SPDR Select Sector Fund ETF – XLF Elliott Wave Technical Analysis

XLF Daily Chart Analysis

Function: Major Trend

Mode: Motive

Structure: Impulse Wave

Position: Wave 4 (Grey)

Direction: Mini Decline

Details:

- The bearish trend remains dominant, moving towards the final stage of wave [c] within a flat wave 4.

- Wave 4 is projected to find support between $46.02 and $47.38, aligning with the 38.2% and 50% Fibonacci retracement levels and the 200 EMA, a key support zone.

- A bullish reversal confirmation will occur if the price breaks above $48.00.

- Following the wave 4 bottom, a 5th wave rally is expected, likely pushing prices above the wave 4 origin.

🔴 Invalidation Level: A drop below $44.00 would question the current Elliott Wave structure.

SPDR Select Sector Fund ETF – XLF Elliott Wave Technical Analysis

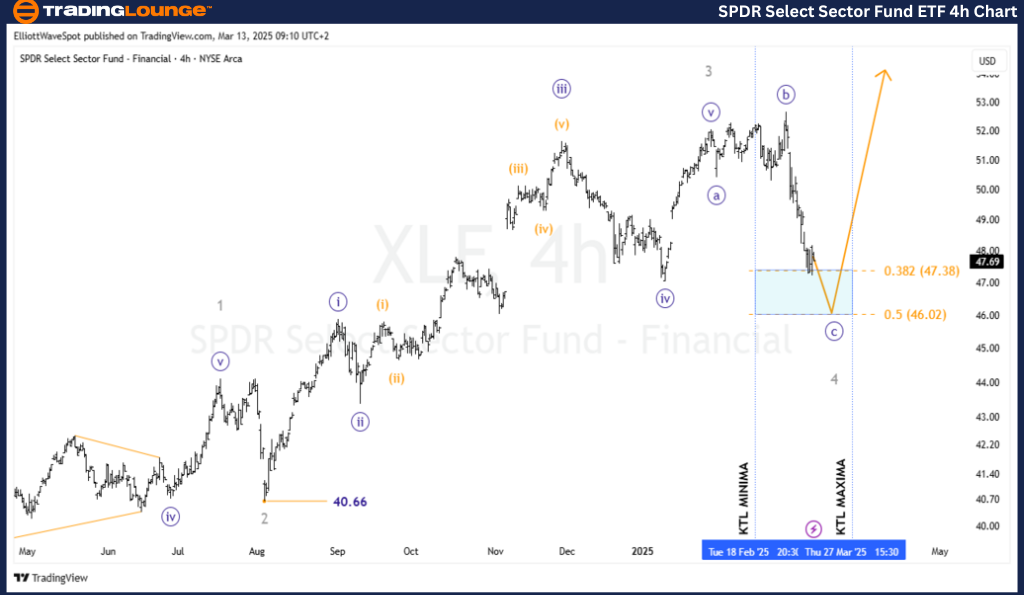

XLF 4-Hour Chart Analysis

Function: Minor Trend (Grey)

Mode: Corrective

Structure: Impulse

Position: Wave [c] (Navy) of Wave 4 (Grey)

Direction: Downtrend

Details:

- A bullish rally is expected after the wave [iv] retracement is completed.

- Wave iv is projected to conclude within the highlighted Fibonacci retracement levels.

- The Kennedy Blue Box, a common reversal zone for 4th waves, suggests an upcoming reversal.

- If the price declines to 50%, traders could enter long positions at the 38.2% retracement, setting stop-losses below the 61.8% level.

- The minimum target is $52.50.

🔴 Invalidation Level: A drop below $44.00 would challenge the current Elliott Wave count.

Technical Analyst: Siinom

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: JPMorgan Equity Premium Income ETF – JEPI Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

The XLF wave decline continues, approaching the end of its corrective phase.

Once the correction is complete, a strong bullish rally should follow, targeting levels above the origin of wave 4.

This scenario offers a key buying opportunity for ETF traders looking for long setups.

Following Elliott Wave principles and respecting invalidation levels is critical to mitigating risk.