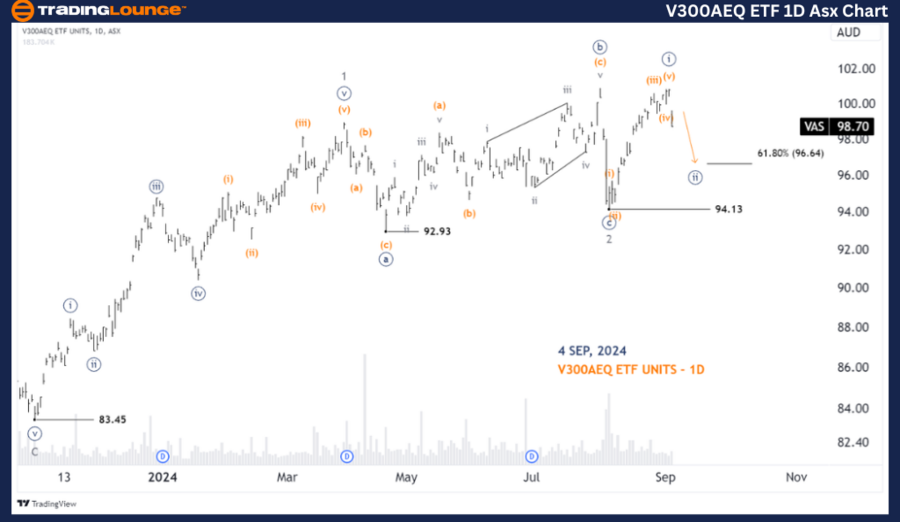

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Analysis TradingLounge (1D Chart)

Greetings, this Elliott Wave analysis offers an updated view of the Australian Stock Exchange (ASX) focusing on V300AEQ ETF UNITS – VAS. According to our assessment, VAS may have completed wave 2-grey, with wave 3-grey currently unfolding, indicating a potential upward trend.

ASX: V300AEQ ETF UNITS – VAS 1D Chart (Semilog Scale) Analysis

Vanguard Australian shares Index – VAS Elliott Wave Technical Analysis

Function: Major trend (Minor degree, grey)

Mode: Motive

Structure: Impulse

Position: Wave ((ii))-navy of Wave 3-grey

Details: Wave ((ii))-navy appears to be pushing slightly lower, targeting a low around 96.64 or possibly lower. Following this, wave ((iii))-navy could push the price higher. A Long Trade Setup will be considered at the Major Level of 100.00.

Invalidation Point: 94.13

ASX: V300AEQ ETF UNITS – VAS Elliott Wave Analysis TradingLounge (4-Hour Chart)

Vanguard Australian shares Index

Function: Major trend (Minute degree, navy)

Mode: Motive

Structure: Impulse

Position: Wave ((ii))-navy

Details: Wave ((i))-navy has completed as a five-wave structure starting from 94.13. Currently, wave ((ii))-orange is unfolding and may push slightly lower, targeting around 96.64. Afterward, we will look for a Long Trade Setup for a return in wave ((iii))-navy.

Invalidation Point: 94.13

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: News Corporation - NWS Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion:

Our analysis of ASX: V300AEQ ETF UNITS – VAS delivers insights into the market's trends, providing clear entry and exit points to maximize potential gains. By identifying key price levels for validation or invalidation, we enhance confidence in our Elliott Wave count. This approach helps investors to make informed decisions based on objective market forecasts and professional technical analysis.