Elliott Wave Analysis of Analog Devices Inc. (ADI): Current Trends and Potential Movements

This detailed Elliott Wave analysis of Analog Devices Inc. (ADI) examines the daily and 1-hour chart structures, shedding light on the prevailing trends and potential future price movements.

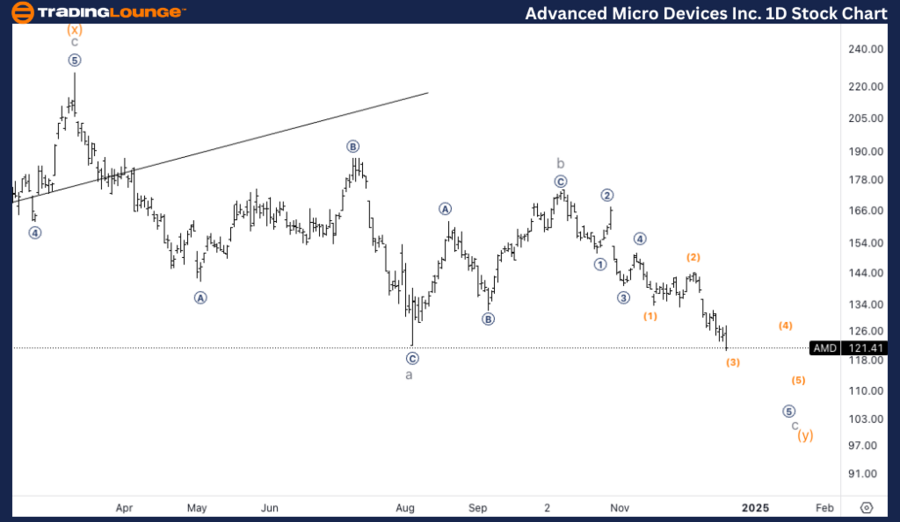

AMD Elliott Wave Analysis: Trading Lounge Daily Chart

Advanced Micro Devices Inc. (AMD) Daily Chart Analysis

AMD Elliott Wave Technical Analysis Overview:

- Function: Counter Trend

- Mode: Corrective

- Structure: Complex

- Position: Wave c of (y) of {iv}

- Direction: Downside into wave c

Key Insights:

- After encountering resistance at TradingLevel2 ($200), AMD's price has retraced to $120, a level where support might form.

- The stock is in wave c of a complex correction (y) within wave {iv}.

- A further decline is expected before completing this corrective phase, as wave c of (y) could push lower before reversing.

AMD Daily Chart Analysis – Summary

The daily Elliott Wave analysis suggests AMD is undergoing a corrective phase in wave {iv}. This phase involves wave c of (y), indicating further downside potential before a rebound occurs. The critical resistance at $200 caused a retracement to $120, where temporary support may emerge. However, additional downside pressure is likely before this phase concludes.

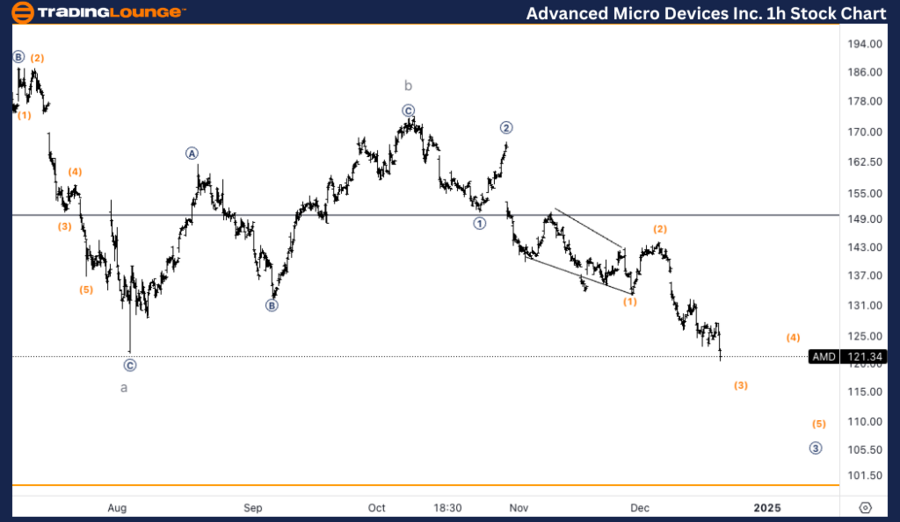

AMD Elliott Wave Analysis: Trading Lounge 1-Hour Chart

Advanced Micro Devices Inc. (AMD) 1H Chart Analysis

Technical Analysis Overview:

- Function: Counter Trend

- Mode: Corrective

- Structure: Complex

- Position: Wave (3) of micro 3

- Direction: Downside in wave 3

Key Insights:

- The 1-hour chart indicates AMD is within wave (3) of micro wave 3, part of a larger wave c correction.

- An internal subdivision is evident, with further downside likely in supermicro wave (3) of micro 3.

- The current structure suggests continued downward momentum in the short term.

AMD 1H Chart Analysis – Summary

The 1-hour Elliott Wave chart analysis highlights AMD's ongoing wave (3) of micro wave 3, part of the broader wave c correction. This pattern points to additional downside pressure as the correction unfolds, with short-term support levels unlikely to halt the downward movement entirely. Further declines are anticipated before the correction completes.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: MicroStrategy Inc. (MSTR) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support