Commodity Wheat Elliott Wave Technical Analysis

Function: Trend

Mode: Trend

Structure: Impulse wave

Position: Wave B of (5)

Direction: Wave B of (5) is still in play

Details: Wave A extends lower. Bullish confirmation for wave B is at 592'6.

Wheat Elliott Wave Technical Analysis

Wheat is extending its decline from late May 2024, nearing a complete unwinding of the significant gains achieved between March and May 2024. This continued weakness adds to the bearish trend that began in March 2022. The commodity is now poised to reach its lowest price since late 2020.

Daily Chart Analysis

The daily chart reveals the ongoing bearish impulse cycle that commenced in March 2022 from the high of 1363. The price is currently completing the fifth wave, wave (5), of this impulse trend. Notably, wave (5) is taking more time to complete compared to the previous waves. Structurally, wave (5) is approaching the completion of an ending diagonal pattern, a specific Elliott Wave formation. The diagonal is in its final leg, suggesting that once it concludes, Wheat is expected to begin its most significant recovery since the peak of 2020.

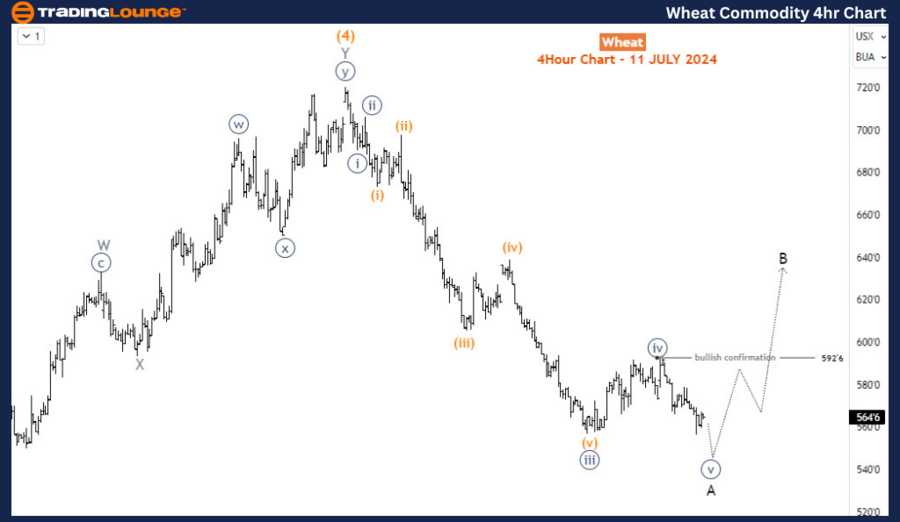

H4 Chart Analysis

On the H4 chart, wave (5) is finalizing a bearish impulse structure that started from the peak of May 2024. Wave (5) should complete a three-wave structure. This implies that after the current impulse wave decline—wave A of (5)—a corrective bounce for wave B of (5) is anticipated, followed by the final decline for wave C of (5). Currently, wave A is in its last sub-wave, wave v (circled), which could extend to the 520-540 range before finding technical support, upon which the wave B bullish correction could build.

Conclusion

Both the daily and H4 charts indicate a continued bearish trend for Wheat, with the commodity nearing a significant support level. The completion of the ending diagonal pattern on the daily chart suggests an imminent end to the long-term bearish impulse, while the H4 chart outlines the final stages of the current wave A decline. By closely monitoring the completion of wave v (circled) on the H4 chart and the overall ending diagonal on the daily chart, traders can identify strategic entry points to capitalize on the anticipated recovery. The forthcoming corrective bounce in wave B, followed by the final decline in wave C, presents potential opportunities for both short-term bearish positions and long-term bullish positions as Wheat approaches a pivotal support level.

Technical Analyst: Sanmi Adeagbo

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: WTI Crude Oil Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support