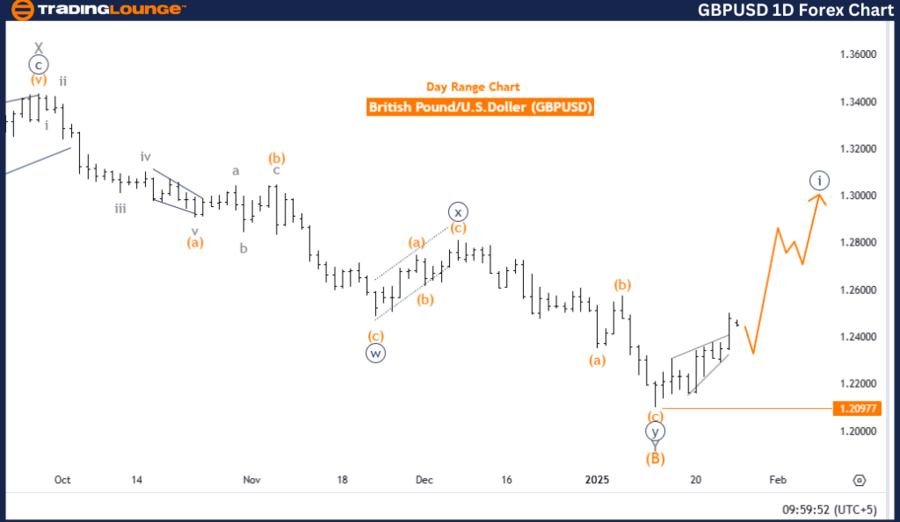

British Pound/ U.S. Dollar (GBPUSD) Elliott Wave Analysis - Trading Lounge Daily Chart Analysis

GBPUSD Elliott Wave Technical Analysis

Function: Bullish Trend

Mode: Impulsive

Structure: Navy Blue Wave 1

Position: Gray Wave 1

Next Lower Degree Direction: Navy Blue Wave 2

Details: Navy Blue Wave 1 within Gray Wave 1 appears to have completed; Navy Blue Wave 2 is currently developing.

Wave Invalidation Level: 1.20977

The GBPUSD daily chart, analyzed using Elliott Wave Theory, indicates a strong bullish trend characterized by an impulsive wave structure. The primary observation revolves around Navy Blue Wave 1, which forms part of the broader Gray Wave 1, marking the beginning of a potential long-term uptrend.

As the market completes Navy Blue Wave 1, it transitions into the corrective phase of Navy Blue Wave 2, which temporarily consolidates previous gains before the upward momentum resumes.

The invalidation level of 1.20977 serves as a critical benchmark; a drop below this level would invalidate the current wave count, prompting a reassessment of the overall market structure.

Summary

The GBPUSD Elliott Wave analysis for the daily chart highlights a bullish outlook, with Navy Blue Wave 1 concluding within Gray Wave 1. The corrective phase of Navy Blue Wave 2 presents trading opportunities for traders looking to capitalize on potential price retracements before the bullish trend resumes. The invalidation level at 1.20977 is essential for risk management, ensuring that traders stay aligned with the correct wave count. By applying Elliott Wave principles, market participants can anticipate the next phase of price movements with greater confidence.

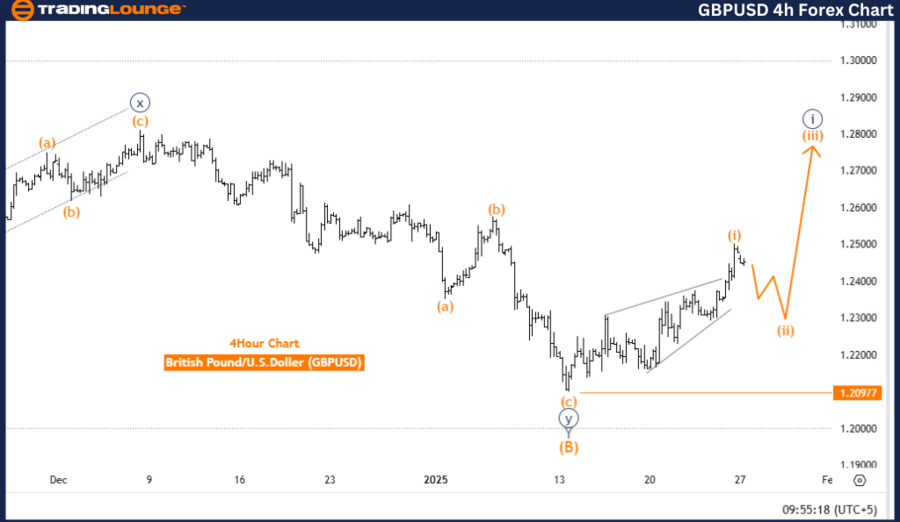

British Pound/ U.S. Dollar (GBPUSD) Elliott Wave Analysis - Trading Lounge 4-Hour Chart Analysis

GBPUSD Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Orange Wave 2

Position: Navy Blue Wave 1

Next Higher Degree Direction: Orange Wave 3

Details: Orange Wave 1 within Navy Blue Wave 1 appears completed; Orange Wave 2 is currently developing.

Wave Invalidation Level: 1.20977

The four-hour GBPUSD Elliott Wave analysis reveals a counter-trend correction, focusing on the development of Orange Wave 2 following the completion of Orange Wave 1 within the larger Navy Blue Wave 1 structure.

With Orange Wave 1 having completed, the market is now experiencing a corrective pullback in the form of Orange Wave 2, which provides a temporary pause within the broader bullish cycle. Once this correction concludes, the market is expected to transition into Orange Wave 3, resuming upward momentum with a higher-degree impulsive move.

The 1.20977 invalidation level acts as a crucial reference point; any price action below this level would require a reassessment of the wave count and trading strategy.

Summary

The GBPUSD four-hour chart analysis showcases an ongoing corrective phase, with Orange Wave 2 following the completion of Orange Wave 1. This retracement offers potential buying opportunities ahead of the anticipated formation of Orange Wave 3, which could drive renewed bullish momentum. Traders should closely monitor the invalidation level to mitigate risk and confirm the wave count's accuracy. By leveraging Elliott Wave analysis, market participants gain valuable insights into the current price action and potential future trends.

Technical Analyst: Malik Awais

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

Previous: AUDUSD Elliott Wave Technical Analysis

VALUE Offer - Buy 1 Month & Get 3 Months!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support