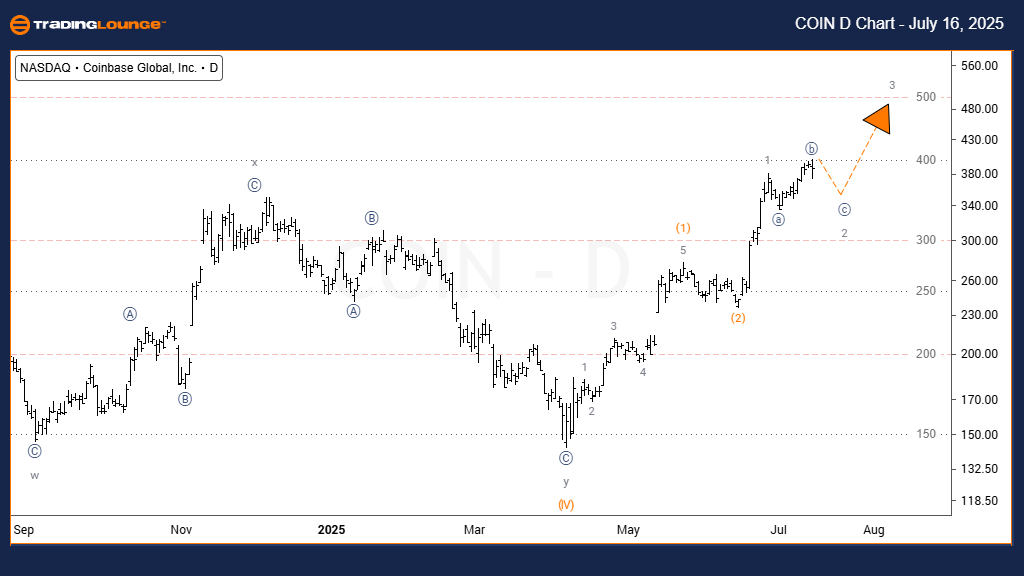

Coinbase Global Inc. (COIN) Elliott Wave Analysis - Trading Lounge Daily Chart

Coinbase Global Inc. (COIN) Daily Chart Overview

Coinbase Global Inc. (COIN) Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulsive

POSITION: Wave (Y) of {B}

DIRECTION: Uptrend

DETAILS: Anticipating acceleration in wave 3 of (3), which is typically a strong momentum phase in Elliott Wave theory.

Coinbase Global Inc. (NASDAQ: COIN) is showing an impulsive Elliott Wave formation on the daily timeframe. The initial waves (1) and (2) in orange have finalized, and the price is progressing into the third wave (3). Subwave 1 of wave (3) has concluded, while subwave 2 is unfolding. Once subwave 2 ends, a strong rally in wave 3 of (3) is expected, with a potential Fibonacci 161.8% extension of wave (1) as a price target.

The wave integrity remains consistent, showing no overlaps, and follows the standard Elliott Wave guidelines. The current price action confirms a motive pattern, with alternation and Fibonacci projections reinforcing the bullish trend outlook.

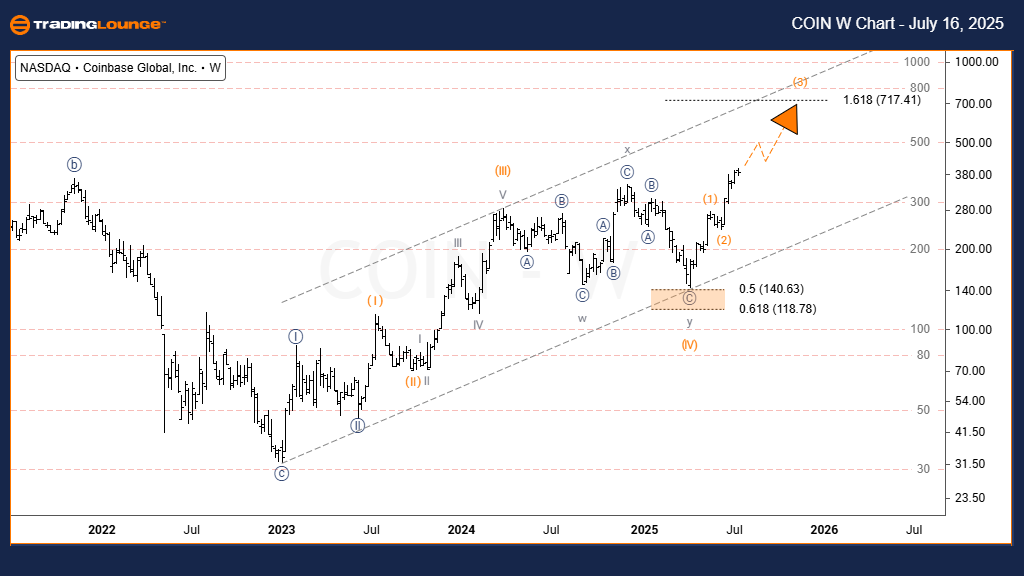

Coinbase Global Inc. (COIN) Elliott Wave Analysis (TradingLounge Weekly Chart)

Coinbase Global Inc. (COIN) Technical Overview

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulsive

POSITION: Wave IV of (c)

DIRECTION: Uptrend

DETAILS: Targeting the 161.8% Fibonacci projection of primary wave {1}, indicating a likely completion zone for navy blue wave {3}.

On the weekly chart, Coinbase (COIN) maintains its structure within a long-term bullish impulse cycle. The asset is now tracking through wave (V) of {III}, following the completion of corrective wave (IV). The projected move aims at the 161.8% Fibonacci extension of wave {1}, a classic target for third waves in impulsive sequences.

The internal wave count remains clean, with clear segmentation and adherence to motive wave principles. This ongoing setup supports the potential for a strong upward continuation, aligned with the broader bullish Elliott Wave framework.

Technical Analyst: Dhiren Pahuja

Visit: TradingLounge.com for detailed analysis and market updates.

Previous: Adobe Inc. (ADBE) Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support