This analysis of NVIDIA Corp. (NVDA) incorporates insights from Elliott Wave Theory using both the daily and 1-hour charts. The focus is on critical support at $150 as a pivotal point in the continued upward movement in wave structures, projecting further bullish potential as long as key structural levels hold.

NVIDIA Corp. (NVDA) Elliott Wave Analysis – Trading Lounge Daily Chart

NVDA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Minor wave 3

Direction: Upside in 3 of (5).

Details

The analysis focuses on the continuation of the uptrend into wave (5). Currently, NVIDIA is trading slightly below the Medium Level at $150, with the expectation that support above this level will confirm a bullish outlook.

NVDA Elliott Wave Technical Analysis – Daily Chart

On the daily chart, NVIDIA is advancing through Minor wave 3 of the larger wave (5). The uptrend is expected to persist, with a key focus on the $150 Medium Level as a potential support zone. A sustained hold and bounce above this level would validate the bullish scenario and signal the continuation of the rally. Successfully breaking and maintaining levels above $150 would further confirm the upward trajectory of wave (5).

NVIDIA Corp. (NVDA) Elliott Wave Analysis – Trading Lounge 1H Chart

NVDA Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iii) of {i}

Direction: Upside into wave (iii).

Details

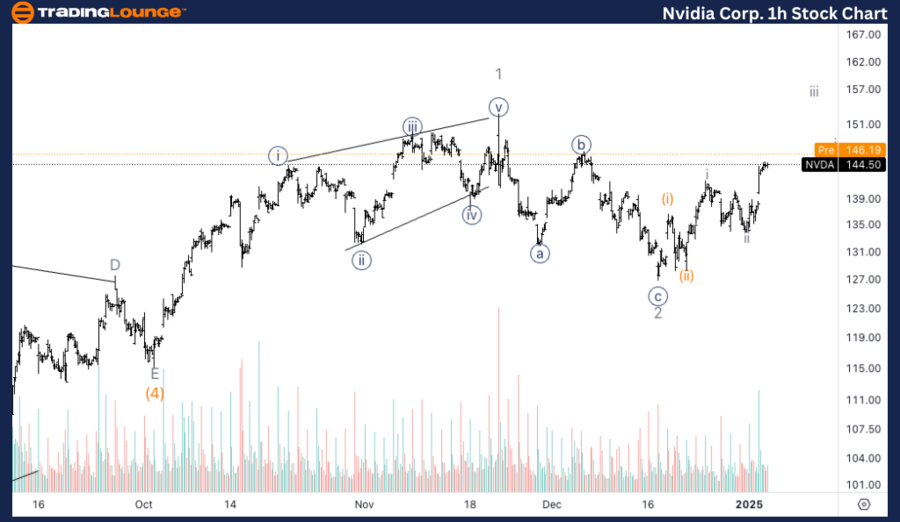

The 1-hour chart highlights the progression of wave (iii) within the broader wave {i} structure. A series of ones and twos within wave {i} is building momentum to challenge the critical $150 level. The next pullback must remain above the territory of wave i to preserve the impulsive structure.

NVDA Elliott Wave Technical Analysis – 1H Chart

The 1-hour chart illustrates the formation of wave (iii) of wave {i}, signaling potential momentum toward a decisive break above the $150 level. Internal subdivisions (ones and twos) are anticipated to drive this movement. Maintaining wave integrity requires the next pullback to avoid retracing into wave i territory. A strong breakout above $150 with sustained momentum would confirm further upside in wave (iii).

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Advanced Micro Devices Inc. (AMD) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support