Johnson & Johnson (JNJ) Daily Chart: Unraveling the Elliott Wave Perspective

The Elliott Wave Principle, a form of technical analysis that traders use to analyze financial market cycles and forecast market trends by identifying extremes in investor psychology, highs, and lows in prices, offers a compelling view of Johnson & Johnson's (JNJ) stock performance. This analysis aims to provide insights into JNJ's current market positioning and potential future movements through the lens of the Elliott Wave Theory.

JNJ Elliott Wave Technical Analysis

Elliott Wave Technical Breakdown for JNJ: Daily Chart Examination

- Function: Trend Analysis

- Mode: Impulsive Moves

- Structure: Motive Phase

- Current Position: Wave (3)

- Expected Direction: The anticipation of an upward trajectory in wave 3 of (3).

Detailed Insight: The analysis points towards an expected three-wave move culminating in wave (2), following which a significant support level was identified at $150. This support marks a crucial juncture, hinting at the necessity of further upside movement to confirm the commencement of wave (3). Traders and investors are keenly observing these patterns, understanding that the confirmation of wave (3) would signify a strong bullish trend.

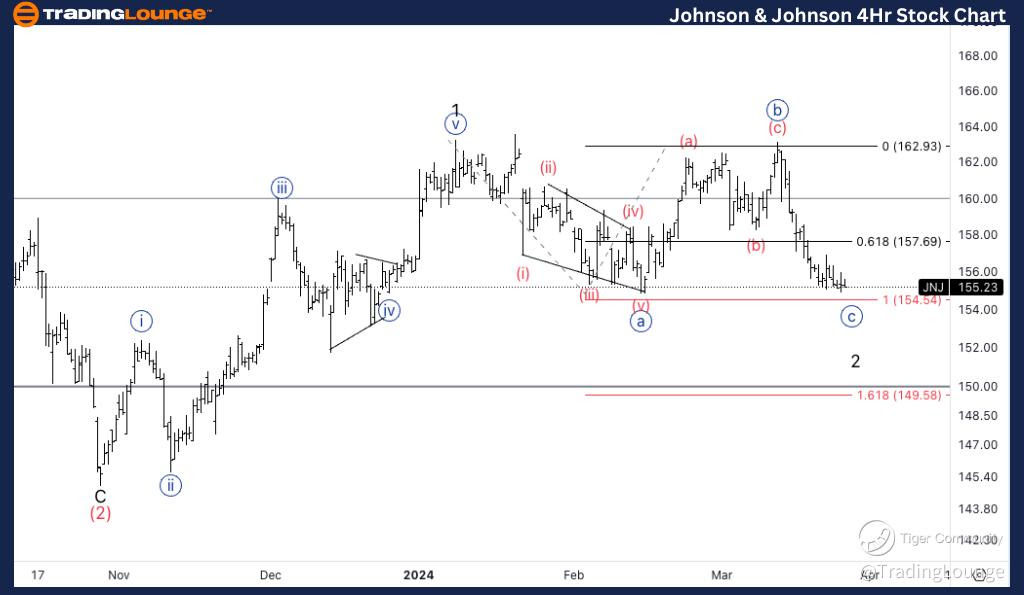

Johnson & Johnson (JNJ) 4-Hour Chart: A Closer Look with Elliott Wave

The shorter-term, 4-hour chart analysis of JNJ offers a more granular view of the stock's movement, aligning with the broader trends observed on the daily chart.

Elliott Wave Technical Analysis: 4-Hour Chart Deep Dive

- Function: Trend Analysis

- Mode: Impulsive Movements

- Structure: Motive Sequence

- Current Position: Wave {c} of 2

- Projected Direction: Transition into wave 3

Analytical Overview: This segment of the analysis focuses on the imminent move into wave {c}, aiming for parity between waves {c} and {a}. The critical observation here is the stock's trajectory towards a support range between $155 and $150. This anticipated support zone is pivotal, as finding solid ground within this range could catalyze the stock's turnaround into wave 3, marking a significant bullish indicator.

Conclusion: Navigating Johnson & Johnson's Market Dynamics with Elliott Wave Analysis

The Elliott Wave Analysis offers a structured and nuanced approach to understanding Johnson & Johnson's stock movements. By dissecting the wave patterns and their implications on the daily and 4-hour charts, traders and investors can gain deeper insights into the potential future directions of JNJ's stock. The identification of critical support levels and the anticipation of impulsive waves underscore the dynamic nature of the financial markets and the value of Elliott Wave Analysis as a tool for navigating them. As JNJ approaches these crucial junctures, market participants will be watching closely, ready to align their strategies with the unfolding wave patterns.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Netflix Inc., (NFLX)

TradingLounge Once Off SPECIAL DEAL: Here > 1 month Get 3 months.