Chainlink /U.S. Dollar TradingLounge Daily Chart – LINKUSD Elliott Wave Forecast

Chainlink /U.S. Dollar Daily Chart Overview

LINKUSD Elliott Wave Technical Analysis

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulse

POSITION: Wave (3) of ((1))

DIRECTION: Bullish Momentum

Technical Overview:

- Wave I peaked at $17.965

- Wave II found support at $10.87

- Current price movement is forming wave (3) of III

- Wave (3) has a projected 1.618 Fibonacci extension near $18.94

Anticipated resistance zone: $20.00–$22.00

Trading Strategy Recommendations:

Swing Traders' Insight:

- If LINKUSD remains inside the ascending channel and stays above $13.50, bullish momentum continues.

- A powerful wave (3) rally may push prices beyond the 2000 Fibonacci Extension.

🟥 Invalidation Scenario:

- A decline below $13.50 would invalidate the current Elliott Wave impulse count.

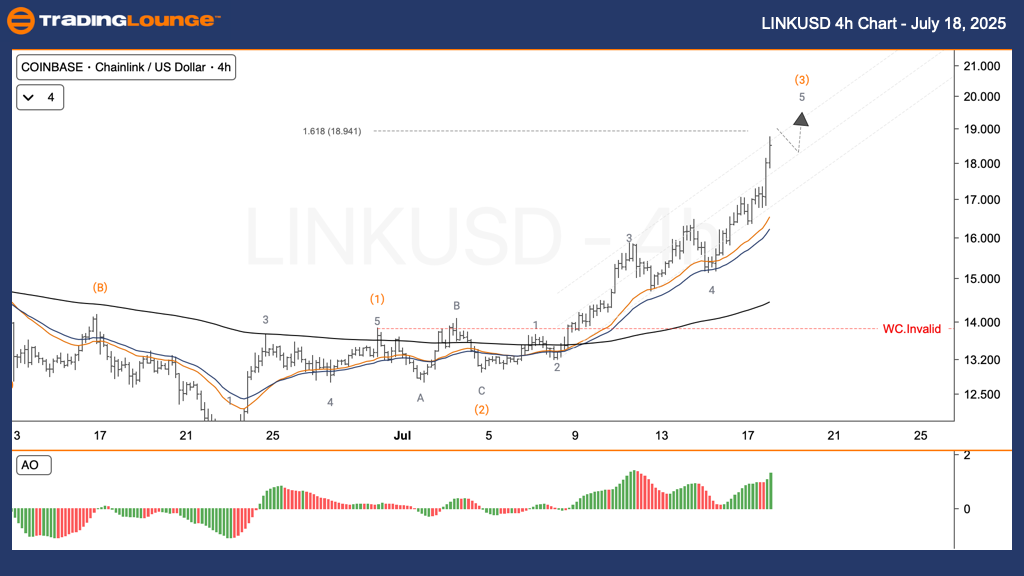

LINKUSD 4H Chart – Elliott Wave Forecast

LINKUSD Elliott Wave Analysis | TradingLounge

FUNCTION: Trend

MODE: Motive

STRUCTURE: Impulse

POSITION: Wave (3) of ((1))

DIRECTION: Bullish Momentum

Technical Overview:

- Wave I reached a high at $17.965

- Wave II corrected to $10.87

- Market action is now developing wave (3) of III

- Projected 1.618 Fibonacci extension for wave (3): $18.94

- Psychological resistance expected at $20.00–$22.00

Trading Strategy Recommendations:

Swing Traders' Insight:

- If LINKUSD trades above $13.50, the upward wave structure remains valid.

- A strong move within wave (3) could target the 2000 Fibonacci extension level.

Invalidation Scenario:

- A price dip under $13.50 would invalidate the current Elliott Wave count.

Technical Analyst: Kittiampon Somboonsod, CEWA

Source: Visit Tradinglounge.com and learn from the Experts. Join TradingLounge Here

Previous: BTCUSD Elliott Wave Technical Analysis

VALUE Offer - $1 for 2 Weeks then $29 a month!Click here

Access 7 Analysts Over 200 Markets Covered. Chat Room With Support