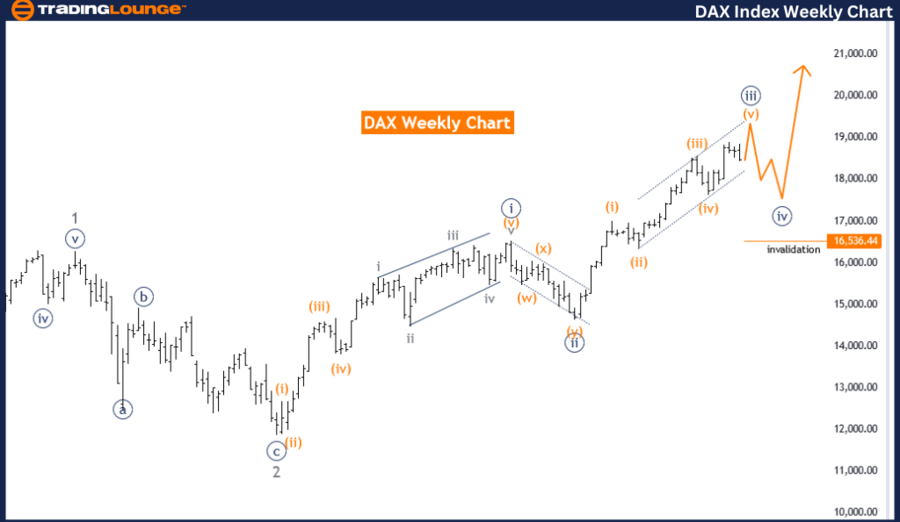

DAX (Germany) Elliott Wave Analysis Trading Lounge Day Chart

DAX (Germany) Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange wave 5

POSITION: Navy Blue Wave 3

DIRECTION NEXT LOWER DEGREES: Navy blue wave 4

DETAILS: After orange wave 4, now orange wave 5 of navy blue wave 3 is in play.

Wave Cancel Invalid Level: 17801.19

The DAX (Germany) Elliott Wave Analysis on the daily chart provides an in-depth look at the current market trends using Elliott Wave Theory. The analysis identifies the primary function of the current movement as a trend, indicating a clear directional bias in the market. The mode of this trend is classified as impulsive, which suggests a strong and decisive market movement rather than a corrective or sideways phase.

The primary wave structure under observation is orange wave 5, which is part of a larger sequence identified as navy blue wave 3. This indicates that the market is in the later stages of a significant upward trend. The position within navy blue wave 3 signifies that orange wave 5 is the final impulsive wave in this sequence, following the completion of orange wave 4.

The analysis also provides insight into the direction of the next lower degrees, which is expected to be navy blue wave 4. This suggests that once orange wave 5 completes, the market may enter a corrective phase as part of the larger wave structure.

A crucial detail in this analysis is that after the completion of orange wave 4, the market has now moved into orange wave 5 of navy blue wave 3. This progression indicates that the current phase is the concluding wave of this impulsive movement, providing traders with a clear perspective on the near-term trend continuation.

The wave cancel invalid level is set at 17801.19. This level serves as a critical threshold; if the market price falls to or below this level, the current wave count would be invalidated. This necessitates a reassessment of the wave structure and potentially alters trading strategies.

In summary, the DAX (Germany) Elliott Wave Analysis on the daily chart highlights that the market is in an impulsive trend phase, specifically in orange wave 5 of navy blue wave 3. The analysis suggests that the market is nearing the end of this impulsive phase, with navy blue wave 4 anticipated next. The invalidation level of 17801.19 is essential for maintaining the

integrity of the current wave count, guiding traders in their strategic decisions based on Elliott Wave Theory.

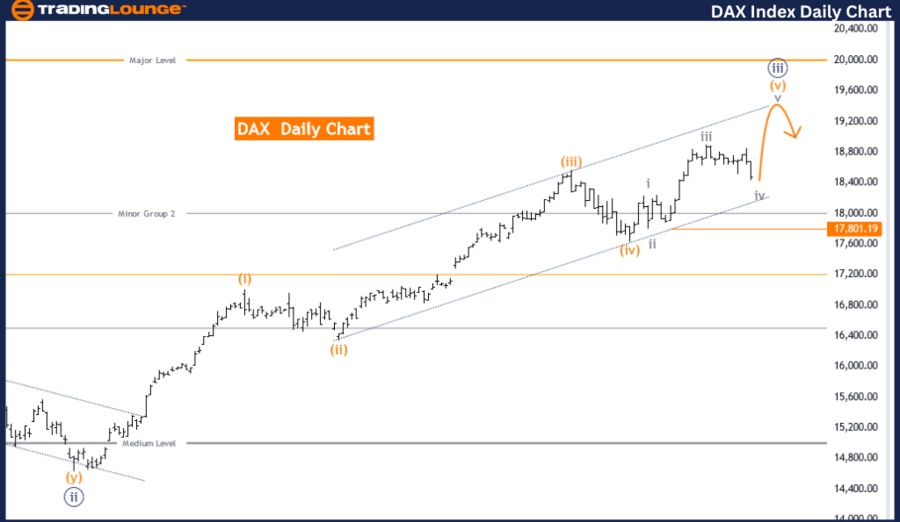

DAX (Germany) Elliott Wave Analysis Trading Lounge Weekly Chart

DAX (Germany) Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Impulsive

STRUCTURE: Orange wave 5

POSITION: Navy blue wave 3

DIRECTION NEXT LOWER DEGREES: Navy blue wave 4

DETAILS: After orange wave 4, now orange wave 5 of navy blue wave 3 is in play.

Wave Cancel Invalid Level: 16536.44

The DAX (Germany) Elliott Wave Analysis on the weekly chart offers a detailed perspective on the current market dynamics using the principles of Elliott Wave Theory. This analysis identifies the primary function of the ongoing market movement as a trend, indicating a clear and sustained directional movement. The trend mode is classified as impulsive, suggesting a strong, directional move rather than a corrective or sideways phase.

The key wave structure under examination is orange wave 5, which is a part of a larger wave sequence identified as navy blue wave 3. This indicates that the market is in the final stages of a significant upward trend, with orange wave 5 representing the last impulsive wave within the broader navy blue wave 3 sequence.

The position within this wave sequence is specified as navy blue wave 3, indicating that the market is currently in the orange wave 5 phase of navy blue wave 3. This suggests that the market is experiencing the concluding impulsive wave before potentially entering a corrective phase, which would be identified as navy blue wave 4 in the next lower degree of waves.

A crucial detail provided in the analysis is that following the completion of orange wave 4, the market has now transitioned into orange wave 5 of navy blue wave 3. This development indicates that the market is in the final impulsive stage of this wave sequence, providing traders with a clear understanding of the current trend direction and its likely continuation in the near term.

The wave cancel invalid level is set at 16536.44. This level is critical as it serves as a threshold that, if breached, would invalidate the current wave count. Such an occurrence would necessitate a reassessment of the wave structure and potentially alter trading strategies based on the new wave count.

In summary, the DAX (Germany) Elliott Wave Analysis on the weekly chart reveals that the market is in an impulsive trend phase, specifically in the orange wave 5 of navy blue wave 3.

The analysis suggests that this impulsive phase is nearing its conclusion, with navy blue wave 4 anticipated next. The invalidation level of 16536.44 is crucial for maintaining the validity of the current wave count, guiding traders in their strategic decisions according to Elliott Wave Theory.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: IBEX 35 (Spain) Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support