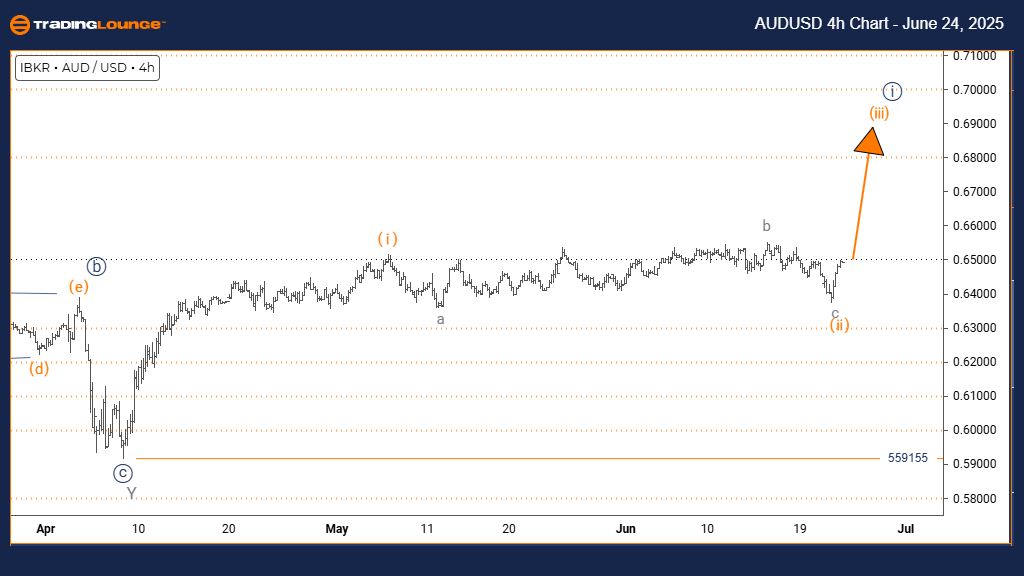

Australian Dollar/U.S. Dollar (AUDUSD) Elliott Wave Analysis – Trading Lounge Day Chart

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Bullish Momentum

MODE: Impulsive Movement

STRUCTURE: Orange Wave 3 in Progress

POSITION: Formation of Navy Blue Wave 1

NEXT LOWER DEGREE DIRECTION: Anticipating Orange Wave 4

DETAILS:

The correction phase labeled Orange Wave 2 appears to be finalized. Price action is currently advancing within Orange Wave 3, which unfolds as part of the broader Navy Blue Wave 1 trend.

Wave Invalidation Level: 0.559155

The daily AUDUSD chart displays a clearly bullish Elliott Wave configuration. The impulsive nature of Orange Wave 3 signals strong buying pressure and institutional activity. This wave structure indicates the market is in a high-momentum phase, often characterized by rapid price increases.

With Orange Wave 2 likely complete, the development of Orange Wave 3 has commenced. Typically, this phase represents the strongest leg in the five-wave sequence of an Elliott Wave cycle. Upon its completion, a corrective move labeled Orange Wave 4 is expected to follow.

It's important to monitor the invalidation threshold at 0.559155. A move below this point would invalidate the current wave count and necessitate a reassessment. As long as price holds above this level, the bullish outlook remains intact.

Given current conditions, the AUDUSD pair has room for additional gains. The impulsive structure of Orange Wave 3 within Navy Blue Wave 1 supports a sustained bullish trend, signaling continued strength in Australian Dollar performance.

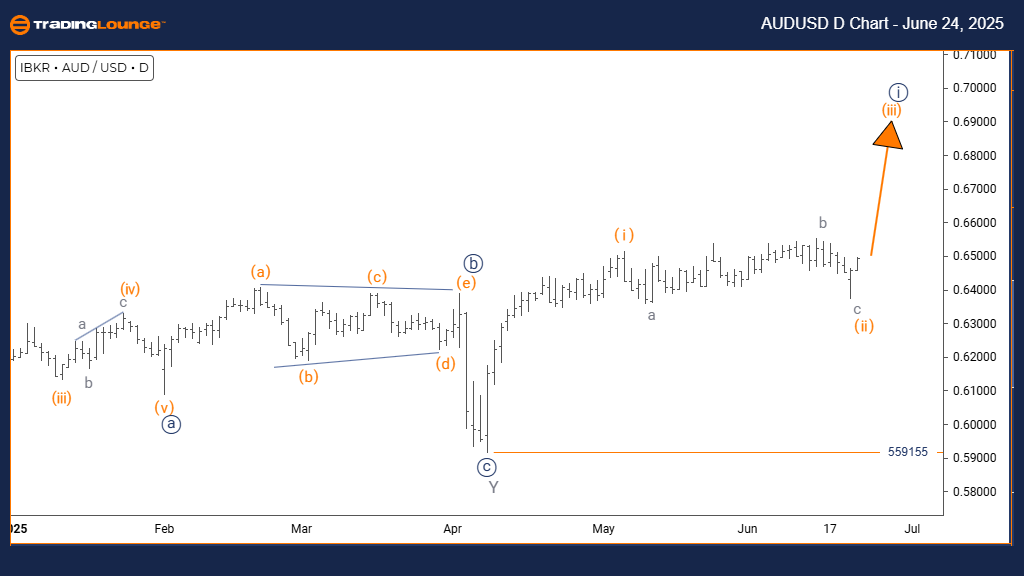

Australian Dollar/U.S. Dollar (AUDUSD) Elliott Wave Analysis – Trading Lounge 4-Hour Chart

AUDUSD Elliott Wave Technical Analysis

FUNCTION: Uptrend Continuation

MODE: Impulsive Pattern

STRUCTURE: Developing Orange Wave 3

POSITION: Advancement of Navy Blue Wave 1

NEXT HIGHER DEGREE DIRECTION: Ongoing Orange Wave 3

DETAILS:

Orange Wave 2 is assumed complete, with current price movements forming Orange Wave 3.

Wave Invalidation Level: 0.559155

The 4-hour chart confirms bullish conditions in the AUDUSD market. The impulsive progression within Orange Wave 3 underlines ongoing strength as part of the broader Navy Blue Wave 1. This pattern is typical of initial Elliott Wave cycles, where sharp upward movement occurs with minimal retracements.

Completion of Orange Wave 2 has given way to a strong push within Orange Wave 3. This stage is generally the most forceful, with consistent upward momentum and limited corrections, indicating strong buyer commitment.

A price drop below 0.559155 would invalidate this wave scenario. Until then, the technical picture supports a continued bullish bias.

Overall, AUDUSD exhibits favorable conditions for further appreciation. Orange Wave 3’s structure reflects aggressive market participation and likely trend continuation in alignment with Navy Blue Wave 1’s trajectory.

Technical Analyst: Malik Awais

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: USDCHF Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support