Corn Commodity Elliott Wave Technical Analysis

Function: Trend

Mode: Counter-Trend

Structure: Impulse wave

Position: Wave 3 of (3)

Direction: Wave 3 of (3) is still in progress

Details: Wave 3 appears to be on a decent momentum upside but more is needed to increase the likelihood above wave 1 high. The invalidation level remains at 438’4.

Corn Elliott Wave Technical Analysis

Corn prices have experienced a substantial surge, increasing over 16% from the February 2024 low. However, this is only a 16% recovery from the April 2022 to February 2024 sell-off, indicating that there is still significant upside potential. From an Elliott wave perspective, the current recovery is expected to extend higher, potentially correcting up to the 610-661 Fibonacci retracement area. This analysis aims to show traders how to capitalize on this bullish corrective cycle.

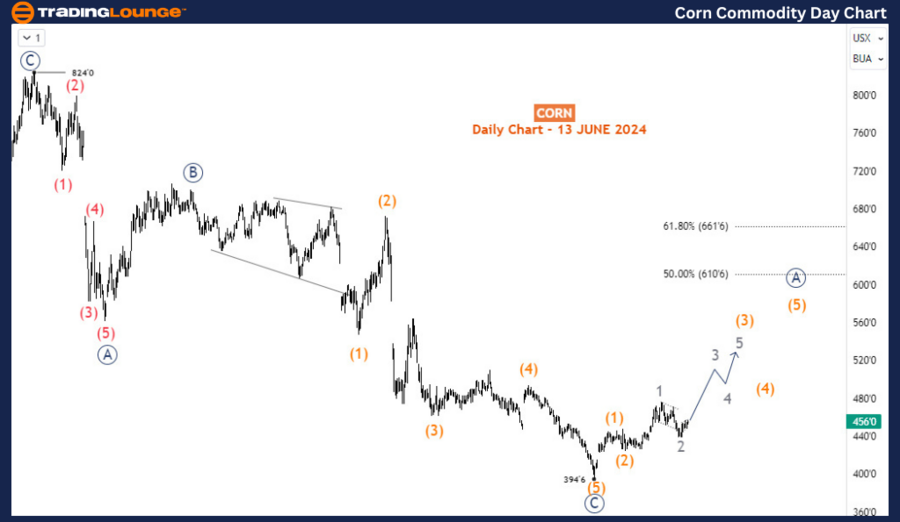

Silver XAGUSD Daily Chart Analysis:

On the daily chart, the recovery from the February 2024 low of 394’6 is anticipated to evolve into either an impulse wave or one of the zigzag structures. Assuming an impulse wave of intermediate degree from that low, it appears the price is still in wave (3), which could be an extended one based on the sub-waves 1 and 2. By projection, wave (3) could reach 523, provided the wave (2) low is not breached.

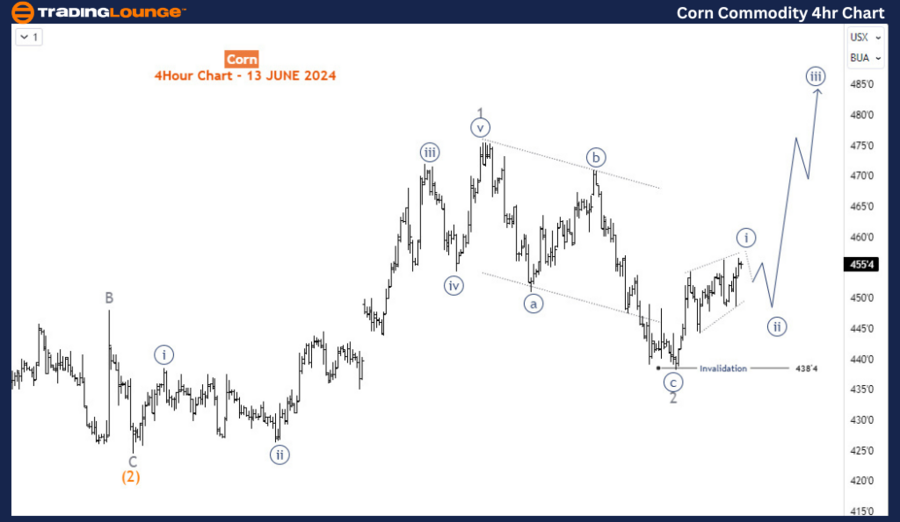

Silver XAGUSD 4-Hour Chart Analysis:

On the H4 chart, wave 2 of (3) ended at 438’4 with a zigzag structure, and the price is now reacting upwards as part of wave 3. It appears that wave i (circled) of 3 is completing with a diagonal structure, suggesting a pullback for the corresponding wave ii (circled) could occur before the price resumes its upward movement. As long as 438’4 remains unbreached, wave 2 stays valid at this level, and wave 3 is in progress with the potential to reach 523 in the coming weeks.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Silver XAGUSD Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Summary:

Corn prices have surged over 16% from the February 2024 low but have only recovered a fraction of the earlier sell-off from April 2022 to February 2024. The Elliott wave analysis suggests that the current recovery is likely to extend higher, targeting the 610-661 Fibonacci retracement area. On the daily chart, the recovery from the February 2024 low is evolving into an impulse wave, with wave (3) potentially reaching 523, provided wave (2) low remains unbreached. On the H4 chart, wave 2 of (3) ended at 438’4, and the price is progressing upwards in wave 3. A pullback for wave ii (circled) may occur, but as long as 438’4 holds, wave 3 is expected to continue towards 523 in the coming weeks.

Traders should monitor the key levels of 438’4 and 523 to gauge the bullish trend's continuation and identify potential entry and exit points.