PANW Elliott Wave Forecast & Technical Analysis – TradingLounge

Elliott Wave analysis of Palo Alto Networks Inc. (NASDAQ: PANW) reviews both the daily and 1-hour charts to identify the current Elliott Wave count, analyse key support/resistance levels, and forecast potential future price moves using classic wave theory principles.

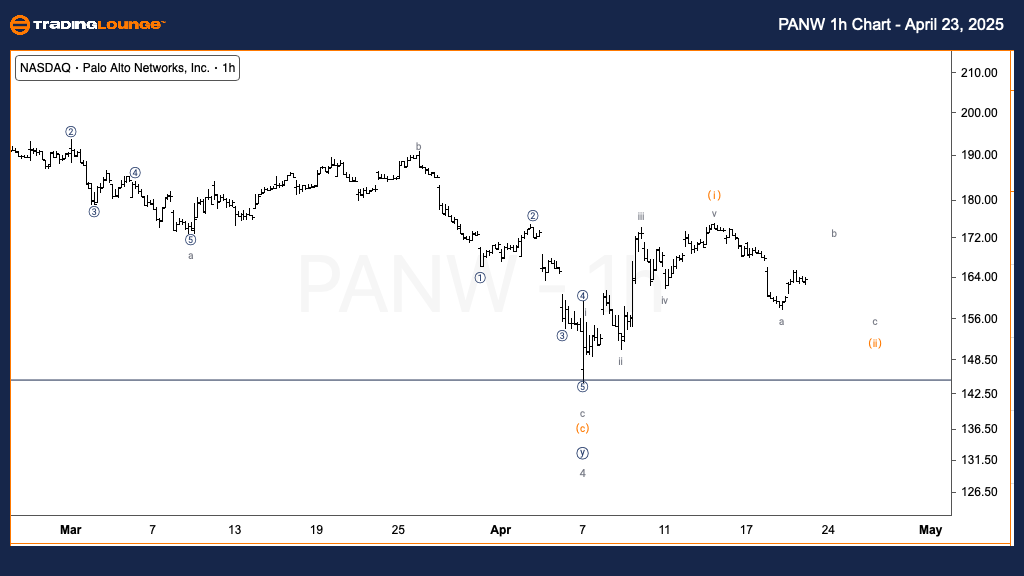

Palo Alto Networks Inc. (PANW) Elliott Wave Analysis – TradingLounge Daily Chart

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave (i) of {i}

Direction: Upside in wave {iii}

Details: Minor wave 4 seems complete, confirmed by a bounce off the W vs. Y equality support. Price is holding above the Medium Level at $150, reinforcing the case for an emerging bullish wave {iii}.

Daily Chart Summary:

Palo Alto Networks (PANW) stock price analysis indicates renewed bullish momentum. With Minor wave 4 likely complete and $150 acting as solid support, wave (i) appears to be unfolding to the upside. Confirmation of this move strengthens the case for wave {iii} targeting higher levels in the next impulsive rally.

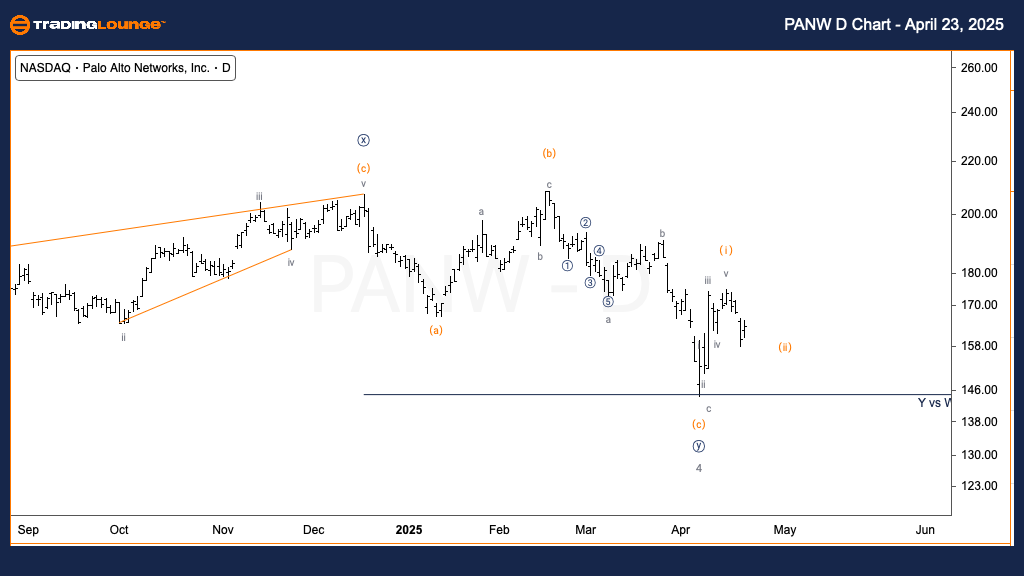

Palo Alto Networks Inc. Elliott Wave Analysis – TradingLounge 1-Hour Chart

PANW Elliott Wave Technical Analysis

Function: Trend

Mode: Motive

Structure: Impulsive

Position: Wave b of (ii)

Direction: Bottoming in wave (ii)

Details: PANW rallied in five waves from the April 7th low. The stock is currently in a possible wave (ii) pullback. Once the correction completes, a bullish continuation in wave (iii) is expected.

1-Hour Chart Summary:

Short-term PANW Elliott Wave outlook shows a potential bullish setup forming. After a clear five-wave advance, the ongoing corrective move could complete wave (ii). Traders should monitor for a completed three-wave structure, which could lead to the next bullish impulse via wave (iii).

Technical Analyst: Alessio Barretta

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: Fortinet Inc. (FTNT) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support