Elliott Wave Analysis for NextEra Energy Inc. (NEE)

This Elliott Wave analysis for NextEra Energy Inc. (NEE) offers a detailed examination of the stock's price movements using the Elliott Wave Theory. The analysis aims to assist traders in identifying potential trading opportunities based on the current market behavior. Insights are derived from both daily and 4-hour charts to provide a comprehensive understanding of NEE's price action.

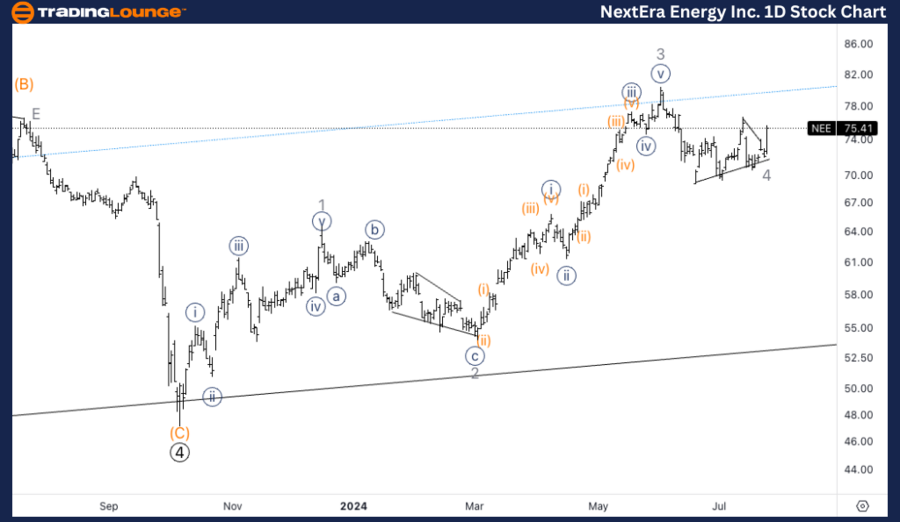

NEE Elliott Wave Analysis - Daily Chart

NextEra Energy Inc. (NEE) Daily Chart Analysis

NEE Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Minor wave 4

Direction: Bottom at wave 4.

Details: The analysis suggests a minor wave 4 formation with support around $72.

NEE Elliott Wave Technical Analysis – Daily Chart

The daily chart analysis indicates that Minor wave 4 has likely established support near the $72 level. This level is crucial as it may signify the end of the corrective phase, potentially leading to the next upward movement. Traders should closely monitor this support level to confirm the bottom's formation.

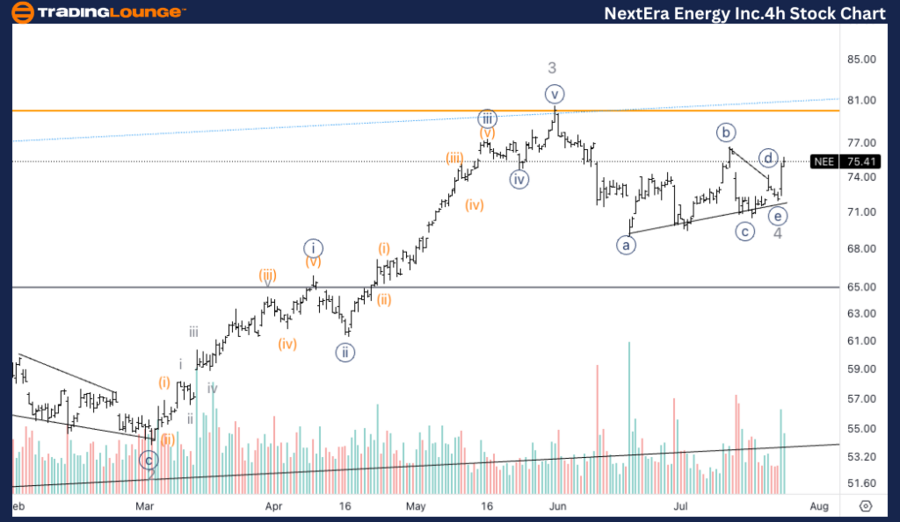

NEE Elliott Wave Analysis - 4-Hour Chart

NextEra Energy Inc. (NEE) 4H Chart Analysis

NEE Elliott Wave Technical Analysis

Function: Counter Trend

Mode: Corrective

Structure: Flat

Position: Minor wave 4

Direction: Bottom at wave 4.

Details: The 4-hour chart suggests a possible triangle formation in wave 4, indicating a bottoming process and the potential start of an upward movement.

NEE Technical Analysis – 4H Chart

The 4-hour chart provides a more detailed view of the wave 4 subdivision, indicating a potential triangle formation. This pattern suggests that wave 4 might have reached its bottom, and an upward trend could be emerging. Traders should look for a breakout from this triangle to confirm the continuation of the upward movement.

Technical Analyst: Alessio Barretta

Source: visit Tradinglounge.com and learn From the Experts Join TradingLounge Here

See Previous: Eaton Corp PLC (ETN) Elliott Wave Technical Analysis

Special Trial Offer - 0.76 Cents a Day for 3 Months! Click here

Access 7 Analysts Over 170 Markets Covered. Chat Room With Support