Function - Trend

Mode - Impulsive

Structure - Impulse Wave

Position - Black wave 4 of larger degree red wave (3)

Direction - Black wave 4 of higher degree red wave (3) still in play

Details: Wave 4 of (3) is still emerging as expected. The black impulse wave structure becomes invalid at 2.319. If the current rally is corrective, we should see further sell-off for wave 5 of (3) toward 1.12.

Natural Gas (NG) is currently experiencing a notable rebound after a prolonged downtrend that saw a staggering 36% decline since late January. Despite this bounce, the Elliott wave perspective suggests that this upward movement is likely a corrective move preceding another downward leg. Let's delve into the Elliott wave analysis of NG on both the daily and 4-hour time frames.

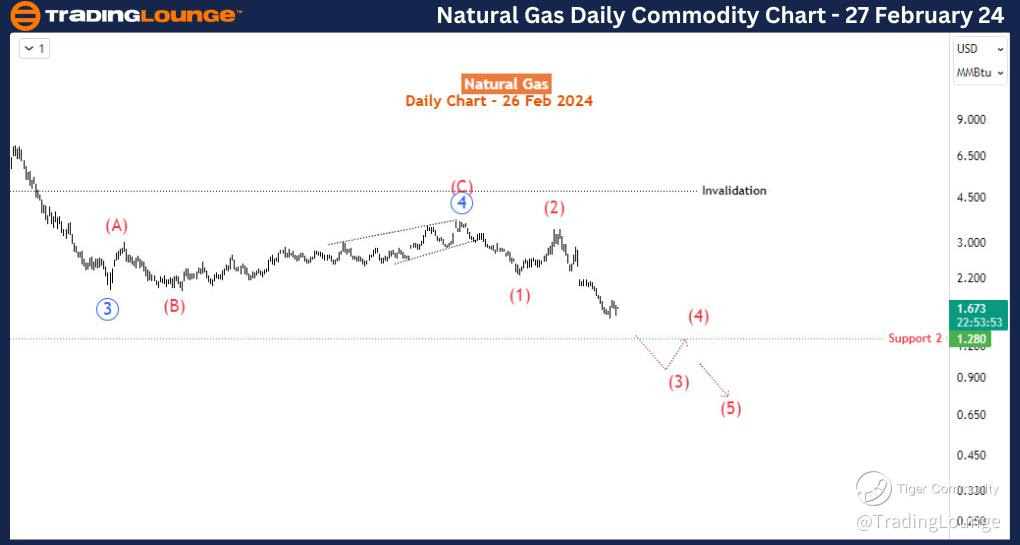

Natural Gas (NG) Daily Chart Analysis

On the daily chart, the bearish trend in NG commenced in late August 2022 when prices hit $10. Since then, NG has been following a clear 5-wave impulse pattern to the downside. The 4th wave (in blue) of this impulse concluded below $3.7 in early November 2023, following an 87% recovery recorded between February and October of the same year. Subsequently, since November, NG has continued its descent, marking a 50% decline as the 5th wave of the impulse unfolds. Currently, the 5th wave (in blue) appears to subdivide into a smaller impulse wave (in red), with Red sub-wave (3) of blue 5 still in progress on the H4 charts. This suggests that the completion of the 3rd leg of the 5th wave is imminent, indicating further bearish price action in the weeks ahead.

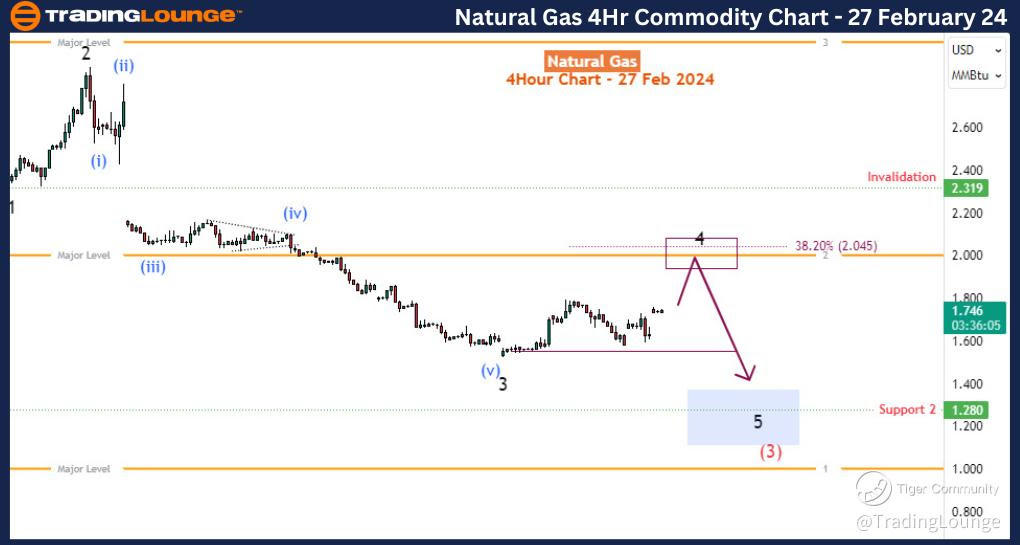

Natural Gas (NG) 4-Hour Chart Analysis Timeframe

Zooming in on the 4-hour time frame, the ongoing bullish correction is identified as wave 4 of (3), representing the most significant upward movement since late January. Unless there's a breach of the 2.319 level, which would invalidate the developing wave (3) impulse, we anticipate a decline for wave 5 of (3) targeting levels around 1.28 or even the 1.20 major level once wave 4 concludes. The wave 4 correction could rally up to the 2.00 major level, coinciding with the 38.2% Fibonacci retracement level of wave 3.

In summary, the Elliott wave theory supports the expectation of further sell-off for NG. However, it's crucial to confirm that the current minor bounce remains corrective and does not exceed levels around or above 2.00, ensuring it stays below the invalidation level.

Technical Analyst : Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Soybeans Commodities