated short-term pullback—orange wave 4—will likely occur after the current rally completes. Traders should stay alert for trend continuation signals while managing risk as this impulsive move evolves.

DOW JONES – DJI Elliott Wave Analysis | Trading Lounge Weekly Chart

DOW JONES – DJI Elliott Wave Technical Analysis

FUNCTION: Bullish Trend

MODE: Impulsive

STRUCTURE: Navy Blue Wave 1

POSITION: Gray Wave 3

DIRECTION NEXT LOWER DEGREES: Navy Blue Wave 2

DETAILS: Gray Wave 2 is likely complete. Navy Blue Wave 1 of 3 appears to be underway.

Invalidation Level: 36642

The weekly Elliott Wave chart for the Dow Jones Industrial Average maintains a bullish outlook, showcasing an impulsive structure with navy blue wave 1 developing inside gray wave 3. The recent completion of gray wave 2 suggests the beginning of a new upward cycle within a larger long-term trend.

This wave formation confirms the start of navy blue wave 1, driven by consistent upward pressure. The broader weekly trend implies that this bullish move may persist over a longer time horizon. An invalidation of this scenario would occur below 36642, which serves as a key reference point for reassessment.

The Elliott Wave setup highlights a favorable environment for long-term investors, aligning with the early phase of an extended rally. Following the current wave, navy blue wave 2—a corrective movement—is expected. Market participants should monitor the structure closely and adjust risk levels accordingly while staying prepared for additional upward progression.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Bovespa Index Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support