XRP Elliott Wave Forecast – XRPUSD Technical Outlook TradingLounge

XRPUSD Daily Chart – Elliott Wave Structure

XRPUSD Elliott Wave Technical Analysis

Function: Trend

Mode: Motive

Structure: Impulse

Current Position: Wave 3 of 3

Market Direction: Sustained Uptrend

Analysis Breakdown:

The Elliott Wave sequence unfolds as follows: Wave 1 ➝ Double Zigzag Wave 2 ➝ Advancing Wave 3

Wave 2 retracement touched $1.9095, marking the correction low

Wave 3 exhibits strong bullish momentum, now surpassing the Wave 1 peak at $2.6623

Key Fibonacci Resistance Zones:

- 0.236 Fib Level = $3.2392

- 0.382 Fib Level = $2.9994

(These resistance levels may trigger brief retracements within the current bullish Wave 3 trend)

Swing Trading Strategy – Short-Term Outlook:

- If already in position, consider securing partial gains near $4.20

- Utilize a “Buy the Dip” strategy – look for a Wave 4 correction before re-entering in Wave 5

Risk Management – Invalidation Level:

A price drop below $2.23 invalidates the current Elliott Wave structure and warrants reassessment

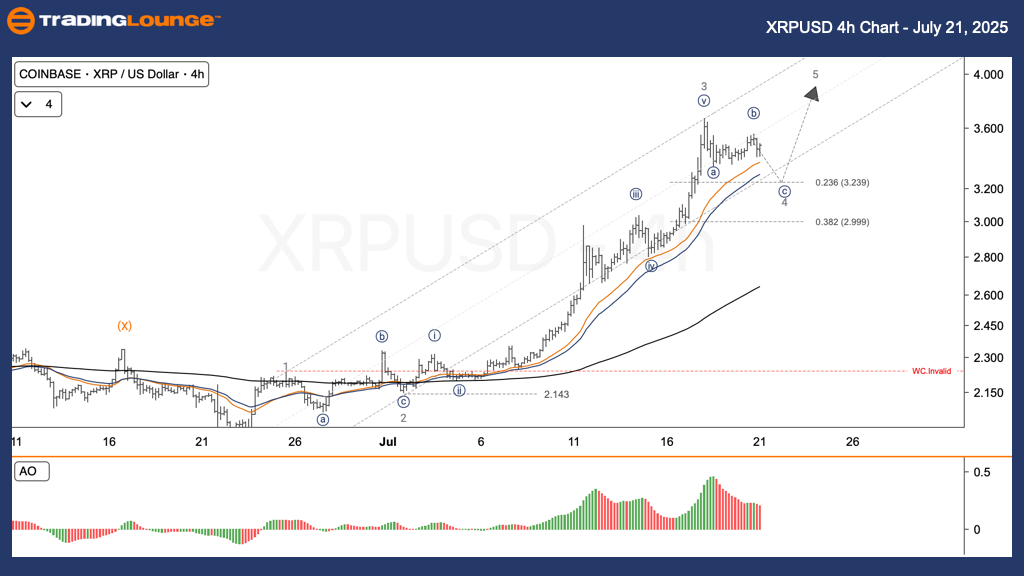

XRPUSD 4-Hour Chart – Intraday Elliott Wave View

Function: Counter-Trend

Mode: Corrective

Structure: Zigzag

Current Position: Wave 4 of 3

Market Direction: Consolidation Phase within Broader Uptrend

Technical Breakdown:

Sub-Waves (1) through (5) within Wave 3 are now complete

Current action reflects consolidation forming Wave 4

Fibonacci Support Levels to Monitor:

- 0.236 Retracement = $3.2392

- 0.382 Retracement = $2.9994

(These levels may offer potential entry opportunities for Wave 5 if the price holds support)

Short-Term Swing Trade Strategy:

- Continue holding? Target potential exits near $4.20

- Apply the “Buy the Dip” approach – enter post-Wave 4 pullback to ride Wave 5

Invalidation Point for Setup:

A drop beneath $2.23 calls for a revised wave count analysis

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: LINKUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support