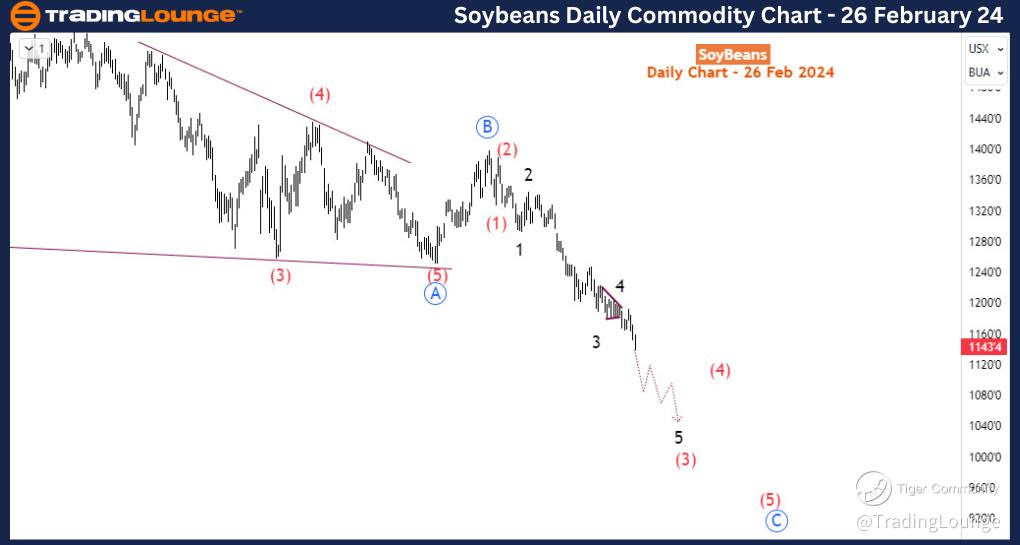

SoyBean Elliott Wave Analysis - The bearish trend remains intact.

Soybeans continue to exhibit a bearish trend according to Elliott Wave analysis, indicating a sustained downward trajectory. This analysis focuses on identifying trends and patterns within the market to inform trading strategies.

Soybean Elliott Wave Technical Analysis

Trend: Bearish

The current trend in Soybeans is distinctly bearish, characterized by downward price movement over time.

Mode: Impulsive

The market is displaying an impulsive mode, meaning it is prone to swift and decisive price shifts.

Structure: Impulse Wave

The structure of the market's movement aligns with an impulse wave pattern, indicating significant directional momentum.

Position: Black Wave 5 of Higher Degree Red Wave (3)

At present, Soybeans are positioned within black wave 5 of a larger red wave (3), highlighting the stage within the Elliott Wave cycle.

Direction: Ongoing Progression of Black Wave 5 of (3)

The market continues to progress within the framework of black wave 5 of (3), signaling a sustained downward movement.

Technical Analysis Overview

Soybeans' Elliott Wave analysis points towards a continuation of its long-term bearish correction, which commenced in June 2022. Recent price action, particularly the breach of the 1163 swing low, underscores the persistence of downward momentum.

Soybean Daily Chart Analysis

On the daily timeframe, the current downward movement is interpreted as corrective, with the completion of a leading diagonal pattern in blue wave A, followed by a shallow correction in blue wave B, concluding in November 2023. The subsequent breach below 1250 confirmed the continuation of the bearish trend, initiating the bearish impulse wave pattern for blue wave C.

Soybean 4-Hour Chart Analysis Timeframe

A closer examination of the 4-hour timeframe reveals the development of an impulse wave for blue wave C. Presently, the price action indicates the early stages of black wave 5 of red (3) of blue 5. This suggests ongoing bearish momentum, with the potential for further downward movement unless a significant rally occurs above 1197. A decline towards the 1100 level is anticipated for blue wave iii of 5.

Trading Strategy

Given the technical outlook, the recommended trading strategy involves selling into bounces and refraining from buying at lows until there is confirmation of a substantial bullish correction. This cautious approach aligns with the expectation of continued bearish pressure in the near term. Traders are advised to remain vigilant, monitoring price action for indications of a potential shift in market sentiment before considering long positions.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Wheat Commodity

Conclusion

In conclusion, the Elliott Wave analysis indicates a bearish outlook for Soybeans, with the likelihood of further downward movement in the short to medium term. Traders should be prepared to navigate the market with a focus on downside potential and remain adaptable to changing conditions.