Wheat Commodity Elliott Wave Technical Analysis

Wheat Elliott Wave Technical Analysis

Since its peak in March 2022, Wheat prices have declined by nearly 61%, dropping from over 1360 to around 530. However, this bearish cycle appears to be nearing its conclusion, and a multi-month bullish phase may soon begin, correcting over 28 months of sell-off.

Daily Chart Analysis

On the daily chart, the decline from the March 2022 peak of 1364 has been unfolding as an impulse wave structure. This structure is now in its final stage, with the 5th wave close to completing an ending diagonal pattern. Although Wheat prices might drop to 500 or slightly below, sellers should remain cautious. In the coming weeks and months, short positions are likely to be exited, paving the way for new bullish positions.

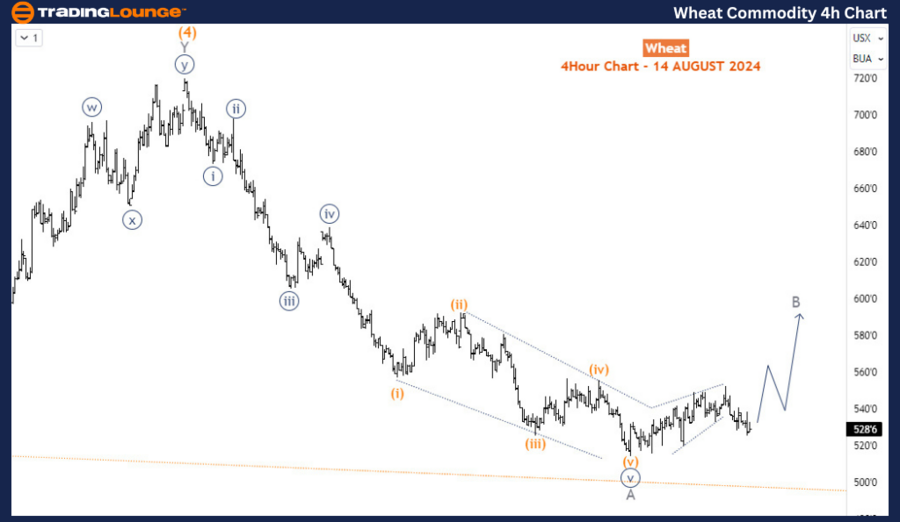

H4 Chart Analysis

The H4 chart shows the sub-waves of wave (5) of the diagonal wave 5 (circled) on the daily chart. Wave (5) is expected to complete a corrective 3-wave structure. It appears that wave A has been completed with a bearish impulse from the top of May 2024, and the current bounce from the low of July 2024 represents a wave B correction.

While there is still potential for the bearish trend from March 2024 to dip below $500, it's clear that the commodity is approaching the final leg before a much more significant and prolonged bullish reaction than previous bounces since 2022.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crude Oil Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support