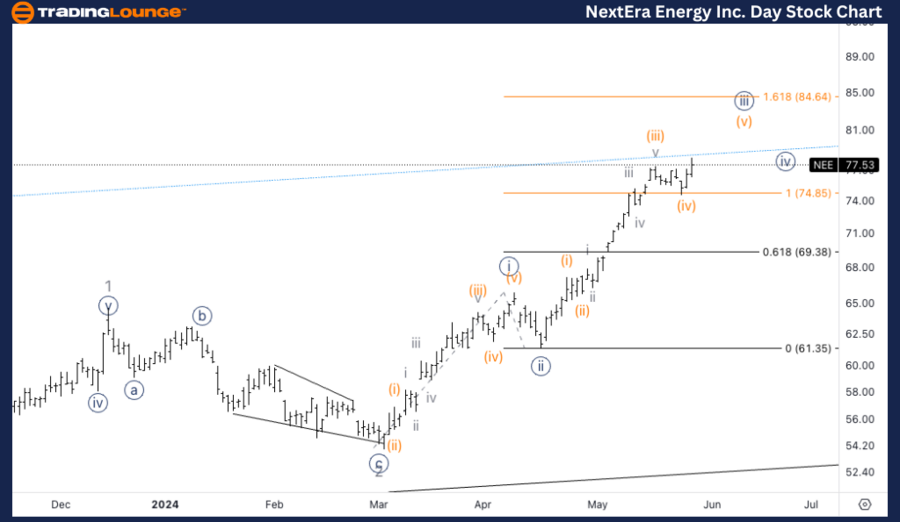

NEE Elliott Wave Analysis Trading Lounge Daily Chart,

NEE Elliott Wave Analysis: Daily Chart Analysis

NEE Elliott Wave Technical Analysis

Trend: Impulsive

Structure: Motive

Position: Minor 3

Direction: Top in 3

Overview:

In the daily chart of NextEra Energy Inc. (NEE), the Elliott Wave analysis indicates an impulsive trend, suggesting a strong and clear directional move. The structure is classified as motive, which is typical for impulsive waves. Currently, the position is in Minor wave 3, with a directional focus on the top in wave 3.

Analysis Details:

Wave 2 Completion: The analysis is looking for the completion of a three-wave corrective move in wave 2. This will set the stage for the continuation of the upward trend.

Minor Wave 3: Expecting Minor wave 3 to continue unfolding in a clear five-wave pattern. This is a characteristic of Elliott's motive wave structure, indicating a strong bullish trend.

Resistance Levels: The next significant resistance level is anticipated at TL8, approximately $80. This level will be crucial to watch as it could determine the next phase of the price movement.

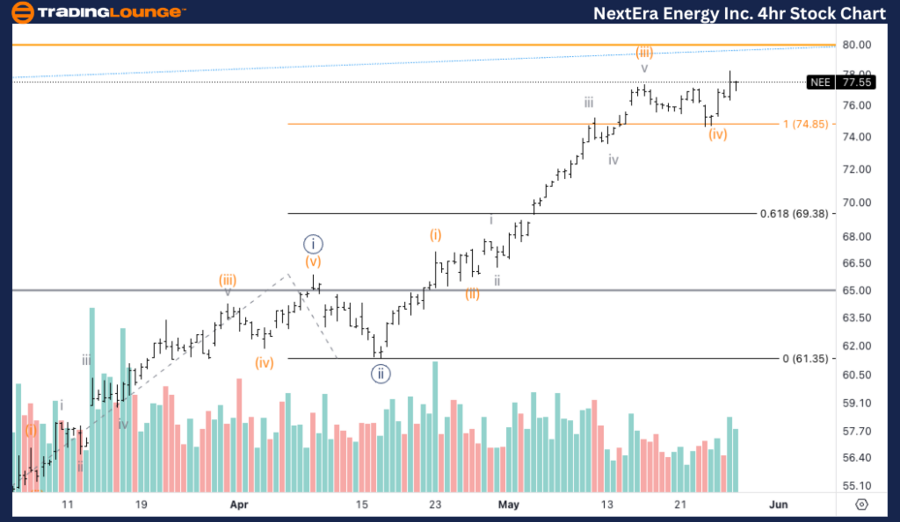

NEE Elliott Wave Analysis Trading Lounge 4Hr Chart,

NextEra Energy Inc., (NEE) 4Hr Chart Analysis

NEE Elliott Wave Technical Analysis

Trend: Impulsive

Structure: Motive

Position: Wave (v) of {iii}

Direction: Upside in (v)

Overview:

The 4-hour chart provides a closer look at the ongoing impulsive trend. The structure remains motive, aligning with the larger daily trend analysis. The position is identified as wave (v) of {iii}, indicating that the bullish wave is in its final stages within this specific timeframe.

Analysis Details:

Wave (v) Development: The focus is on the upward movement into wave (v). This wave is critical as it completes the larger wave {iii}.

Volume Confirmation: The bullish move is supported by volume analysis, which confirms the strength of the upward trend.

Equality of Waves: The price has already surpassed the equality of wave {iii} vs. wave {i} at $75. This milestone is significant as it validates the strength of wave {iii}.

Key Fibonacci Level: The 1.618 Fibonacci extension stands at $84. This level is important for projecting the potential reach of wave (v) and serves as a significant resistance point.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous:The Home Depot, (HD) Stocks Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support

Conclusion:

NextEra Energy Inc. (NEE) is currently exhibiting a strong impulsive trend as per the Elliott Wave analysis on both daily and 4-hour charts. In the daily chart, the completion of wave 2 will pave the way for further bullish movement in Minor wave 3, targeting the $80 resistance level. On the 4-hour chart, wave (v) of {iii} is in progress, with a crucial Fibonacci extension target at $84. Investors and traders should closely monitor these resistance levels and volume confirmations to gauge the continuation of the bullish trend.