Welcome to our comprehensive Elliott Wave analysis for Caterpillar Inc. (CAT). This in-depth examination leverages the Elliott Wave Theory to help traders identify potential opportunities by analyzing CAT's price movements. Our insights span both daily and 4-hour charts, providing a thorough perspective on CAT's market behavior.

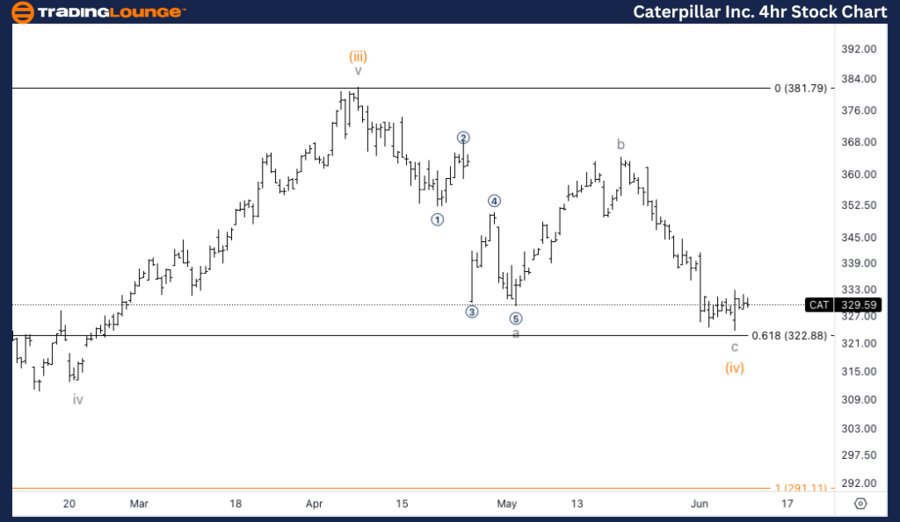

CAT Elliott Wave Analysis Trading Lounge Daily Chart

Caterpillar Inc. (CAT) Daily Chart Analysis

CAT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Minuette wave (iv)

Direction: Bottom in (iv)

Details: We are looking for a bottom in Minuette wave (iv), as it has reached the 0.618 Fibonacci retracement level compared to wave a. The equality level is at $313.

In our daily Elliott Wave analysis of Caterpillar Inc. (CAT), we identify a counter-trend corrective pattern forming a Zigzag structure. Currently, CAT is in Minuette wave (iv), indicating a potential bottom in this corrective phase. The price has reached the 0.618 Fibonacci retracement level relative to wave a, with the equality level at $313. Traders should watch this key support area for signs of a reversal, which may indicate the end of wave (iv) and the beginning of a new upward movement.

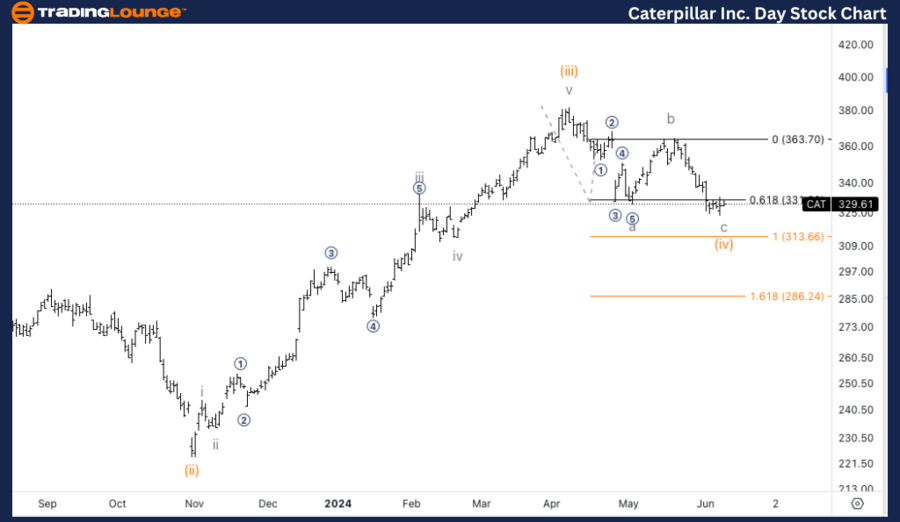

CAT Elliott Wave Analysis Trading Lounge 4-Hour Chart

Caterpillar Inc. (CAT) 4-Hour Chart Analysis

CAT Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave c of (iv)

Direction: Bottom in c

Details: We are looking for a bottom in wave c, targeting the 0.618 retracement level of wave (iv) versus wave (ii) at $322, a commonly respected ratio, followed by equality.

In our 4-hour Elliott Wave analysis of Caterpillar Inc. (CAT), we observe a counter-trend corrective pattern in a Zigzag structure. CAT is currently in wave c of (iv), suggesting a potential bottom at the 0.618 retracement level of wave (iv) compared to wave (ii), around $322. Traders should monitor this level for a possible reversal, which could mark the end of wave c and signal a new upward trend.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Exxon Mobil Inc. (XOM) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support