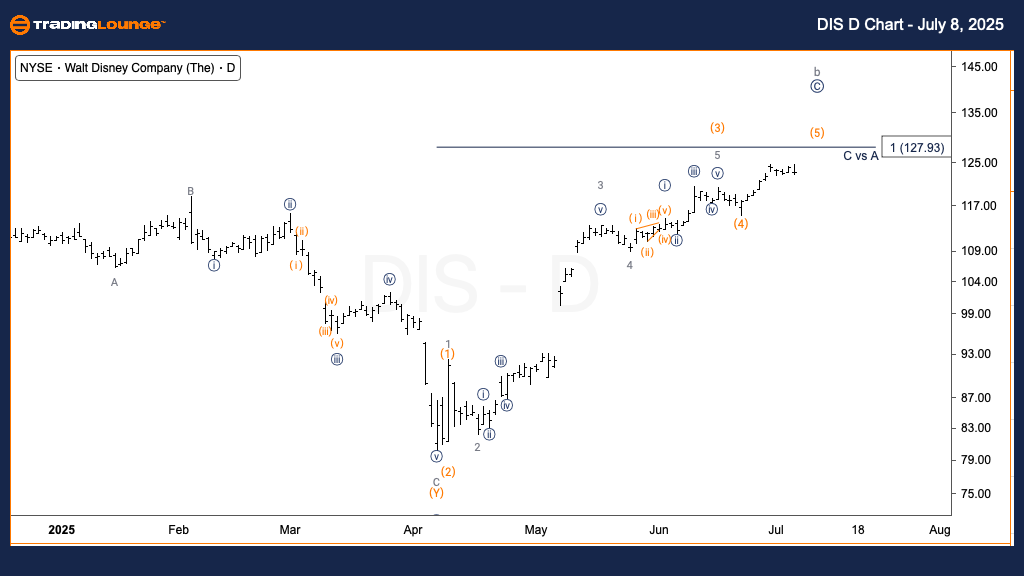

The Walt Disney Co. (DIS) Elliott Wave Analysis - TradingLounge Daily Chart

The Walt Disney Co. (DIS) Daily Chart Analysis

DIS Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave (5) of C

DIRECTION: Top in Wave (5)

DETAILS:

The upward trend that started on April 7 is showing signs of peaking. The projected target for Primary Wave C aligns with Wave A around the $128 price level.

On the daily chart, The Walt Disney Co. (DIS) is approaching the end of a corrective rally, currently forming wave (5) of C. This leg of the rally is structured as a motive wave, stemming from the April 7 low. As wave C converges with the height of wave A near $128, traders should watch this resistance zone closely. If wave (5) completes in this range, it could indicate the conclusion of the corrective cycle and the beginning of a potential market reversal.

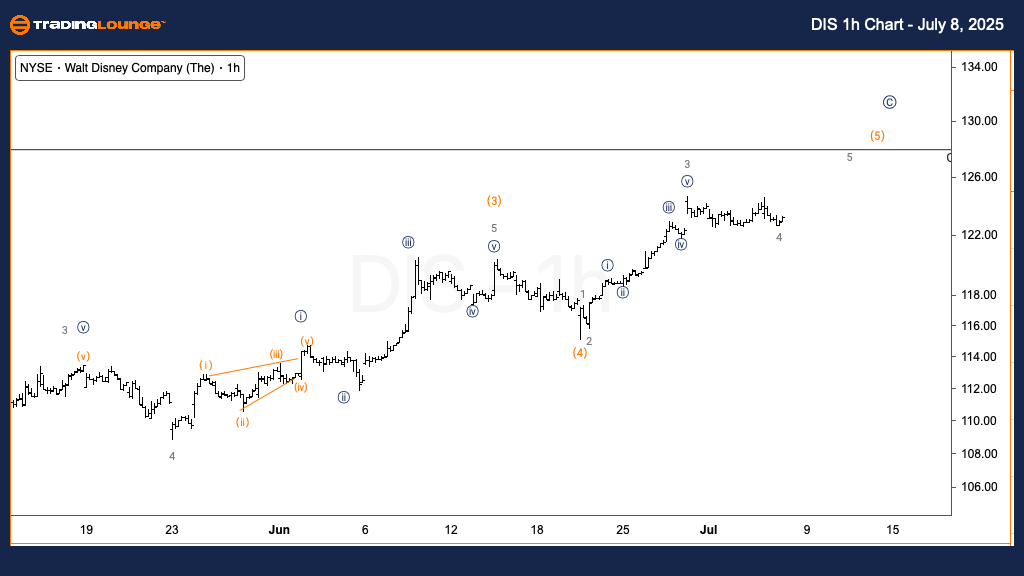

The Walt Disney Co. (DIS) Elliott Wave Analysis - TradingLounge 1H Chart

The Walt Disney Co. DIS Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Motive

POSITION: Wave 4 of (5)

DIRECTION: Upside in Wave 5

DETAILS:

Wave 4 of (5) is currently forming, and another upward movement is expected into wave 5 of (5).

There is also a bullish scenario in which this structure could evolve into wave 1 and 2 of a new upward impulsive sequence.

The 1-hour timeframe for DIS signals that wave 4 of (5) is nearly complete. A final advance into wave 5 of (5) is projected to complete the overall corrective structure of wave C. Alternatively, a bullish wave count suggests the current formation might be the early phase of a new impulsive trend. Should this alternate scenario materialize, DIS stock could surpass present levels, targeting resistance above the $128 mark.

Technical Analyst: Alessio Barretta

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: Mastercard Inc. (MA) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support