ASX: BLOCK, INC - XYZ (SQ2) Elliott Wave Technical Analysis | TradingLounge

Greetings,

Welcome to our Elliott Wave update for BLOCK, INC - XYZ (ASX:SQ2), listed on the Australian Stock Exchange. Based on current Elliott Wave structure, ASX:SQ2 may be entering an early-stage bullish wave (3)-orange. However, for this upward scenario to hold strong, the price must remain above the invalidation level for at least 5–7 trading days.

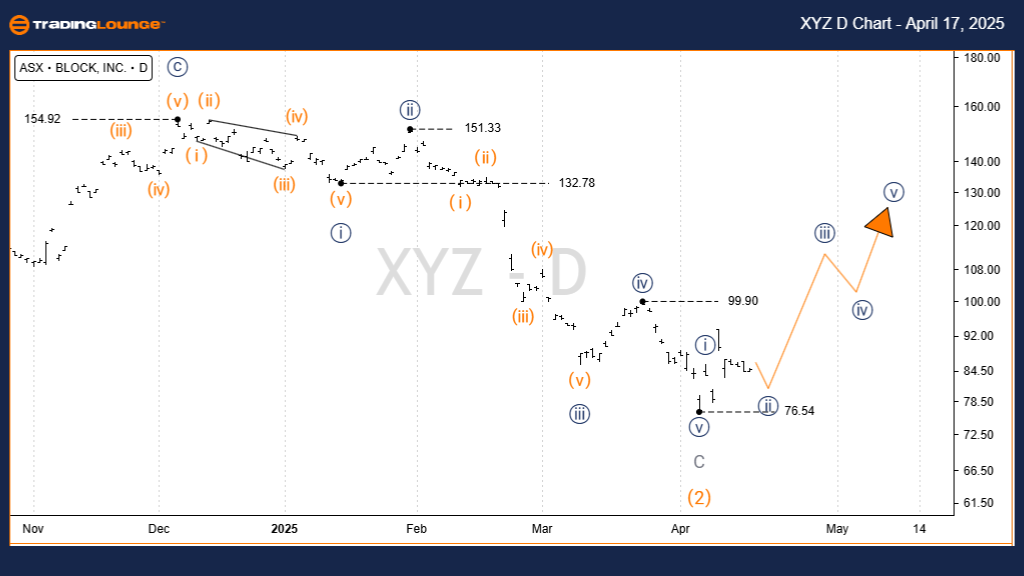

ASX: BLOCK, INC - XYZ (SQ2) Technical Analysis Overview (1D Semilog Chart)

Function: Major Trend (Intermediate Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ii))-navy of Wave (3)-orange

Details:

Wave (2)-orange is likely complete, with upward momentum suggesting the development of wave (3)-orange. A confirmed breakout above $93.49 would validate the bullish scenario, opening the path toward retesting previous highs near $110.

Key Invalidation Level: $76.54

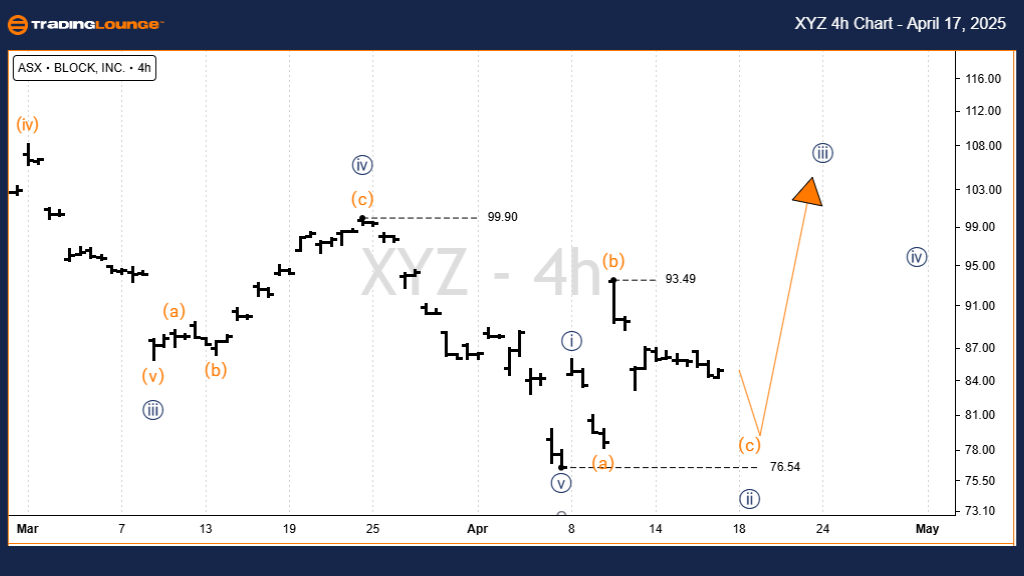

ASX: BLOCK, INC - XYZ (SQ2) Technical Summary: 4-Hour Chart Analysis

Function: Major Trend (Minute Degree, Orange)

Mode: Motive

Structure: Impulse

Position: Wave ((I))-navy of Wave (3)-orange

Details:

The 4-hour chart highlights the unfolding internal wave structure of (3)-orange, moving from ((i))-navy to ((v))-navy. Price stability above $76.54 supports the bullish near-term view and suggests continued upward wave progression.

Key Invalidation Level: $76.54

Technical Analyst: Hua (Shane) Cuong, CEWA-M (Master’s Designation).

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

See Previous: NEWMONT CORPORATION – NEM Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

This ASX:SQ2 Elliott Wave analysis provides a technical roadmap, pinpointing critical wave structures and price levels. A sustained move above key levels will reinforce the bullish wave count, giving traders confidence in managing positions. TradingLounge is committed to delivering precise, actionable Elliott Wave forecasts for serious market participants.