TradingLounge Elliott Wave Analysis: Avery Dennison Corp. (AVY) Daily Chart

Welcome to our comprehensive Elliott Wave analysis for Avery Dennison Corp. (AVY). This article explores AVY's price movements through the lens of Elliott Wave Theory, helping traders pinpoint potential trading opportunities. We'll analyze data from both the daily and 4-hour charts to provide a detailed view of AVY's market dynamics.

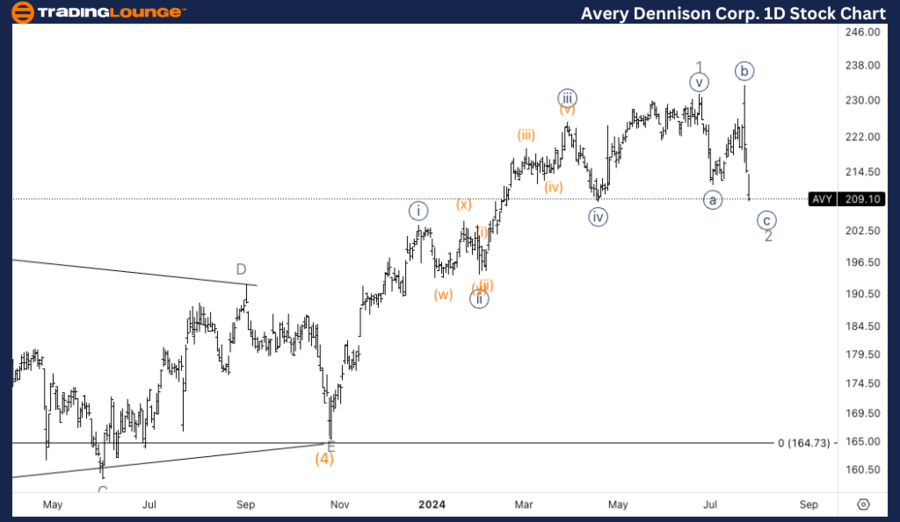

Avery Dennison Corp. (AVY) Daily Chart Overview

AVY Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave 2

Direction: Bottom in Wave 2

Details: The daily chart indicates that AVY is nearing the bottom of wave 2 within an Intermediate wave (5). The price action suggests that wave 1 of (5) has already reached an all-time high (ATH), pointing to strong bullish momentum. We are currently observing for the bottom of wave 2, which, once established, could trigger the continuation of the uptrend in wave 3 of (5).

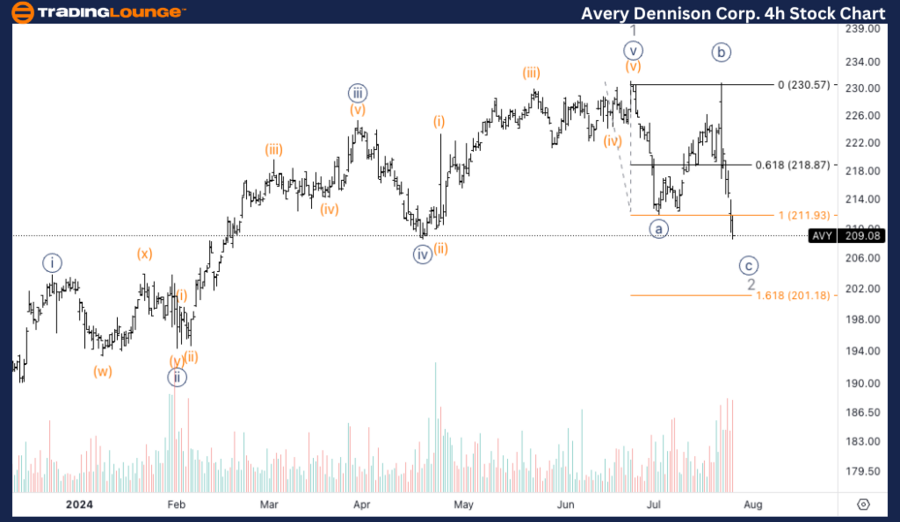

AVY Elliott Wave Analysis - 4-Hour Chart

Avery Dennison Corp. (AVY) 4H Chart Overview

AVY Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Wave {c} of 2

Direction: Bottom in Wave {c}

Details: The 4-hour chart offers a closer examination of wave {c} of 2. Here, the price has entered the area between the equality and 1.618 times the length of wave {a}, a common target zone for wave {c}. The increased volume suggests a potential bottom formation is near. Traders should monitor this area closely for signs of a bounce, which could signal the resumption of the overall uptrend.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: NextEra Energy Inc. (NEE) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support