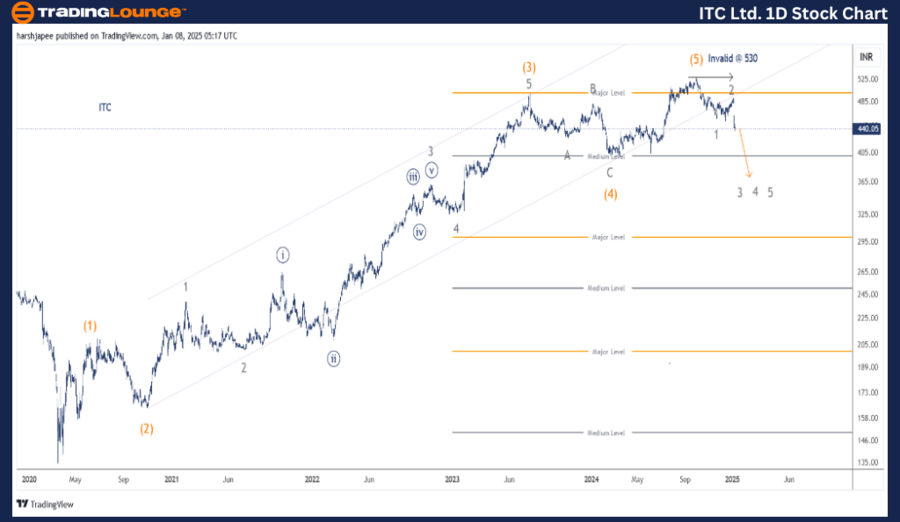

ITC LTD – ITC (1D Chart) Elliott Wave Technical Analysis

ITC Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Larger degree zigzag

Position: Minor Wave 3 Grey

Details: Minor Wave 3 is unfolding lower, with resistance at the 530 mark.

Invalidation Point: 530

ITC Daily Chart Technical Analysis and Potential Elliott Wave Counts

The ITC daily chart suggests a potential trend reversal after reaching the 530 high in October 2024. The stock has declined below the 445 mark, forming Minor Waves 1 and 2 at approximately 455 and 490 levels, respectively.

In the larger picture, ITC saw a significant drop to 134 lows in March 2020. The subsequent recovery unfolded as follows:

- Intermediate Wave (1) Orange: A leading diagonal ending near 209.

- Wave (2): Corrective decline to 164.

- Wave (3): An extended rally reaching 498.

The stock reversed sharply after Intermediate Wave (5) terminated near the 530 level. Currently, Minor Wave 3 is developing and is likely targeting 394 as a medium-term support zone.

ITC LTD – ITC (4H Chart) Elliott Wave Technical Analysis

Function: Counter Trend (Minor degree, Grey)

Mode: Corrective

Structure: Larger degree zigzag

Position: Minor Wave 3 Grey

Details: Minor Wave 3 is progressing downward, with resistance near 530 as Minor Wave 2 concluded as an expanded flat within the 490-500 range.

Invalidation Point: 530

ITC 4H Chart Technical Analysis and Potential Elliott Wave Counts

The 4H chart reflects a trend reversal after Intermediate Wave (4) Orange ended near 400 in March 2024. The subsequent rally to Intermediate Wave (5) near 530 formed a strong impulse, which has since reversed.

Key observations:

- Minor Wave 1: Formed near 455.

- Minor Wave 2: An expanded flat correction ending around the 490-500 range.

- Current Status: The stock is trading at 447 and unfolding Minor Wave 3 Grey, indicating further downside potential.

Technical Analyst: Harsh Japee

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: COAL INDIA Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support

Conclusion

ITC is in a corrective phase, moving lower within Minor Wave 3 against the 530 high, with key support expected near the 394 level.