MicroStrategy Inc. (MSTR) Elliott Wave Analysis Trading Lounge Daily Chart

MSTR Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave {v} of 3

Direction: Pullback in (iv) of {v}

Details: Wave (iv) is nearing completion, after which an upward movement is expected to finalize the five-wave structure, completing Minute wave {v} and targeting levels around $500.

MSTR Elliott Wave Technical Analysis – Daily Chart

The daily chart analysis indicates that wave (iv) of {v} is ongoing. A corrective pullback is anticipated to conclude wave (iv), allowing the stock to resume its upward momentum. This upward movement is projected to complete Minute wave {v}, with a potential target around $500. Once wave (iv) is complete, the final leg of the impulsive five-wave sequence is expected to unfold, marking the culmination of the current trend.

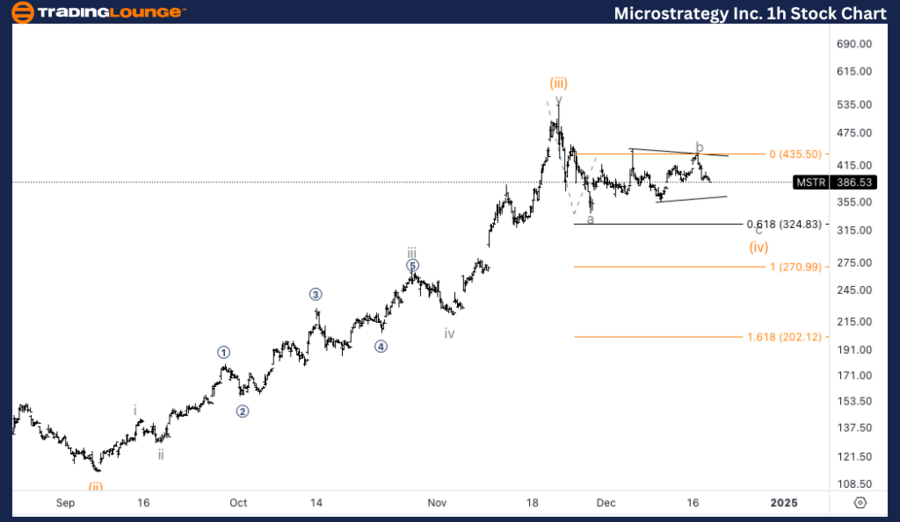

MicroStrategy Inc. (MSTR) Elliott Wave Analysis Trading Lounge 1H Chart

MSTR Elliott Wave Technical Analysis

Function: Trend

Mode: Impulsive

Structure: Motive

Position: Wave (iv) of {v}

Direction: Downside in wave c of (iv)

Details: Wave b is in progress and may develop into a triangle or a sideways correction. A subsequent downward leg in wave c is anticipated, targeting the 0.618 Fibonacci retracement or the equality of wave c vs. wave a around $300.

MSTR Elliott Wave Technical Analysis – 1H Chart

The 1-hour chart reveals that wave (iv) is still forming, with wave b nearing completion. This phase may evolve into a triangle pattern or a lateral corrective structure. Following the conclusion of wave b, a downward move in wave c is expected. The likely target lies near the 0.618 Fibonacci retracement or the equality of wave c vs. wave a, around $300. This phase would signify the end of the corrective wave before the stock resumes its upward trajectory in wave {v}.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Netflix Inc. (NFLX) Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support