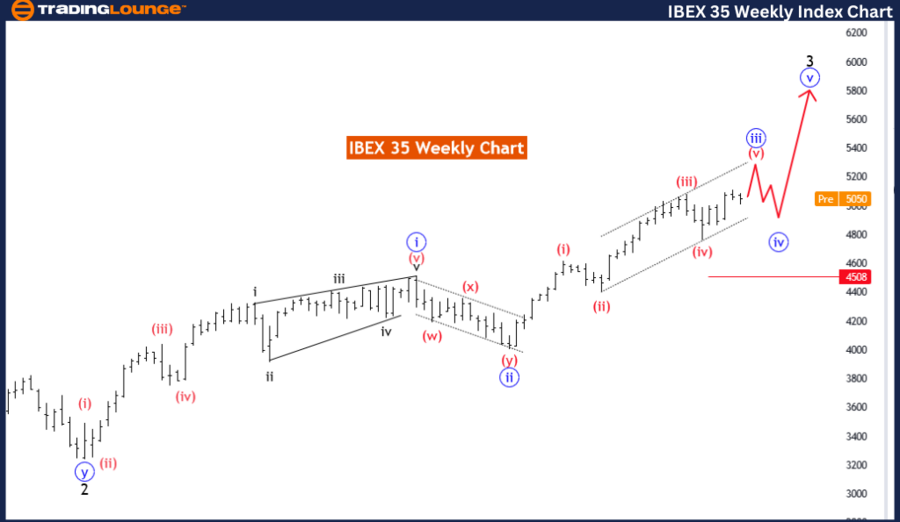

IBEX 35 (Spain) Elliott Wave Analysis Trading Lounge Day Chart

IBEX 35 (Spain) Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Red wave 5

Position: Blue wave 3

Direction Next Lower Degrees: Blue wave 4

Details: Red wave 4 completed at 476. Red wave 5 of 3 is now in play.

Wave Cancel Invalid Level: 4508

The IBEX 35 Elliott Wave analysis on the daily chart provides insights into the current market trend and anticipated movements using Elliott Wave theory. This analysis identifies the trend as impulsive, indicating robust directional movements with significant price changes following the primary market direction.

The key structure in this analysis is red wave 5, a crucial component of the impulsive wave cycle. Within this larger wave structure, the market is in blue wave 3, indicating a phase of strong market activity. Blue wave 3 is typically associated with substantial price movements and is an essential part of the impulsive wave sequence.

Looking ahead, the analysis suggests blue wave 4 as the next direction for the lower degrees. This wave will follow the completion of blue wave 3 and generally involves a corrective phase where the market consolidates recent price movements before resuming the primary trend.

The details provided highlight that red wave 4 appears to be completed at 4761. This completion indicates the market is now in red wave 5 of blue wave 3, suggesting continued strong market activity within the broader impulsive wave structure.

A critical aspect of this analysis is the wave cancel invalid level, set at 4508. If the market price falls below this level, it would invalidate the current wave count, necessitating a reassessment of the Elliott Wave structure. This invalidation level is crucial for confirming the wave pattern's accuracy and the projected market direction.

In summary, the IBEX 35 is currently in an impulsive trend on the daily chart, situated within the third wave of the red wave 5 sequence. The market has completed red wave 4 and is now progressing through red wave 5 of blue wave 3. Monitoring the invalidation level is essential to validate the current wave count and accurately predict future market movements.

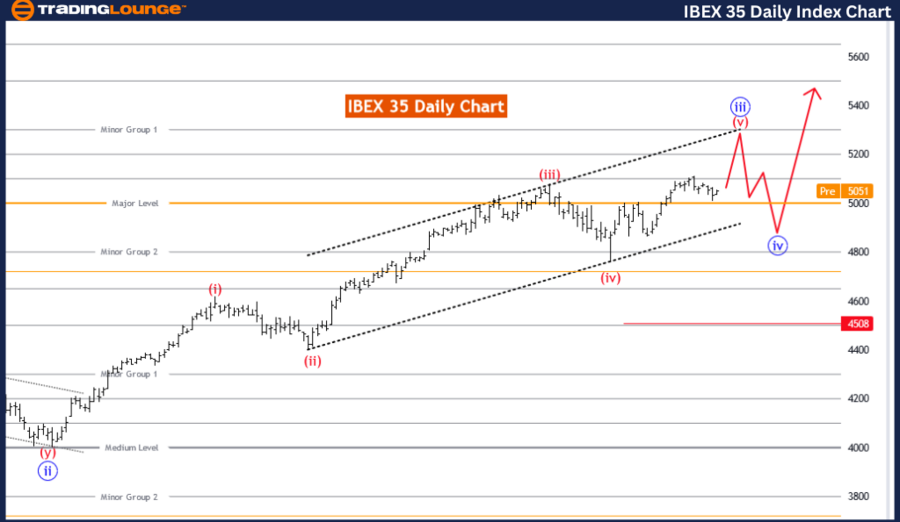

IBEX 35 (Spain) Elliott Wave Analysis Trading Lounge Weekly Chart

IBEX 35 (Spain) Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Blue wave 3

Position: Black wave 3

Direction Next Lower Degrees: Blue wave

Details: Blue wave 3 still in play, blue wave 4 expected next.

Wave Cancel Invalid Level: 4508

The IBEX 35 Elliott Wave analysis on the weekly chart offers a detailed examination of the current trend using Elliott Wave theory. This analysis identifies the trend as impulsive, indicating strong, consistent directional market movements. Impulsive trends are characterized by clear, sharp price movements that follow the primary market direction.

The primary structure under consideration is blue wave 3, part of a larger impulsive wave sequence. Within this context, the market is positioned in black wave 3, representing a significant phase of the impulsive cycle, typically associated with substantial price advances and strong market activity.

Looking ahead, the analysis suggests blue wave 4 as the next expected movement in the lower degrees of the wave structure. Blue wave 4 usually follows the completion of blue wave 3 and involves a corrective phase where the market consolidates recent gains before continuing the primary trend.

The details provided emphasize that blue wave 3 is still actively unfolding, indicating ongoing strong market movements. Once blue wave 3 completes, the market is anticipated to enter blue wave 4, which will involve a period of correction and consolidation.

A crucial aspect of this analysis is the wave cancel invalid level, set at 4508. This level serves as a critical threshold; if the market price drops below this point, it would invalidate the current wave count. This invalidation necessitates a reassessment of the wave structure and the market's projected direction. Monitoring this level is essential to confirm the validity of the wave pattern and ensure accurate market predictions.

In summary, the IBEX 35 is currently in an impulsive trend on the weekly chart, situated within the third wave of blue wave 3. The market is expected to continue through blue wave 3 before transitioning to blue wave 4, a corrective phase. Keeping an eye on the invalidation level is crucial to validate the current wave count and ensure the accuracy of future market forecasts.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See previous: NIFTY 50 (INDIA) Elliott Wave Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support